Login to your account

SUMMARY

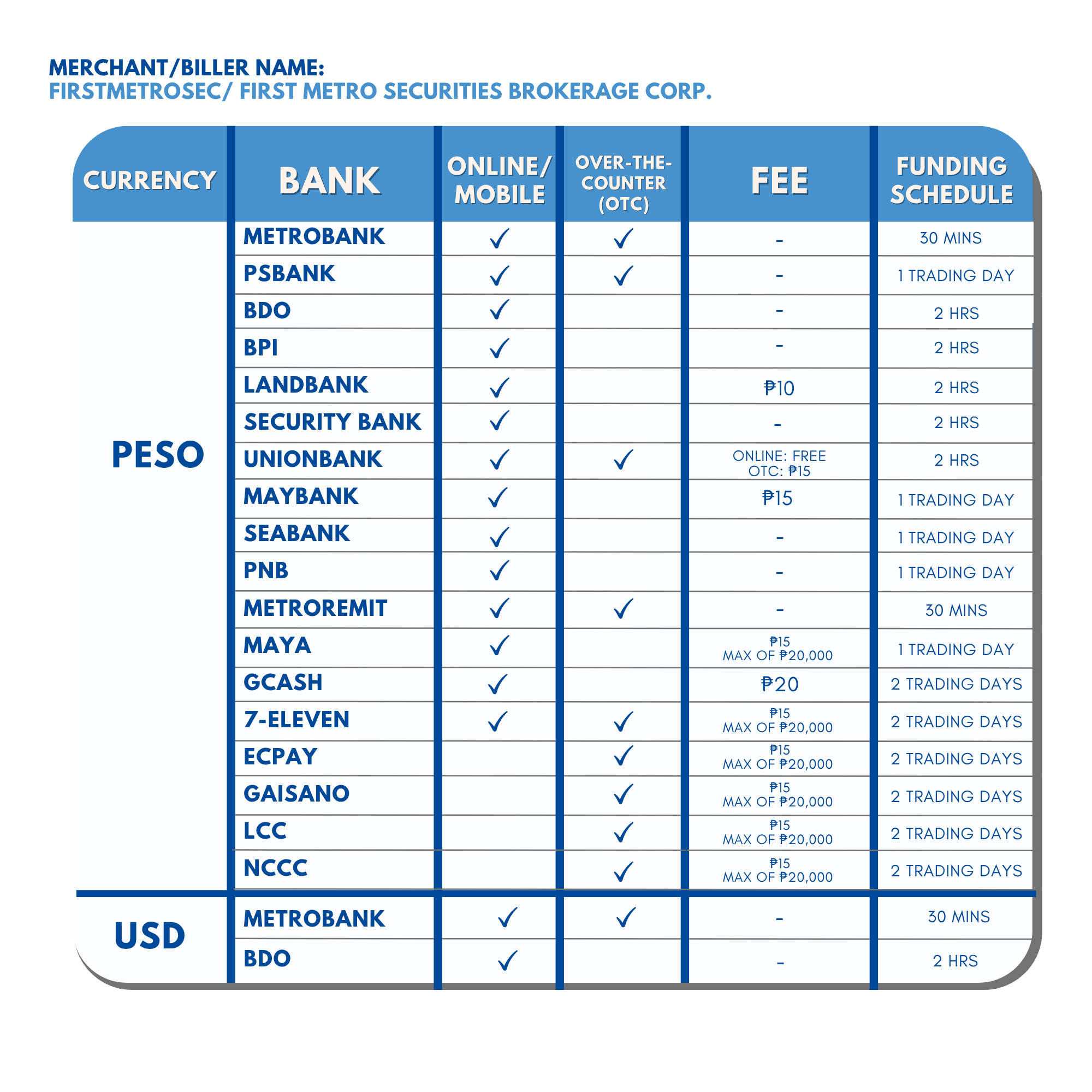

VIA BILLS PAYMENT

- Trading day cut-off: 3:00 PM

- Payments received past cut-off time shall be processed on the next trading day.

- For Metrobank, use Biller Reference No. 660

- You may auto-fund your FirstMetroSec account (monthly/quarterly) using the bank’s Scheduled/Recurring Payment option for the Voluntary Investment Program (VIP)