Bonds Basics

Looking for low-risk investments that provide a steady stream of income?

Invest in bonds through FirstMetroSec!

What are bonds?

Bonds are debt securities. A borrower sells bonds to lenders with a promise to pay regular interest over a period of time (the “tenor” or “term”) and return lenders’ money at a set date in the future ( the “maturity date”).

How do bonds work?

Borrowers, which can be the government or corporations, issue bonds to the public in order to raise funds for their projects, operations, repayment of existing debt, etc. Lenders, which can be corporations or individual investors, are then paid regular interest throughout the life of the bond thus providing stable income for the lender/investor. Upon maturity, the lender gets the last interest payment plus his full principal back.

What are the differences between government and corporate bonds?

While both provide regular income through interest payouts, corporate bonds are relatively riskier than government bonds because of the additional risk that the company may not be able to repay its debt obligation. Here’s a quick comparison between government and corporate bonds:

| Government Bonds | Corporate Bonds | |

| Issuer | Philippine Government | Company |

| Investment Objective | Capital preservation Steady cash flow |

Steady cash flow, with yields higher than government bonds |

| Credit Rating | Fitch Ratings: Philippines BBB Investment Grade |

Philippine Ratings Services (PRS) Aaa: Very Strong Aa: Strong A: Above Average Baa: Average Ba: Below Average B: Weak |

| Risks | Inflation Risk Price Risk Liquidity Risk |

Default Risk Inflation Risk Price Risk Liquidity Risk Call Risk Company Risk |

| Interest Payout | Quarterly | Quarterly or semiannual |

Are bonds risky?

Bonds are considered low-risk investments. Government bonds, in particular, are considered default risk-free because they are a direct and unconditional obligation of the government. Investors are guaranteed to get their principal back upon maturity. For corporate bonds, however, there is a chance that the company would not be able to repay its debt. Hence, it is important to choose stable companies when investing in these types of bonds.

Why invest in bonds?

Bonds are affordable, low risk, and accessible online. While returns are not as high as stocks or other equity funds, its interest rates are still generally higher than most savings or time deposits.

Who can invest in bonds?

In FirstMetroSec, the following account types are allowed to order bonds:

| Government Bonds | Corporate Bonds |

| Individual only | Individual Joint In-Trust-For (ITF) Corporate |

If you do not have a FirstMetroSec account yet, account opening is quick and easy upon submission of complete requirements. Click HERE to learn how.

How much is the minimum investment amount?

| Bond | Minimum Amount | In multiples of |

| Premyo Bonds | P500 | P500 |

| Retail Treasury Bonds (RTBs) | P5,000 | P5,000 |

| Corporate Bonds | P50,000 | P10,000 |

| Retail Dollar Bonds (RDBs) | $300 | $100 |

How much is the maximum investment amount?

For government bonds, the maximum amount per transaction is P500,000 or $10,000. For higher amounts, you may divide into multiple online orders instead. For corporate bonds, no limit.

Can I buy bonds anytime?

For now, FirstMetroSec only accepts buy orders for primary offerings.

Can foreigners invest in bonds?

Yes. You will need to submit your Alien Certificate of Registration (ACR) Card when you open a FirstMetroSec account. Check the complete list of requirements HERE.

Can I buy bonds from abroad?

Yes. Ordering is online and may be accessed anywhere in the world. You may email [email protected] for assistance.

When and how will I receive interest payments?

Regular interest payouts will be credited to your buying power on the scheduled dates (quarterly or semiannual). Should the date fall on a weekend or holiday, they will be credited on the next business day.

Are interest payments subject to tax?

For peso-denominated bonds, interests are subject to 20% withholding tax. Meanwhile, for Retail Dollar Bonds, tax is paid by the government so the investor will get the interest payment in full.

What would be my proof of investment?

After issue date, you may download your Confirmation of Outright Sale from your FirstMetroSec account under the Accounts > Statements tab. For government bonds, you will also find the Bureau of the Treasury’s Summary of Transactions, which shows your nRoSS account number. For corporate bonds, the Philippine Depository & Trust Corp. (PDTC) will send your copy of the Authority to Purchase (ATP) through your registered email address, while the Registry Confirmation (RC) will be sent via snail mail. Delivery period varies.

Are there additional charges when I invest in bonds thru FirstMetroSec?

None. Zero broker’s fees for primary issuances (similar to Initial Public Offering or IPO in stocks).

Can I pre-terminate/withdraw my bond investment?

No.

Can I sell my bond investment?

Except for Premyo Bonds, you can sell your bond holdings in the secondary market ANYTIME based on the prevailing market rate, subject to fees and taxes. For instructions, you may visit the following links:

- Retail Treasury Bonds and Retail Dollar Bonds

- Corporate Bonds

Can I sell partial amounts?

Yes, you may sell less than your face amount. Once sold, you will be issued a new Confirmation of Sale for the remaining amount.

Premyo Bonds

What are Premyo Bonds?

Premyo Bonds are government-issued bonds that pay a fixed interest every quarter, with 1-year maturity. But unlike other government securities, Premyo Bonds also offer cash and non-cash prizes for investors awarded through a raffle draw.How much to invest in Premyo Bonds?

Minimum investment is just P500. This entitles you to one (1) Electronic Rewards Number (ERN). Every additional P500 invested gives you an additional ERN (Example: P5,000 = 10 ERNs). You get the same number of chances (ERNs) per quarterly raffle draw.How would I know if I win the raffle?

The Bureau of the Treasury (BTr) broadcasts the raffle draws via Facebook Live and announces the winning NRoss numbers. Winners will also receive an email notice from FirstMetroSec. To get your NRoss number, log in to your FirstMetroSec online account then go to Account > Statements > Bond Certificates then click Download. Example: FMSB3641AIXG05.How do I claim my prize/s?

Grand Prize winners must present one (1) valid government-issued ID and the Notification Letter sent by the Premyo Bond Facility Agent at any LandBank branch to claim their prizes. Other cash rewards will be credited to your FirstMetroSec account.

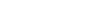

How to order bonds

-

No physical forms. No branch visits. No personal appearance. It's that easy.

-

Make sure that you have enough cleared/withdrawable cash in your FirstMetroSec account before placing an order. To check the various ways to fund your PHP/USD FirstMetroSec account, click here. No FirstMetroSec account yet? Open here.

-

You may order multiple times within the duration of the offer period. Order here.

How to Participate in Corporate Bonds?

- Submit your INTENT FORM through FirstMetroSec Help Center before the set deadline. Note that submission constitutes your firm and irrevocable intent to participate in the proposed issuance.

- Ensure that you have sufficient cleared/withdrawable cash in your FirstMetroSec account. The amount will be earmarked from your account.

- On offer period, expect an email advise of your final allocated volume. Your FirstMetroSec account will be debited on the same day as payment for your order.

- Accomplish and submit the following requirements through FirstMetroSec Help Center before the end of the offer period.

- Application to Purchase (ATP)

- PDTC Signature Card

- Client Suitability Assessment (CSA)