By: Fehl Dungo

Source: https://dailypik.com/first-metro-sec-pro-review-most-advanced-trading-platform-in-the-philippines/

I’m in awe of this new stock trading platform.

For years, I have been wanting for a trading platform that could give me all the tools, the numbers I watch out for, multiple company snapshots, valuations, real-time news, professional research – on the same screen.

I’ve been using different platforms in trading stocks because they are different in every way.

But I would often check out Bloomberg and Wall Street Journal to dig deeper about things like historical performance, income and loss, valuations, consensus.

I used to do that because I couldn’t find enough financial statistics I was looking for. Sometimes the window would freeze on me and I needed to log back in.

I’m glad there is now a cutting-edge stock trading system that serves everything in one platform. I need that and it’s one of my requirements about trading in the stock market.

Metrobank has launched the most advanced online stock trading platform in the Philippines, First Metro Sec Pro. I gotta say you must have it if you’re into investing and trading stocks and mutual funds.

Having access to it means having access to the most advanced OS of online trading.”

In this page, I’m sharing here my review of using First Metro Sec Pro.

Currently, it is exclusive to most valued clients who trade at least 100K per month or maintain a portfolio worth at least 200K in stocks or mutual funds.

First Metro Sec Pro Review

Amazing Interface

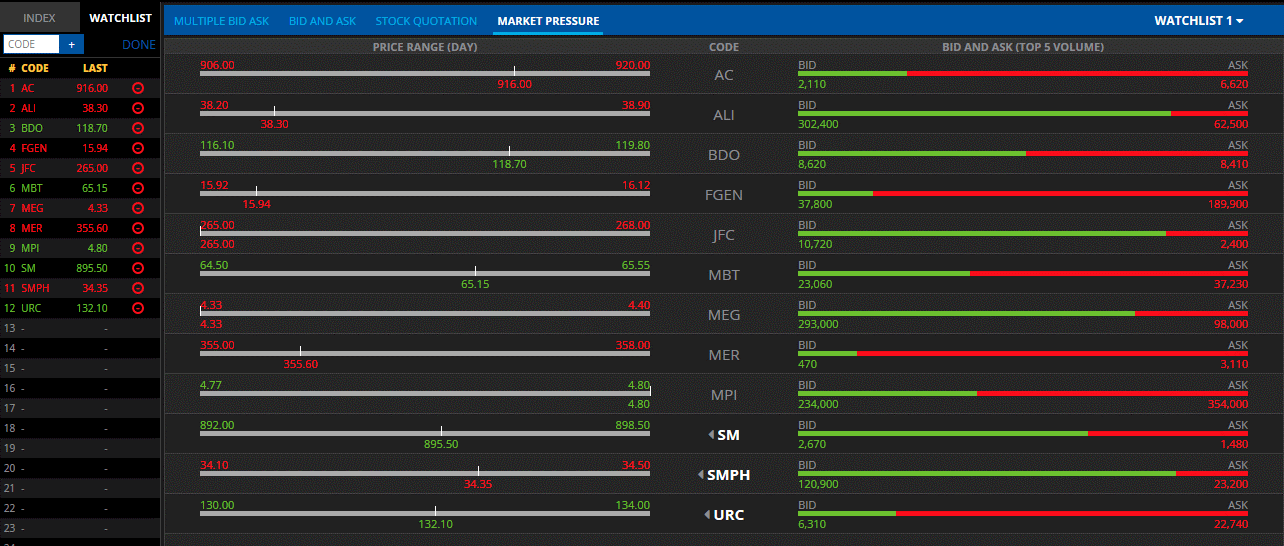

Active traders or passive investors can both take advantage of the incredible interface of First Metro Sec Pro as it is empowered with blazing fast system.The ability to multitask is what I admire the most in this trading platform.

I can view several reports next to each other like viewing different stocks live feed and my portfolio at the same time. Did I say in one dashboard?

Multiple Watchlists

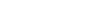

Yup, one of my favorite features of this trading platform is easy creation of multiple watchlists.

You can create and group different watchlists according to your wish and navigate them with ease while viewing their Market Pressure in real time.

On another tab, you can view the Index’s most active, biggest losers, top gainers and browse further at each stock as the center dashboard displays charts, figures and actionable tabs at your fingertips.

Blazing Fast Tools

I’d say it again, First Metro Sec Pro is blazing fast. I think it is designed this way.

Everything is effortlessly quick. So far, I have never experienced any frozen window, error or any glitch at all using this online trading platform.

Catchy Infographics

First Metro Sec Pro’s simple infographics are very catchy. In my personal experience, they help a lot with analyzing figures easily.I’m a fan of infographics because they sum up the reports better than Excel data or PDF snapshots.

First Metro Sec Pro displays user-friendly infographics and thank God we don’t have to download them.

Market News in Real Time

Being able to view the latest news about each stock or the market is quite impressive. I can even see the latest Tweets from First Metro Sec.Using this online trading program, I like reading economic trends after viewing market indices next to each other.

Excellent Research

As a First Metro Sec client, we have the advantage to be given excellent market research by financial professionals.I am thankful that their market research includes not only the latest figures but the past reports as well.

My cousin had a take home assignment and she needed the EPS (Earnings Per Shares) of various companies in the PSE from 2014 to 2019. She couldn’t find it anywhere online.

I helped her, and we checked them out on Bloomberg, WSJ, and some other trading platforms. Unfortunately, those data in the past were not displayed.

We even checked at PSE Edge but we got lost. Luckily, I found them at First Metro Sec. Her professor was very impressed.

Seamless Trading

First Metro Sec Pro is by far the most advanced online stock trading platform in the Philippines. Everything you need is served on the screen as quickly as possible.You can monitor, analyze, and trade stocks and mutual funds conveniently.

You can also customize the look of your dashboard like choosing from available theme colors, sidebar, ticker and portfolio options.

Every feature is easy to navigate.

Consolidated Portfolio

At one look, you would easily know what compose your portfolio because of the beautiful infographics.Using First Metro Sec Pro, you can both trade stocks and mutual funds. Thus, you can view the consolidated amount of your investments.

Having the pleasure of viewing your portfolio on the side while you explore other things like analyzing different stocks inside the dashboard and an easy view of PSEI performance at the left sidebar is amazing.

First Metro Sec Pro Review – Most Advanced Trading Platform

To sum up, what I love most about this stock trading platform are the following:

- Amazing Interface

- Multiple Watchlists

- Blazing Fast Tools

- Catchy Infographics

- Market News in Real Time

- Excellent Research

- Seamless Trading

- Consolidated Portfolio

Special thanks to Ms. Abegael Iselle Go of First Metro Securities for inviting me and for giving me the privilege to use this awesome platform in trading stocks and mutual funds.

Use of Technology in Investing Still Eludes Millennials

By: Business Mirror

Source: https://businessmirror.com.ph/2018/09/09/use-of-technology-in-investing-still-eludes-millennials-broker/

THE stock brokerage arm of the Metrobank Group said millennials lag behind baby boomers and Gen X in terms of financial literacy.

In a statement released late August, First Metro Securities Brokerage Corp. (FirstMetroSec) said it estimates less than 10 percent of these “digital natives” have an investment or savings in some way or form.

Digital natives is a term attributed to millennials, because using technology for them is said to be innate. However, FirstMetroSec thinks otherwise.

“Millennials in general have a lot of financial aspirations,” FirstMetroSec Business Development Head Andro Leo L. Beltran was quoted in the statement as saying. “Often you’d hear they desire to gain financial independence by the time they reach 40, some [hope to do so] even as early as 30.”

Beltran added the millennials’ wish list “often includes being able to travel the world, spend worry-free and enjoy more-than-average standard of living for themselves and their family.”

“But a great majority has no clear strategy on how to achieve this,” he explained. “And if ever they do, they tend to go conservative, not maximizing the opportunities and resources available to them.”

Sans citing sources, FirstMetroSec said data show less than 1 percent of Filipinos invest in the stock market.

“Although it is where one can significantly grow his money, we noticed that millennials tend to be apprehensive due to unfamiliarity, confusion and intimidation,” Beltran said. “We think this shouldn’t be the case, especially now that technology has already made stock-market investing a lot easier and intuitive, especially for the tech-savvy millennials.”

Beltran finds it paradoxical that the supposed digital natives themselves have fears about stock-market investing.

“If they can figure out how to shop or sell pre-owned items online without the help of a manual, they can surely handle an online trading platform.”

He explained that the concept is pretty much similar.

One can choose the item—or from the listed securities the stock—from a catalog you want to purchase, fund your shopping—or online trading—account, buy—or place a bid—and wait for the item to be delivered to your doorstep in two to three days—or wait for someone to sell the stock.

Beltran added that, just like online shopping, an investor has to do his research.

“If you read reviews or compare prices before you buy items online, you have to do the same when you invest in stocks, lest you find yourselves losing the value of your investment. Although stock investing has many benefits—such as high returns, income from dividend and liquidity—there are also corresponding risks that may be due to market volatility and wrong stock picks, among others.”

“That is why it’s crucial you keep yourselves abreast of what’s happening to the market and the company you wish to invest in. Most online trading accounts give investors access to their research and publications. They are there to guide you in making a smart investment decision,” Beltran said.

He also admonished millennials to stop saying they have no time to trade stocks.

“That is becoming an excuse. Data on Filipinos’ Internet usage suggest otherwise.”

Beltran cited Global Web Index as saying Filipinos are connected to the World Wide Web over five hours daily, with nearly four hours spent on social-media sites.

“We’re not saying social media is bad. In fact, it can even help you get started into investing in the stock market,” Beltran said.

“There are online communities that promote healthy exchange of ideas and knowledge about investing.”

He added FirstMetroSec is advocating for “a more balanced and purposeful use of your time online.”

“You only need 10 minutes on average to trade stocks, so it’s really not time-consuming,” the brokerage executive said. “You can even use your smartphones.”

Beltran, of course, cited online stockbrokers like FirstMetroSec have a mobile app version of their online trading platform. “You can trade wherever you are.”

“If you’re still apprehensive, you can always get guidance from experts. Don’t be paralyzed by fear of the market,” Beltran said. “You are bound to lose more in the end if you don’t act.”

He said millennials can connect with investing influencers if they are on online social-networking platforms.

“A lot of them are more than willing to give assistance to those who are really interested.”

Beltran added, “You can also check the free seminars or webinars offered by the Philippine Stock Exchange and some financial institutions. Maximize your use of technology to include starting or growing your investments.”

By: Doris Dumlao

Source: https://www.philstar.com/business/2018/08/27/1846065/millenials-are-behind-online-stock-market-investing-firstmetrosec

MANILA, Philippines — Millennials may be good in technology, but they are behind when it comes to online stock market investing, according to First Metro Investment Corp.’s stockbrokerage arm.

According to the Labor and Employment Estimates of the Philippine Statistics Authority, millennials make up 45.1 percent of the total Philippine workforce, making them the largest group among the three generations, but First Metro Securities Brokerage Corp. (FirstMetroSec) estimates that less than 10 percent have an investment or savings in some way or form.

“Millennials, in general, have a lot of financial aspirations. Often you’d hear that they desire to gain financial independence by the time they reach 40, some to even as early as 30. The wish list often includes being able to travel the world, spend worry-free, and enjoy more-than-average standard of living for themselves and their family. But a great majority have no clear strategy on how to achieve this. And if ever they do, they tend to go conservative, not maximizing the opportunities and resources available to them,” Beltran said.

Compared to baby boomers and Gen X, millennials somewhat lag behind in terms of financial standing, according to the brokerage company.

It estimates that less than one percent of Filipinos are invested in the stock market.

“Although it is where one can significantly grow his money, we noticed that millennials tend to be apprehensive due to unfamiliarity, confusion, and intimidation. We think this shouldn’t be the case, especially now that technology has already made stock market investing a lot easier and intuitive, especially for the tech-savvy millennials,” First Metro Securities Brokerage official Andreo Leo Beltran said.

Just like online shopping, an investor has to do his research, according to FirstMetroSec.

“If you read reviews or compare prices before you buy items online, you have to do the same when you invest in stocks lest you find yourselves losing the value of your investment. Although stock investing has many benefits such as high returns, income from dividend, and liquidity, there are also corresponding risks that may be due to market volatility and wrong stock picks among others.”

To help raise awareness about online stock trading, FirstMetroSec regularly conducts seminars, including Basic Education on Stock Trading (BEST), which tackles basic stock market information, and Guided Investor, Fearless Trader (GIFT) for individuals already invested in the market and with in-depth understanding of market valuations and technical analysis.

First Metro Securities Brokerage Corp. is a stockbrokerage house licensed to trade in the Philippine Stock Exchange (PSE). FirstMetroSec is wholly owned by FMIC, the investment banking arm of the Metrobank Group. FirstMetroSec also offers timely and accurate research and aims to empower clients to make informed investment decisions.

By: Doris Dumlao

Source: https://business.inquirer.net/256206/millennials-urged-invest-stocks

Millennials should conquer their fear of stock investing and they should instead use their digital savviness to start learning how this asset class to achieve their financial aspirations, local stock brokerage First Metro Securities said.

“Often you’d hear they desire to gain financial independence by the time they reach 40, or, to some, even as early as 30. The wish list often includes being able to travel the world, spend worry-free and enjoy more-than-average standard of living for themselves and their family. But a great majority have no clear strategy on how to achieve this. And if ever they do, they tend to go conservative, not maximizing the opportunities and resources available to them,” FirstMetroSec business development head Andro Leo Beltran said.

Stock trading accounts are growing as online trading gains ground, but less than 1 percent of Filipinos are invested in the stock market.

“Although it is where one can significantly grow his money, we noticed that millennials tend to be apprehensive due to unfamiliarity, confusion and intimidation. We think this shouldn’t be the case, especially now that technology has already made stock market investing a lot easier and intuitive, especially for the tech-savvy millennials,” Beltran said.

Beltran finds it paradoxical that the supposed digital natives themselves have fears about stock market investing.

“If they can figure out how to shop or sell pre-owned items online without the help of a manual, they can surely handle an online trading platform. The concept is pretty much similar: Choose from a catalog the item (or from the listed securities the stock) you want to purchase; fund your shopping (or online trading) account; buy (or place a bid), and wait for the item to be delivered to your doorstep in two to three days (or wait for someone to sell the stock),” he said.

Just like online shopping, an investor has to do his research, Beltran said. If one reads reviews or compare prices before buying items online, one has to do the same when investing in stocks to avoid losing the value of one’s investment. Although stock investing has many benefits such as high returns, income from dividend and liquidity, there are also corresponding risks that may be due to market volatility and wrong stock picks, among others, he noted.

“That is why it’s crucial you keep yourselves abreast of what’s happening to the market and the company you wish to invest in. Most online trading accounts give investors access to their research and publications. They are there to guide you in making a smart investment decision,” Beltran said.

Based on Global Web Index, Filipinos are connected to the web over five hours daily, with nearly four hours spent on social media sites. As such, he said millennials could not use lack of time as an excuse not to know more about stocks.

“We’re not saying social media is bad. In fact, it can even help you get started into investing in the stock market,” he said.

SBG, FirstMetroSec conduct forum on financial literacy

By: Kimberly Maragañas

Source: https://atenews.ph/sbg-firstmetrosec-conduct-forum-financial-literacy

To cultivate financial literacy and money management among the students, a three-part talk symposium held at the Finster Auditorium last Jan. 27, 2018.

The seminar, organized by the School of Business and Governance (SBG) in partnership with the First Metro Securities Brokerage Corporation (FirstMetroSec), was attended by students of the graduate and undergraduate programs.

Margie Clavano, the assistant dean for graduate programs of SBG, shared the rationale of the event in her opening remarks.

“We hope that through this seminar we would be able to know what to do with our money and our excess funds. So that we would not only become richer but to also do it for the common good because that is the goal of the university,” Clavano remarked.

Andro Beltran, business development head of FirstMetroSec, shared his personal experience of being a student and becoming a young working adult.

“We were taught how to balance millions of pesos [in a balance sheet], without being taught how to even earn the first million, and there is the gap. That is why we are here in order to address that gap [of financial literacy],” Beltran cited.

He also stressed how 75% of Filipinos are financially illiterate and 80% of the working middle class have no formal financial plan.

Luis Zacal, an equity research associate of FirstMetroSec, discussed the impacts of 2018 economic and market updates to new investors.

Zacal also advised that new investors should be wary of investing by seeking stocks or experts that have at least a five-year track of moderate but consistent growth.

Alexander Gilles, the consultant for the market education of FirstMetroSec, also discussed the effects of the tax reform law on one’s finances.

Angelica Sucayan, a fourth-year accountancy student, shared her experience from attending the event.

"Eto ang first seminar na nakinig ako ng maayos. Noon pa ako nag-plan na mag-start investing pero kulang pa ang knowledge ko in this area so di ko pa natuloy. This seminar reassured me that it’s better to invest and allow my money to grow than to just set aside my savings.,” Sucayan commented.

The seminar ended with an open forum that allowed students to make consultations and ask questions from the three speakers.

By: Omeng Tawid | Smart Pinoy Investor

Source: http://www.smartpinoyinvestor.com/2017/12/first-metro-securities-funding-options-using-bpi-and-bdo.html

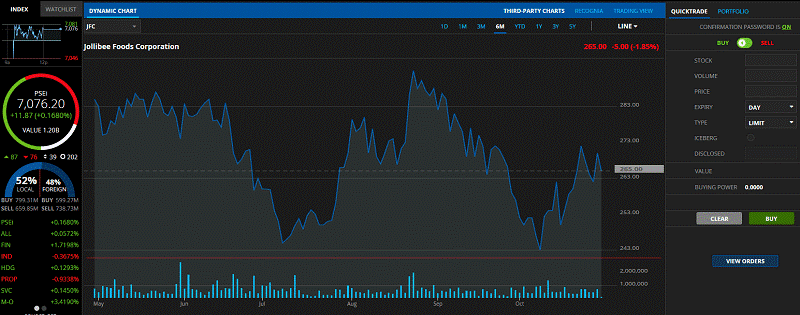

First Metro Securities, the stock trading brokerage arm of giant local Philippine bank Metrobank now allows funding of your trading account through other competitor banks. The best thing is that it’s all free, with no transaction fee, for other big banks in the Philippines including BDO and BPI!

Before, you could only fund your First Metro Sec account directly from Metrobank’s online banking facility Metrobank Direct. This of course greatly limits your trading account funding options to one, and would certainly require additional steps needed on your end should your source of capital come from your account in banks other than Metrobank.

And so for someone like me who has accounts in multiple banks, this new development is therefore a great news for an easier utilization and rotation of my funds with just a matter of clicks. It’s convenient, safe and fast, and especially useful for our OFW’s.

If you actually think about it a level layer, this raises the possibility of moving your money from one bank to a different bank through your broker account.

If you use a different account as your beneficiary account, say using your Metrobank payroll account with your FirstMetroSec trading account, and you receive funds in other banks like BDO or BPI, then all you need to do is to do funding of your trading account through BDO/BPI and request for withdrawal once the money is available for withdrawal. While this option may not always remain fee-less, this can save anyone for now from charges who need such a set-up.

Of course, you can still choose to invest anytime that money you just added to take advantage of opportunities in the market. The bottomline is – there’s less and less borders as to harnessing the potential of your money placed anywhere and make your hard-earned money work for you through investing in Philippine stock market and even in Philippine mutual funds.

With the Philippine stock trading sector becoming more and more flexible for its investors, only one thing remains to make all these news become beneficial to you – and that’s YOU ACTUALLY START INVESTING. Start making your 2018 better taking charge today and consistently doing one easy step moving forward.

Happy investing (and funding!)

First Metro Securities Lures Millennials with Tech-Savvy Tools

By: Bilyonaryo | www.bilyonaryo.com.ph

Source: https://www.bilyonaryo.com.ph/2017/05/05/first-metro-securities-lures-millennials-tech-savvy-tools/

The stockbrokerage business of the Metrobank Group has launched two investment products as part of efforts to reach out to a younger generation.

We are targeting the younger investor crowd, as they are the market who are into digital technology. They are the market who puts a premium on ease and convenience,? First Metro Securities president Gonzalo Ordoñez said in an interview with Sun Star.

These investment products give the public access to invest in the equities market.

Through FundsMart, one may invest in more than 25 peso-denominated mutual funds.

Margin trading account, on the other hand, allows clients to borrow funds using existing shareholdings as collateral.

By: KarenMNL.com

Source: https://www.karenmnl.com/first-metro-securities-online-fundsmart/

Here on the blog, I usually talk about how to save money or how to get the most for your money. But what do you do with the money you have saved up?

It’s important to learn how to grow your money. You can’t just always sell your time and your labor for money. Someday, you are going to be too tired, too exhausted, and too old to do so. You have to start learning how to let your assets work for you – let your assets work to give you money, and not you selling your time and labor working for money.

Not everyone has accumulated enough assets to set them financially free for life – not everyone has a successful business, and not everyone is a big investor. Not yet. Most of us are still working for a paycheck. But that doesn’t mean you can’t start small. You can start investing even with just a small amount, as low as P5,000!

The point is, you have to start an investment because it’s better to have something extra on the side rather than just relying on savings and your paycheck when you need money.

That P5,000 invested in a blue chip stock or a well-managed fund, even if you don’t touch it again, can grow to P6,000 in a few years while you are doing nothing. That’s P1,000 out of thin air, sort of. That’s the beauty of it. Your money is working for you and not you working for the money. Now, don’t you think you need to start something like that in your life?

Now, if you’re starting an investment strategy, wouldn’t you want to pick a company who is well-regarded and knows what they’re doing?

FIRST METRO SECURITIES ONLINE

FirstMetroSec Online is a one-stop shop online platform for stocks, mutual funds, and other financial services.

Back in the old days, people had stockbrokers who do all their trading for them. If you wanted to buy or sell a stock or do some other things, you had to call your stockbroker, often on the phone, to tell them what to do. It was a bit time-consuming because you had to wait for your stockbroker to get back to you about the results of the transaction, etc…

Nowadays, everything is online! You can log on to your account, and do all your transactions yourself. In many cases, everything is transparent and you are notified of the results of your transactions right away! There are no more delays between you and the stockbroker if time is precious. The downside is, there is also no one else to blame but yourself in case you lose money or miss an opportunity. ![]()

![]()

![]()

The minimum deposit to open a trading account is only P5,000! If you have an existing Metrobank or PSBank account, that minimum is waived, so there is actually no minimum deposit!

They also have a mobile app for both Android and iOS, so you can also trade on the go.

Just because all of these transactions are available to you at the push of a button, doesn’t mean that you have to be an aggressive investor a la Wolf of Wall Street. Before you start investing, there’s usually a questionnaire to find out what kind of investor you are, and what type of investing you are comfortable with. How much risk are you willing to take? Are you the invest and forget type? Or are you the type to check the stock prices every minute?

I just recently opened an account with First Metro Securities Online to try my hand at a little online investing. I sent in my application and I’m just waiting for my application to be processed. Sign-up is online, but the printout / hard copy with your signatures need to be submitted (government regulations). You can either mail the application form to their office, or course it through any Metrobank branch.

FUNDSMART MUTUAL FUNDS ONLINE PLATFORM

First Metro Securities also recently launched some new products. FundsMart lets you invest in over 25 peso mutual funds of the six leading fund houses in the country using their web-based online trading platform.

You can invest and redeem mutual funds with no additional paperwork, sales loads, and transaction fees with only one First Metro Sec online trading account.

For the few mutual funds that I have, it’s always the bank branch manager who convinces me to invest a little into the bank’s mutual funds, and it is always processed by the bank so I end up not touching it because, blech, paperwork pa and I have to go to the bank pa. As long as it is appreciating in value, I’m okay.

I am actually looking forward to checking out FundsMart since everything is done online.If you are the type of investor who just wants to see your money grow but don’t want to make too much effort watching it like a hawk everyday, mutual funds are a good way to go. They are less volatile than individual stocks, and they are managed by seasoned fund managers. What’s a mutual fund? It’s like hiring your own fund manager to buy and sell stocks for you and to manage it all, but sharing him with many people so you all benefit from his expertise, and spreading the cost so each investor is not burdened with the big cost of maintaining the fund manager’s fees. I imagine when mutual funds started decades ago, that the people who participated in mutual funds knew each other and met regularly. But it’s 2017, and everything is very professional now and you don’t know who your co-investors are.

MARGIN FINANCING FACILITY

If you are a more seasoned investor and you know what you are doing, FirstMetroSec also has a Margin Facility that will enable you to buy more stocks using securities you already own as collateral.

You can buy securities like stocks, etc… by PAYING ONLY HALF the cost and then borrowing the rest of the money from FirstMetroSec. This doubles your buying power and magnifies your earning potential.

Interest is 0.9% per month, lower than credit cards and other unsecured loans, and there are no set-up costs or annual fees for this service.

My advice is to only use this for “sure-thing” type of securities, if there are such things. If the price of the stock ends up falling instead of rising as you expected, you’ll not only lose money on the stock, but also have debt to pay off. Double whammy. ![]() However, if the price of the stock ends up going your way, then you will have made 2x than what you would have if you only used your own money

However, if the price of the stock ends up going your way, then you will have made 2x than what you would have if you only used your own money ![]()

![]()

![]()

This one has a minimum opening amount of P200,000.

By: Isabella Olivares

Source: http://peopleasia.ph/?p=8069

Nowadays, most of us seem to live life from day-to-day, ticking off items in our bullet journals and writing out tomorrow’s to-do list. But every once in a while we need to plan a couple of years ahead, and nothing spells out future planning like expanding your stock portfolio. But for those of us who clock in the usual nine to five, it’s difficult to keep track of all these stocks and call our brokers.

That’s why First Metro Securities Brokerage Corporation of the Metrobank Group is launching FundsMart, a mutual funds online platform that invest in mutual funds with the six leading fund houses in the country using their web-based online trading platform, FirstMetroSec Online. With FundsMart, you can invest and redeem mutual funds with no additional paperwork, sales loads and transaction fees with only one online trading account.

Accompanying FundsMart is the company’s new mobile application, available on both iOS and Android. With this application, you can check and trade stocks wherever and whenever you want. FundsMart was launched along with FirstMetroSec Online’s enhanced mobile application and the FirstMetroSec Margin facility last Feb. 22 in Valkyrie at The Palace.

Joining the brokerage companies were Sun Life Financial, Philequity Management, Inc., Philam Asset Management, Inc., BPI and the ATR Asset Management Group. Guests were treated to a grand raffle as well as a panel with some of the country’s greatest minds in stock brokerage, including FirstMetroSec president Gonzalo Ordonez.

If you want to build your future while living for today, then start investing with First Metro Securities!

By: Doris Dumlao

Source: Stockbrokerage Firm Launches New Online Platform, Margin Trading

First Metro Securities Brokerage Corp. has unveiled a new online platform to invest in mutual funds and a new window to allow stock investors to boost their purchasing power using “margin” account trading.

The new mutual fund platform “Fundsmart” and the margin account trading facility were launched by the Metrobank group’s securities brokerage arm last week alongside the introduction of an upgraded mobile trading app.

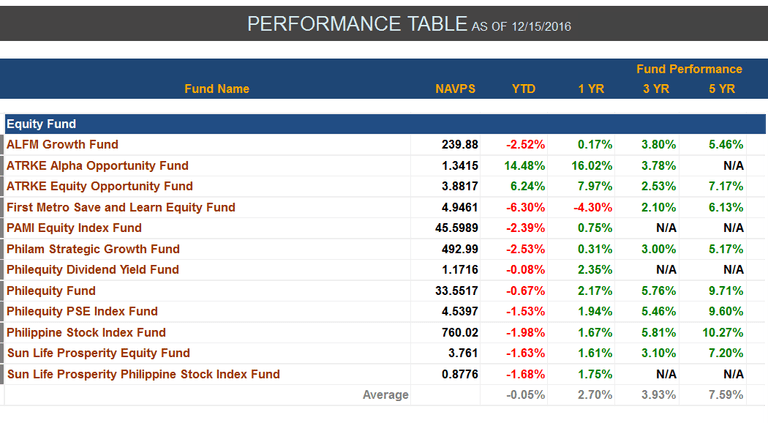

First Metro Securities president Gonzalo Ordoñez said that using the web-based trading platform of the stockbrokerage, investors could now invest in more than 25 peso-denominated mutual funds of the six leading fund houses in the country: ALFM, ATR Asset Management, First Metro Asset Management, Philam Asset Management Inc., Philequity and Sun Life Asset Management.

Fundsmart, First Metro Securities’ one-stop-shop mutual fund investment facility, allows investors to gain access to sophisticated tools for analyzing, screening and comparing mutual funds most suitable to one’s risk appetite.

The brokerage house requires a minimum deposit of P5,000 to open a trading account. The minimum deposit is waived for those with existing bank accounts with Metrobank and Philippine Savings Bank.

“We believe that the keys to successful investing are the freedom to choose and having the right tools at your disposal. That is why we put together in one place everything you need to build a solid portfolio of stocks and mutual funds—powerful interactive solutions, access to all the best performing funds and a consolidated portfolio view,” a First Metro Securities briefer said.

The new margin trading facility, on the other hand, allows investors to buy stocks using securities they already own as collateral.

“You double your buying power by paying half the cost then automatically borrowing rest,” Ordonez said.

Ordonez said the interest rate charged by First Metro Sec at 0.9 percent for this margin account is the lowest in the industry at 0.9 percent – lower than credit cards and other unsecured loans.

Margin trading is suitable for investors with greater risk appetite and more experience in trading. Minimum initial deposit of P200,000 is required to open a margin account.

Meanwhile, First Metro Sec’s online platform allows investors to trade anytime anywhere using web and mobile trading platforms. The online platform facilitates real-time market data streaming, checking of trading positions and balances and convenient trade execution. It also allows investors to view charts with technical indicators and create watchlists

First Metro Sees Millennial Market Boosting Client Base in 2017

By: Kristyn M. Lazo

Souce: https://www.manilatimes.net/first-metro-sees-millennial-market-boosting-client-base-2017/314334/

FIRST Metro Securities Brokerage Corp., the stock brokerage firm of the Metrobank Group, expects to expand its client base by 30 percent this year, driven by new online accounts coming from tech-savvy millennials.

Gonzalo Ordonez, president of First Metro Sec, told reporters Wednesday night that the firm is aiming to attract more millennial clients, tapping and educating them to financial literacy.

“Basically the driver is online [trading]… We want the online trading system to be really good, so that we can get more investors to come in. In terms of volume or percentage of the pie, it’s more of the FundsMart and the margin trading,” Ordonez said.

On Wednesday night at a posh nightclub, First Metro Sec launched three products intended to attract the millennial market, namely: version 2 of the FirstMetroSec mobile application, online mutual funds trading platform FundsMart, and the margin financing scheme.

The mobile app lets online account holders trade instantly through their phones anywhere they are. FundsMart is a trading platform that enables clients to choose from 23 mutual funds and trade according to their own assessment of the funds.

Margin financing, on the other hand, is a trade scheme that allows a client with at least P200,000 worth of marginable stocks to borrow an investible amount—up to double the amount they invested —from the brokerage firm. This enables the client to grow their investments fast by putting down only 50 percent of the total equity.

“In margin financing, if you have at least P200,000 worth of marginable stocks, that’s the minimum. Marginable stocks is not all of the stocks—we have a list of stocks that you can use as collateral. If you have at least P200,000 worth of that, you can apply for a marginal account, and you have to maintain at least P50,000. [The minimum amount] can go down to P50,000 eventually.

“So basically if you have P200,000, you can buy worth P400,000. You can double the number of stocks,” he added.

Ordonez said the move to the digital space through online and mobile application launches is to get millennials started in investing — whether in equities funds, fixed income funds, or mixed equities and fixed income funds.

At present, more than 50 percent of First Metro Sec’s clients are the traditional institutionals, while the balance are online accounts. Majority of the capital market players are also in their 30s and above.

“It is really enabling the Filipinos to invest, to think of their financial wealth — financial health first before spending. The millennials tend to spend a lot, right? If it’s easy and it’s accessible in your mobile, its instant gratification for them,” Ordonez said.

Ordonez sees diverse income generating channels in the next three to five years, from FundsMart (30 percent), margin financing (30 percent), and combined traditional and online stock brokerage operations (40 percent).

In 2016, First Metro Sec grew its client account base by 55 percent, comprised mostly of those in the 30-50-year age group.

Established in 1994, First Metro Sec is the stock brokerage firm of the Metrobank Group. It offers equity brokering services and solutions to individuals, public and private corporations and other financial institutions. It is the firm behind First Metro Philippine Equity Exchange Traded Fund (FMETF) which tracks the performance of the top 30 stocks that comprise the Philippine Stock Exchange index (PSEi).

First Metro Securities sees 30% growth

By: Philippine News Agency

Source: https://edgedavao.net/competitive-edge/2017/02/26/first-metro-securities-sees-30-growth/

Metrobank Group’s stockbrokerage firm First Metro Securities Brokerage Corp. expects its business growing 30 percent this year with the launch of three new investment products, including the online trading platform for mutual funds.

First Metro Securities President Gonzalo Ordoñez said the firm also unveiled margin financing product and mobile app V2.0.

“Half of our business is online (though) we still have a lot of institutional accounts and foreign accounts. The bread and butter of the company are shifting now from institutional to online. But today, it is still on the institutional side. But i think, that’s the growth that we see,” he told reporters.

Ordoñez expects more investors, particularly millennials, to avail of these investment products through its online trading system.

“Overall, we will grow about 30 percent this year, the bulk of that is online,” he said.

FundsMart offers new benefits and features, such as convenient one-stop access to mutual funds offered by the six biggest fund providers in the country, including First Metro Asset Management, Inc.

Ordoñez further said under the margin financing, investors who have at least P200,000 worth of marginable stocks can apply for an account. Marginable stocks are those that one can use as collateral.

“You can make much more money, you can double your money, but you can also lose your money. So it’s for the more sophisticated investors. The mutual funds are for the investors that are just entering the market,” he added. (PNA)

First Metro partners with 6 stockbrokers

By: Business Mirror | www.businessmirror.com.ph

Source: https://businessmirror.com.ph/2016/11/23/first-metro-partners-with-6-stockbrokers/

FIRST Metro Securities Brokerage Corp., the stock brokerage arm of the Metrobank Group, has collaborated with six of the country’s top asset managers to offer the mutual funds through First Metro Securities’s online trading platform.

The platform now includes First Metro Asset Management Inc., ALFM–BPI Investment Management Inc., ATR Asset Management, Philam Asset Management, Philequity Management Inc. and Sunlife Asset Management.

“We are excited to offer clients ready access to the services of top professionals in the mutual-funds industry, with no up-front charges and in affordable amounts. We designed an intuitive and flexible interface, so that investors can best decide on funds that suit their individual needs,” First Metro Securities President Gonzalo Ordoñez said.

This platform broadens the services offered by FirstMetroSec, from Philippine Stock Exchange-listed stocks to peso-denominated mutual funds offered by various providers, he said.

It enables clients to buy and redeem funds without the need to fill out new forms or submit additional requirements.

Investors will be able to save on front-end fees that are normally paid when a mutual fund is purchased.

The platform features include scanning and sorting of funds by various criteria, accessing fund information, buying and selling, and generating consolidated statements.

“We are breaking barriers. This development is in line with our goal of providing Filipinos with investment products that are suitable, available and accessible. We don’t require any minimum balance for Metrobank and PSBank customers,” he said.

“Our clients can now also opt to fund their investments through the online banking platforms of other major banks. And very soon, clients can further expand their investment options through mutual funds,” Ordoñez added.

Mutual funds will be available to clients of First Metro Securities by the first quarter of 2017.

FirstMetroSec Joins Money Summit For the First Time

By: Learning Curve, Inc.

Source: https://money-summit.com/firstmetrosec-joins-money-summit-for-the-first-time/

First Metro Securities Brokerage Corporation or FirstMetroSec for short, is a stockbrokerage house licensed to trade in the Philippine Stock Exchange (PSE). Our company is wholly-owned by First Metro Investment Corporation (FMIC), the investment banking arm of the Metropolitan Bank and Trust Company (Metrobank).

At FirstMetroSec, we strive to provide our clients with easy and convenient access to the listed securities in the PSE, coupled with timely and accurate market research, as well as investor education programs. By fulfilling this mission, we hope to provide equal investment opportunities for all Filipinos.

FirstMetroSec is a Silver Sponsor at the 10th Money Summit & Wealth Expo.

By: Katrina A. Valdez

Source: https://www.manilatimes.net/first-metro-targets-retail-market/244646/

STOCK broker First Metro Securities Brokerage Corp. is targeting to attract a good portion of the retail investor market which is expected to see exponential growth in the next few years amid rising incomes and the availability of online and mobile platforms for investing.

First Metro Securities president Gonzalo Ordoñez said the number of retail investors is expected to increase in the months and years ahead given the improved incomes of Filipinos and the growing popularity of online or mobile platforms, which make investing more attractive and convenient.

“As we see the growing trend of more retail investors participating in the stock market, we also see the volume increasing over the next years. With this in mind, we will continue to move forward to help change the way people invest and save money,” Ordoñez said.

Ordoñez noted that the market for retail investing is still young and remains largely untapped.

Philippine Stock Exchange (PSE) data in 2014 showed that less than one percent of the estimated 100 million Filipinos have invested in the stock market.

“The Philippines still has a long way to go before achieving widespread domestic investor participation in the stock market,” Ordoñez said.

But the PSE noted that the number of online investor accounts, which comprise mainly individual investors, is increasing.

According to the PSE’s 2014 Stock Market Investor Profile reports, online investor accounts registered a five-year compounded annual growth rate of 44 percent compared to the overall investor base, which grew by an average of just 6 percent in the past five years.

Online investors already constitute 27 percent of the total investor accounts base, coming from only 7 percent in 2010.

With the trend of more retail investors participating in the stock market, the First Metro Securities earlier this year launched a service that enables clients to borrow funds to buy stocks online using eligible securities as collateral. This provides clients with the ability to take on more risk in order to take advantage of emerging trends or build a larger portfolio.

First Metro Securities is wholly owned by First Metro Investment Corp., the investment banking arm of the Metrobank Group.

In 2013, First Metro Investment Corp. launched the country’s first exchange-traded fund (ETF), which acts as a mutual fund that mirrors the performance of the benchmark PSE Index (PSEi) and trades like a stock on the PSE. First Metro Securities is the market maker and an authorized participant of the said ETF.