What is FundsMart?

FundsMart is a FirstMetroSec investment funds supermarket which empowers you to invest in the country’s top peso- and dollar-denominated mutual funds and Unit Investment Trust Funds (UITFs).

With FundsMart, you can easily:

|

Analyze, screen, and compare funds to identify which ones are suitable for you. Even better, you can simply take the client suitability assessment for automatic filtering of funds based on your risk profile

|

|

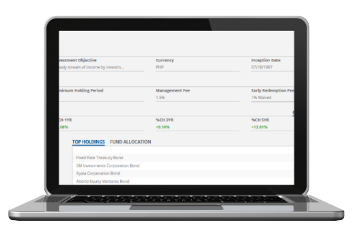

View complete fund profile to better understand specific funds. You can view fact sheet, prospectus, risk rating, fund overview, fee information, performance, top holdings, etc.

|

|

Buy and redeem funds online just like stocks. No need to open multiple investment accounts with banks or investment companies. All you need is one account with FirstMetroSec to get started.

|

|

Invest without sales load and transaction fees, as friction costs are not passed onto the investor but rather, paid by the fund.

|

Note: Management fees in the Fund Profile are not charged to you.

_1508058458.png)

MUTUAL FUND AND UITFS BASICS

What are mutual funds and UITFs?

|

Money from various investors are pooled together by professional fund managers to make up "baskets" of cash, bonds, stocks, and/or other investment assets. As an investor, your ownership is represented by the number of shares or units you hold in the fund. As share/unit prices (NAVPS or NAVPU) increase, so does your investment's value. Mutual funds and UITFs are similar such that a fund manager buys and sells securities on behalf of the investors. Basic differences are as follows:. |

|

|

Mutual Fund |

UITF |

| Offered by | Investment Companies | Banks and Trust corporations |

| What you own | Shares in the investment company reported in NAVPS (Net Asset Value Per share) | Units of participation in the Trust Fund reported in NAVPU (Net Asset Value Per Unit) |

| Voting Rights | Yes | No |

| Regulated by | Securities and Exchange Commission (SEC) | Bangko Sentral ng Pilipinas (BSP) |

What are the different types of mutual funds and UITFs?

|

|

MONEY MARKET

|

|

Composition: Time deposits, treasury bills, other short-term bonds

Risk level: Low |

|

|

BOND

|

|

Composition: Debt instruments with fixed interest rates issued by the government or private corporations

Risk level: Low |

|

|

BALANCED

|

|

Composition: Government securities, corporate bonds, stocks

Risk level: Medium |

|

|

EQUITY

|

|

Composition: PSE index, dividend yielding and/or growth stocks

Risk level: High |

Why invest in a mutual fund or UITF?

|

• You can rely on expert fund management. |

| • Low minimum investment. Invest for as low as Php1,000. | |

| • Reduce risk through automatic diversification. | |

| • Always liquid. Buy or redeem anytime. |

What peso and dollar mutual funds and UITFs are available in FirstMetroSec?

With FundsMart, you can select from over 130+ mutual funds and UITFs to invest in from the country’s leading providers including ALFM, ATR Asset Management, Inc. (ATRAM), First Metro Asset Management Inc. (FAMI), PhilEquity Management Inc.(PEMI), Sun Life Asset Management Company Inc. (SLAMCI), and Manulife Investment Management and Trust Corp. (MIMTC).

Peso-denominated Mutual Funds

| FUND PROVIDER | FUND NAME | FUND STRATEGY | MIN INVT | MIN ADD SUB |

| ATRAM Alpha Opportunity Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Corporate Bond Fund | Bond Fund | 1,000.00 | 500.00 | |

| ATRAM Philippine Balanced Fund | Balanced Fund | 1,000.00 | 500.00 | |

| ATRAM Phil. Equity Opportunity Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Unicapital Diversified Growth Fund | Balanced Fund | 1,000.00 | 500.00 | |

| ALFM Peso Global Multi-Asset Income Fund | Balanced Fund | 1,000.00 | 100.00 | |

| ALFM Growth Fund | Equity Fund | 1,000.00 | 500.00 | |

| ALFM Money Market Fund | Money Market Fund | 5,000.00 | 1,000.00 | |

| ALFM Money Market Fund (UNITS) | Money Market Fund | 1,000.00 | 100.00 | |

| ALFM Philippine Stock Index Fund (UNITS) | Equity Fund | 1,000.00 | 100.00 | |

| ALFM Peso Bond Fund | Bond Fund | 1,000.00 | 500.00 | |

| ALFM Phil. Stock Index Fund | Equity Fund | 5,000.00 | 1,000.00 | |

| Philam Bond Fund | Bond Fund | 1,000.00 | 500.00 | |

| PAMI Equity Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| Philam Fund | Balanced Fund | 1,000.00 | 500.00 | |

| PAMI Horizon Fund | Balanced Fund | 5,000.00 | 1,000.00 | |

| Philam Managed Income Fund | Bond Fund | 1,000.00 | 500.00 | |

| Philam Strategic Growth Fund | Equity Fund | 5,000.00 | 1,000.00 | |

| First Metro Consumer Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| First Metro Save and Learn Balanced Fund | Balanced Fund | 1,000.00 | 1,000.00 | |

| First Metro Save and Learn Equity Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| First Metro Save and Learn Fixed Income | Bond Fund | 1,000.00 | 1,000.00 | |

| First Metro Save & Learn FOCCUS Dynamic | Balanced Fund | 1,000.00 | 1,000.00 | |

| First Metro Save and Learn Money Market | Money Market Fund | 1,000.00 | 1,000.00 | |

| First Metro Save and Learn PH Index Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Philequity Alpha One Fund | Equity Fund | 1,000.00 | 500.00 | |

| Philequity Dividend Yield Fund | Equity Fund | 1,000.00 | 500.00 | |

| Philequity Fund | Equity Fund | 1,000.00 | 500.00 | |

| Philequity MSCI Philippines Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| Philequity Peso Bond Fund | Bond Fund | 1,000.00 | 500.00 | |

| Philequity PSE Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| SunLife Prosperity Balanced Fund | Balanced Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity Bond Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity PH Equity Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity GS Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity PH Stock Index Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity Peso Starter Fund | Money Market Fund | 1,000.00 | 1,000.00 | |

| SunLife Prosperity World EQ Index Feeder | Equity Fund | 10,000.00 | 1,000.00 | |

| Sunlife World Income Fund | Balanced Fund | 10,000.00 | 1,000.00 |

Peso-denominated Unit Investment Trust Funds (UITFs)

| FUND NAME | FUND STRATEGY | MIN INVT | MIN ADD SUB | |

| ATRAM Asian Multi-Asset Income Feeder Fund | Balanced Fund | 1,000.00 | 500.00 | |

| ATRAM Asia Equity Opportunity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| ATRAM Global Consumer Trends Feeder Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Global Allocation Feeder Fund | Balanced Fund | 1,000.00 | 500.00 | |

| ATRAM Global Bond Income Feeder Fund | Bond Fund | 1,000.00 | 500.00 | |

| ATRAM Global Equity Opportunity Feeder Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Global Health Care Feeder Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Global Infra Equity Feeder Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Global Dividend Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| ATRAM Global Multi-Asset Income Feeder Fund | Balanced Fund | 1,000.00 | 1,000.00 | |

| ATRAM Global Financials Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| ATRAM Global Technology Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| ATRAM Peso Diversified Income Fund | Bond Fund | 1,000.00 | 500.00 | |

| ATRAM Total Return Peso Bond | Bond Fund | 1,000.00 | 500.00 | |

| ATRAM Peso Money Market Fund | Money Market Fund | 1,000.00 | 500.00 | |

| ATRAM Philippine Equity Smart Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM Philippine Sustainable Development and Gr | Equity Fund | 1,000.00 | 500.00 | |

| ATRAM US Multi-Asset Income Feeder Fund | Balanced Fund | 1,000.00 | 1,000.00 | |

| ABF Philippines Bond Index Fund | Bond Fund | 1,000.00 | 500.00 | |

| BPI Invest Equity Value Fund | Equity Fund | 1,000.00 | 500.00 | |

| BPI Invest Philippine Consumer Equity Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| BPI Invest Philippine Infrastructure Equity Index Fund | Equity Fund | 1,000.00 | 500.00 | |

| BPI Invest Premium Bond Fund | Bond Fund | 1,000.00 | 500.00 | |

| BPI Invest Philippine High Dividend Equity Fund | Equity Fund | 1,000.00 | 500.00 | |

| BPI Invest Short Term Fund | Money Market Fund | 1,000.00 | 500.00 | |

| BPI Invest US Equity Index Feeder Fund | Equity Fund | 1,000.00 | 500.00 | |

|

Manulife American Growth Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 |

| Manulife Asia Best Select Equity Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife ASEAN Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Clean Energy Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Asia Dynamic Bond Feeder Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| Manulife Dragon Growth Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Dynamic Leaders Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Equity Wealth Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Healthcare Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Multi Asset Diversified Income | Balanced Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Preferred Income Feeder Fund | Balanced Fund | 1,000.00 | 1,000.00 | |

| Manulife Global REIT Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Technology Equity Feeder | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Income Builder Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| Manulife India Equity Feeder Fund | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Money Market Fund | Money Market Fund | 1,000.00 | 1,000.00 | |

| Manulife Asia Pacific REIT Fund of Funds | Equity Fund | 1,000.00 | 1,000.00 | |

| Manulife Asia Short Duration Bond Feeder Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| Manulife Stable Income Fund | Bond Fund | 1,000.00 | 1,000.00 | |

| Manulife Global Thematic Opportunities | Equity Fund | 1,000.00 | 1,000.00 |

Dollar-denominated Mutual Funds

| FUND PROVIDER | FUND NAME | FUND STRATEGY | MIN INVT | MIN ADD SUB |

| ATRAM AsiaPlus Equity Fund | Equity Fund | 150.00 | 50.00 | |

| ATRAM Total Return Dollar Bond Fund | Bond Fund | 150.00 | 50.00 | |

| ALFM Dollar Bond Fund | Bond Fund | 500.00 | 500.00 | |

| ALFM Global Multi-Asset Income Fund | Balanced Fund | 100.00 | 20.00 | |

| PAMI Asia Balanced Fund | Balanced Fund | 200.00 | 50.00 | |

| PAMI Global Bond Fund | Bond Fund | 5,000.00 | 1,000.00 | |

| Philam Dollar Bond Fund | Bond Fund | 2,000.00 | 100.00 | |

| First Metro Save and Learn Dollar Bond | Bond Fund | 1,000.00 | 100.00 | |

| Philequity Dollar Income Fund | Bond Fund | 500.00 | 100.00 | |

| SunLife Prosperity Dollar Advantage Fund | Balanced Fund | 500.00 | 100.00 | |

| SunLife Prosperity Dollar Abundance Fund | Bond Fund | 500.00 | 100.00 | |

| SunLife Prosperity Dollar Wellspring | Balanced Fund | 500.00 | 100.00 | |

| SunLife Prosperity Dollar Starter Fund | Money Market Fund | 500.00 | 100.00 | |

| SunLife Prosperity World Voyager Fund | Equity Fund | 500.00 | 100.00 |

Dollar-denominated Unit Investment Trust Funds (UITFs)

| FUND PROVIDER | FUND NAME | FUND STRATEGY | MIN INVT | MIN ADD SUB |

| ATRAM Global Access Bond Income Feeder Fund | Bond Fund | 100.00 | 50.00 | |

| ATRAM Global Allocation Feeder Fund | Balanced Fund | 100.00 | 50.00 | |

| ATRAM Global Equity Opportunity Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| ATRAM Global Total Return Bond Feeder Fund | Bond Fund | 100.00 | 50.00 | |

| ATRAM Global Multi-Asset Income Feeder Fund | Balanced Fund | 100.00 | 50.00 | |

| ATRAM US Equity Opportunity Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| BPI Invest Global Health Care Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| BPI Invest PH Dollar Bond Index Fund | Bond Fund | 100.00 | 50.00 | |

| BPI Invest European Equity Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| BPI Invest Global Equity Fund-of-Funds | Equity Fund | 100.00 | 50.00 | |

| BPI Invest US Dollar Short Term Fund | Money Market Fund | 100.00 | 50.00 | |

| BPI Invest Global Bond Fund-of-Funds | Bond Fund | 100.00 | 50.00 | |

| BPI Invest US Equity Index Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| BPI Invest World Technology Feeder Fund | Equity Fund | 100.00 | 50.00 | |

| BPI Invest Sustainable Global Balanced Fund of Funds | Balanced Fund | 100.00 | 50.00 | |

| BPI Invest Sustainable Global Bond Fund of Funds | Bond Fund | 100.00 | 50.00 | |

| BPI Invest Sustainable Global Equity Fund of Funds | Equity Fund | 100.00 | 50.00 | |

| Odyssey Asia Pacific High Dividend Equity Fund | Equity Fund | 100.00 | 50.00 | |

|

Manulife American Growth Equity Feeder Fund | Equity Fund | 100.00 | 100.00 |

| Manulife Asia Best Select Equity Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Global Clean Energy Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Asia Dynamic Bond Feeder Fund | Bond Fund | 1,000.00 | 100.00 | |

| Manulife ASEAN Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Dragon Growth Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Global Dynamic Leaders Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Global Healthcare Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Global Money Market Feeder Fund | Money Market Fund | 100.00 | 100.00 | |

| Manulife Global Multi Asset Diversified Income | Balanced Fund | 1,000.00 | 100.00 | |

| Manulife Global Preferred Income Feeder Fund | Balanced Fund | 1,000.00 | 100.00 | |

| Manulife Global REIT Feeder Fund | Equity Fund | 1,000.00 | 100.00 | |

| Manulife Global Technology Equity Feeder | Equity Fund | 100.00 | 100.00 | |

| Manulife India Equity Feeder Fund | Equity Fund | 100.00 | 100.00 | |

| Manulife Asia Pacific REIT Fund of Funds | Equity Fund | 1,000.00 | 100.00 | |

| Manulife Asia Short Duration Bond Feeder Fund | Bond Fund | 100.00 | 100.00 | |

| Manulife Global Thematic Opportunities | Equity Fund | 100.00 | 100.00 |

HOW TO ACCESS FUNDSMART - OPEN AN ACCOUNT

1. Log in to your FirstMetroSec account

2. Click Funds.

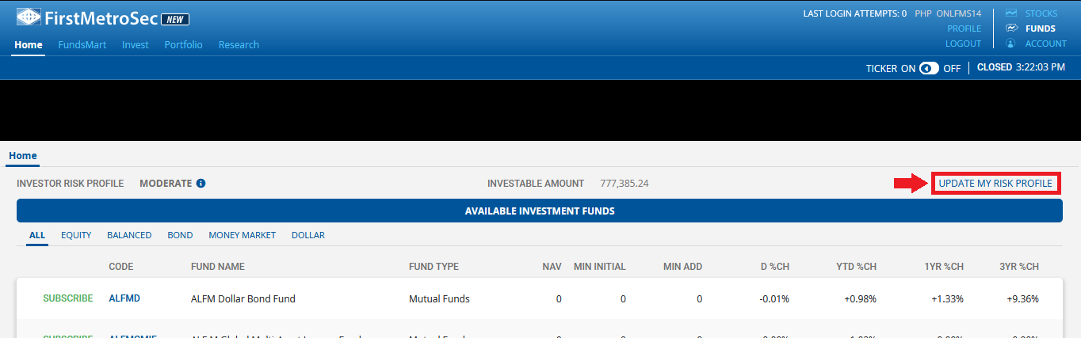

3. Click TAKE RISK ASSESSMENT (if you are a first-time investor) or UPDATE MY RISK PROFILE. This is required for all fund investors, as it ensures that you invest in funds that are suited to your objectives, risk profile, and investment horizon.

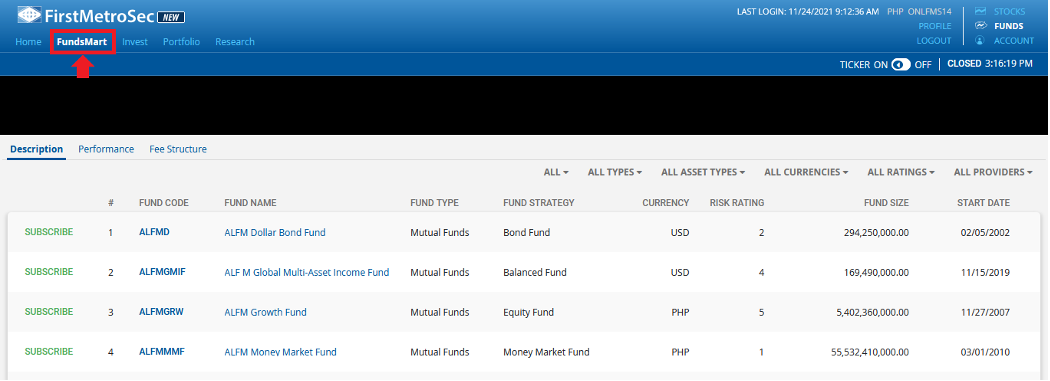

4. Click FundsMart to sort funds based on performance and fee structure.

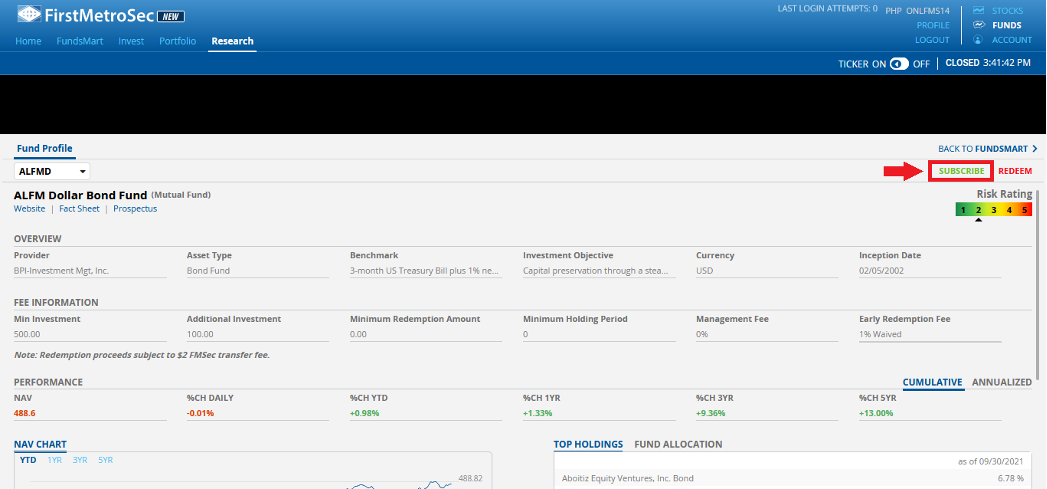

5. Click on a fund to view its profile. You can view its fact sheet, prospectus, risk rating, fund overview, fee information, performance, top holdings, etc. Click SUBSCRIBE to start investing.

Daily order cut-off: 11:00 AM. Orders received after this time shall be processed on the next business day.

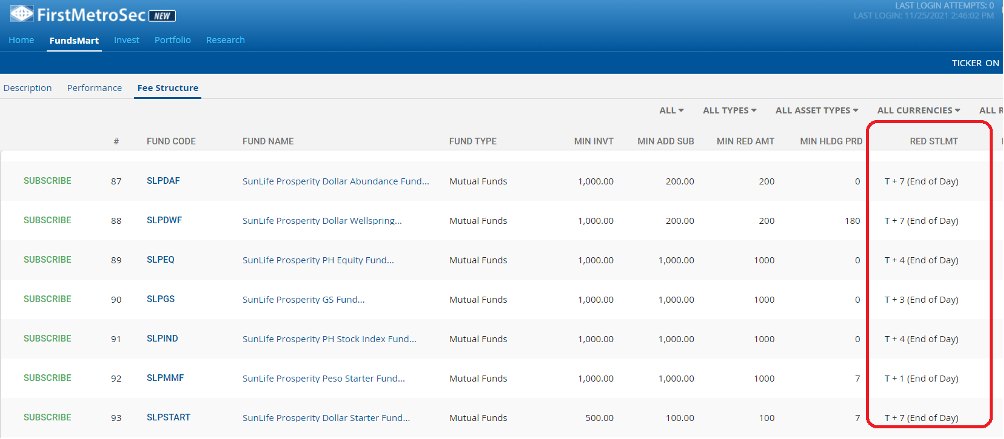

Redemption Settlement: Funds have different redemption schedules depending on the fund type and currency.

| Money Market | 1 day |

| Bond, Balanced, and Equity | 1-5 days |

| Dollar funds | Up to 8 days |

You may go to FUNDS > FUNDSMART > FEE STRUCTURE > RED STLMT to check the turnaround time for each fund.

Note that you may redeem within the holding period, but you may be subjected to an early redemption fee, which depending on the fund may range from 0.25% to 1% (+VAT) of the amount. This will be automatically deducted from your proceeds.

FAQs

Can I invest in funds if I have a joint or In-Trust-For (ITF) account?

Mutual funds are available for all account types including joint or ITF. For Manulife UITFs, only individual accounts are allowed for now.

How do I choose what type of fund to invest in?

You have to consider your (1) objective for investing, (2) investment horizon or period of time you are willing to stay invested, and (3) risk tolerance. As a general rule, higher returns would entail you taking higher risks.

As investor, do I get to choose the stocks or bonds that I want?

No. That will be the job of the fund manager. As investor, you get to choose the fund according to the strategy you prefer.

Are funds guaranteed and insured?

UITFs and mutual funds are not guaranteed by the investment/trust company and not insured by the PDIC.

Do funds have a maturity date?

Funds are open-ended thus, no maturity date.

How is the NAVPS/NAVPU computed?

NAVPS/NAVPU is computed as:NAVPS/NAVPU = Total Assets - Total Liabilities

Number of Outstanding Shares

Underlying securities of the fund are the assets while expenses such as management, custody, brokers’ fees, taxes, and other costs form part of the liabilities.

When I buy funds, what NAVPS/NAVPU shall apply?

For regular peso-denominated and USD-denominated funds ordered within the cut-off, the NAVPU/NAVPS on the same day will apply. For SLWEIF, the applicable NAVPS is T+2. Note that funds will be reflected in your portfolio on this ff. schedule:| Funds | Applicable NAVPS/NAVPU | Availability in the portfolio |

| SLWEIF, SLPWIF | T+2 | T+2 |

| ATRAM UITF Feeder Funds, ATRAM MF USD, PAMIABF, PAMIGBF, and all Manulife funds (except Money Market) | Same day | T+2 |

| Other funds | Same day | T+1 |

What is Benchmark?

This is the standard where the fund’s performance is measured, and the level of return the fund hopes to achieve. For example, an equity fund’s 1-year return is 10% versus the PSEi benchmark returning 8% within the same period. This tells the investor that the equity fund is doing 2% better, therefore, exceeding expectations.

What is the minimum amount of investment?

Minimum investment is as low as PHP1,000.

What are the fees I have to pay?

The fees are already embedded in the NAVPS/NAVPU. The management fees you see in the Fund Profile are not charged to you directly but rather paid by the fund as whole.

Do I get voting rights for my mutual fund/UITF shares?

As a shareholder of the mutual fund, you are entitled to attend shareholder meetings and vote during elections pertaining to the management and administration of the fund. On the other hand, UITF investors do not become shareholders of the fund, so they are not entitled to such rights.

If the companies where the fund invests in give out dividends, do I get dividends as well?

For non-income paying funds, no. All dividends received are added to the assets of the fund, possibly increasing the NAVPS/NAVPU of your investment.For income-paying funds or income-paying feeder funds, all dividends received from companies or the target fund where the fund invests in, clients will be given an income payout, which the client may choose to get as cash or re-invest.