SUMMARY

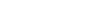

VIA BILLS PAYMENT

- Trading day cut-off: 3:00 PM

- Payments received past cut-off time shall be processed on the next trading day.

- For Metrobank, use Biller Reference No. 660

- You may auto-fund your FirstMetroSec account (monthly/quarterly) using the bank’s Scheduled/Recurring Payment option for the Voluntary Investment Program (VIP)

METROBANK ONLINE

- Go to the Metrobank Online website and log in using your credentials.

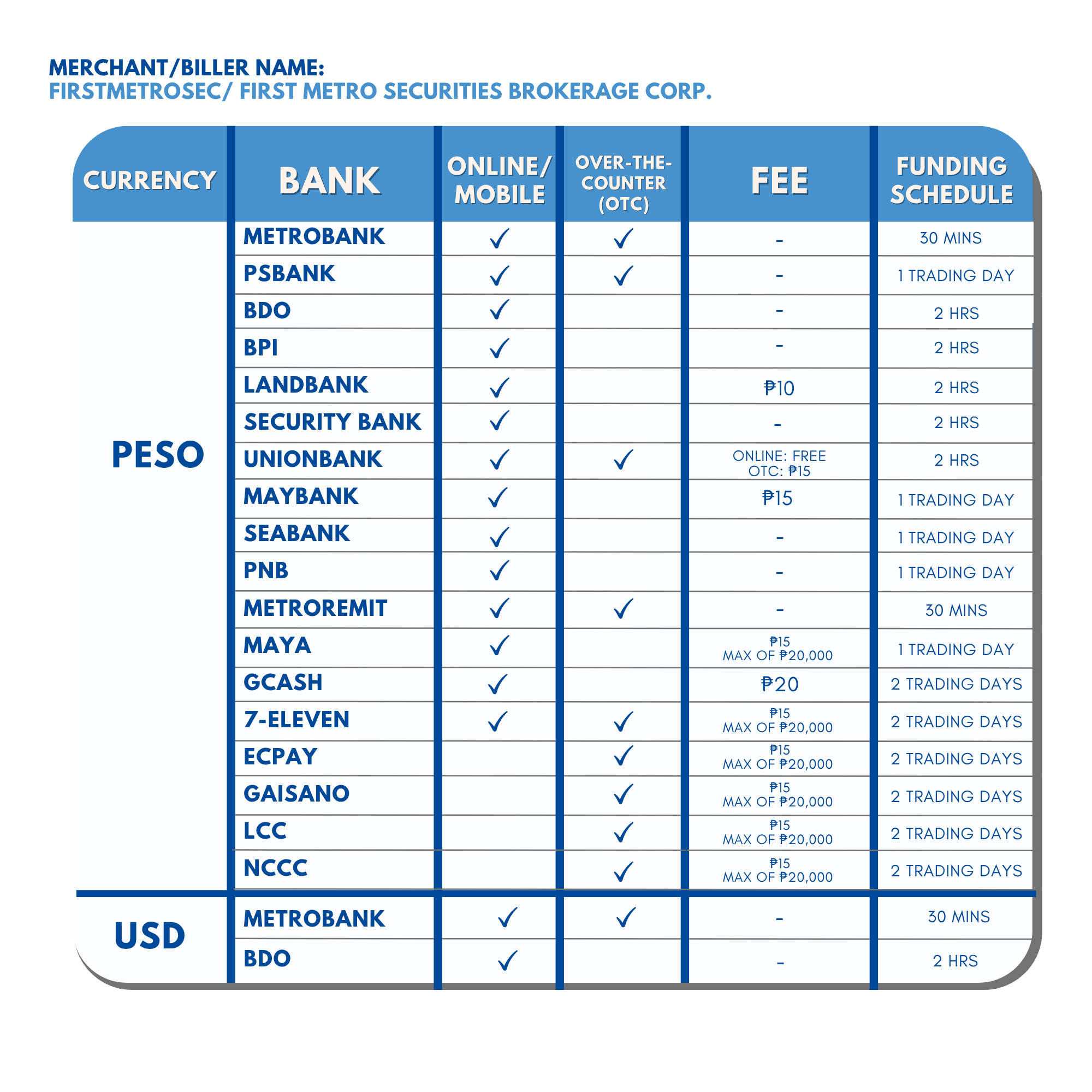

- Register FirstMetroSec as your biller. Go to CONTACTS. Under BILLERS, click the Add (+) button.

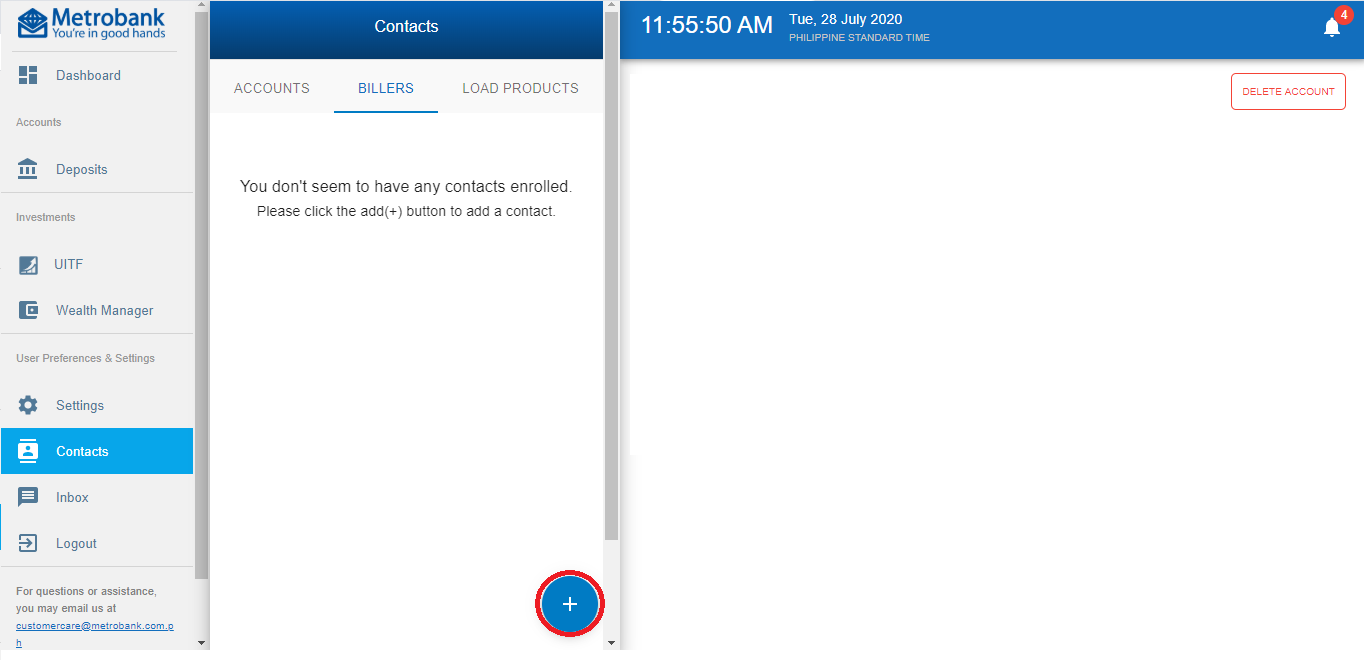

- For Contact Name, type your preferred label/nickname. Under Biller, choose First Metro Securities Brokerage Corporation. Enter your FirstMetroSec Account Code under Subscriber Number (ex. OTAXXXXXX or OTXXXX-X). Enter 660 as Reference Code, then click CREATE.

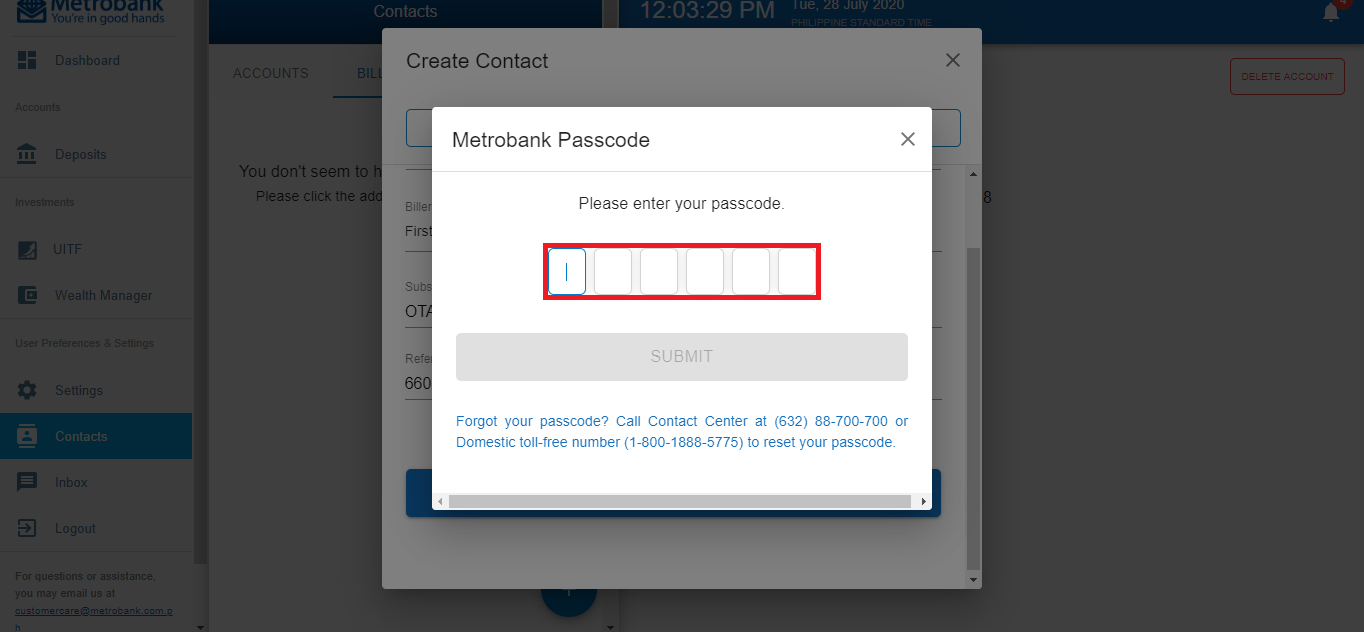

- Enter your passcode to finalize.

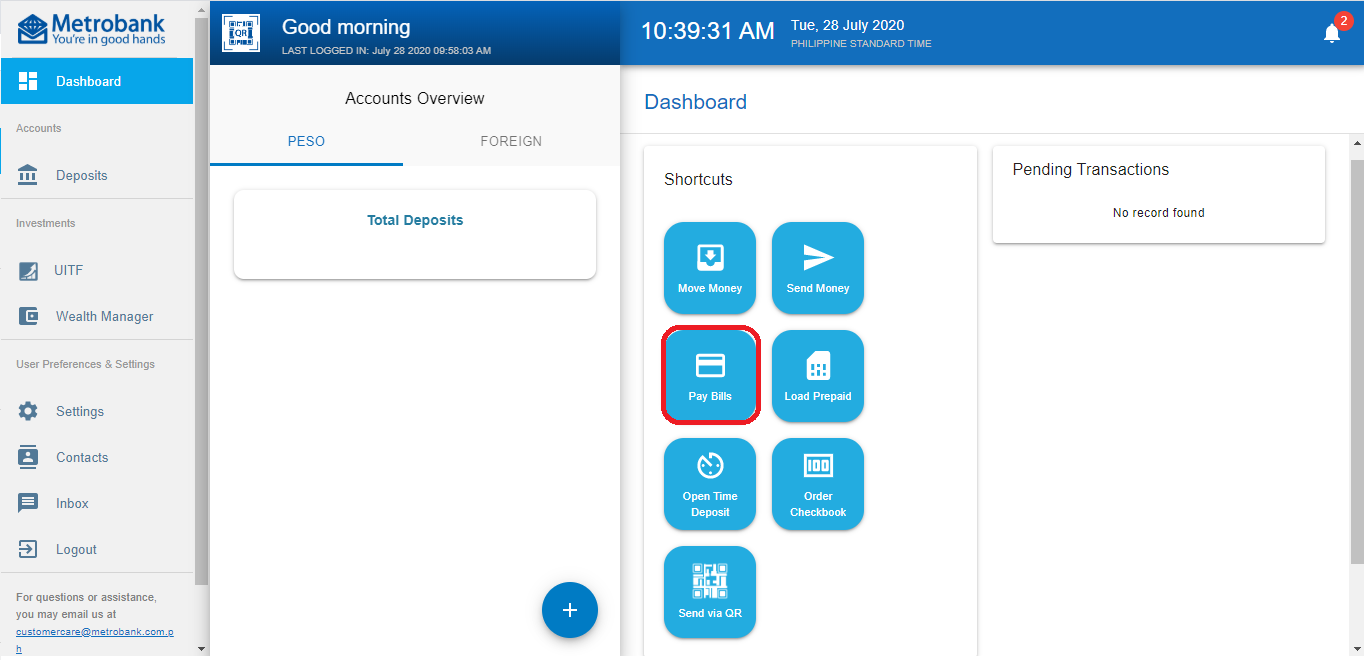

- Next, click on Pay Bills from the Dashboard.

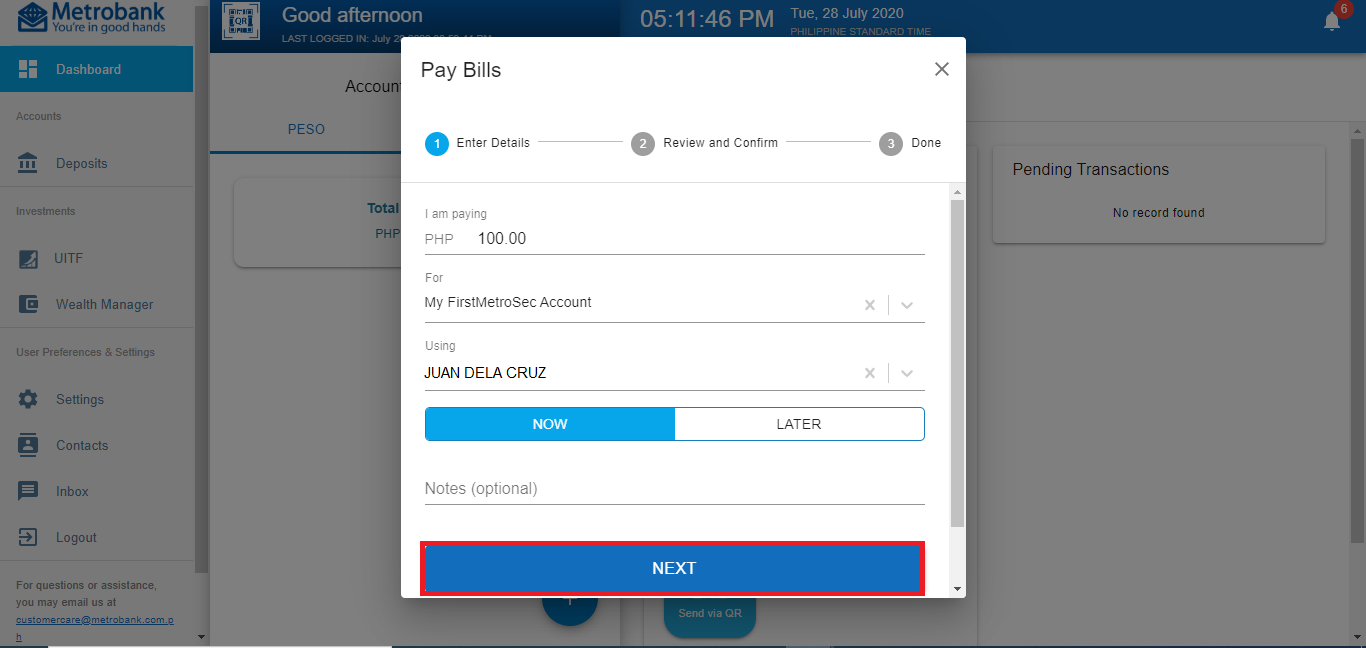

- Enter the amount, your registered FirstMetroSec biller, and your source account. Choose the schedule (NOW or LATER), and click NEXT.

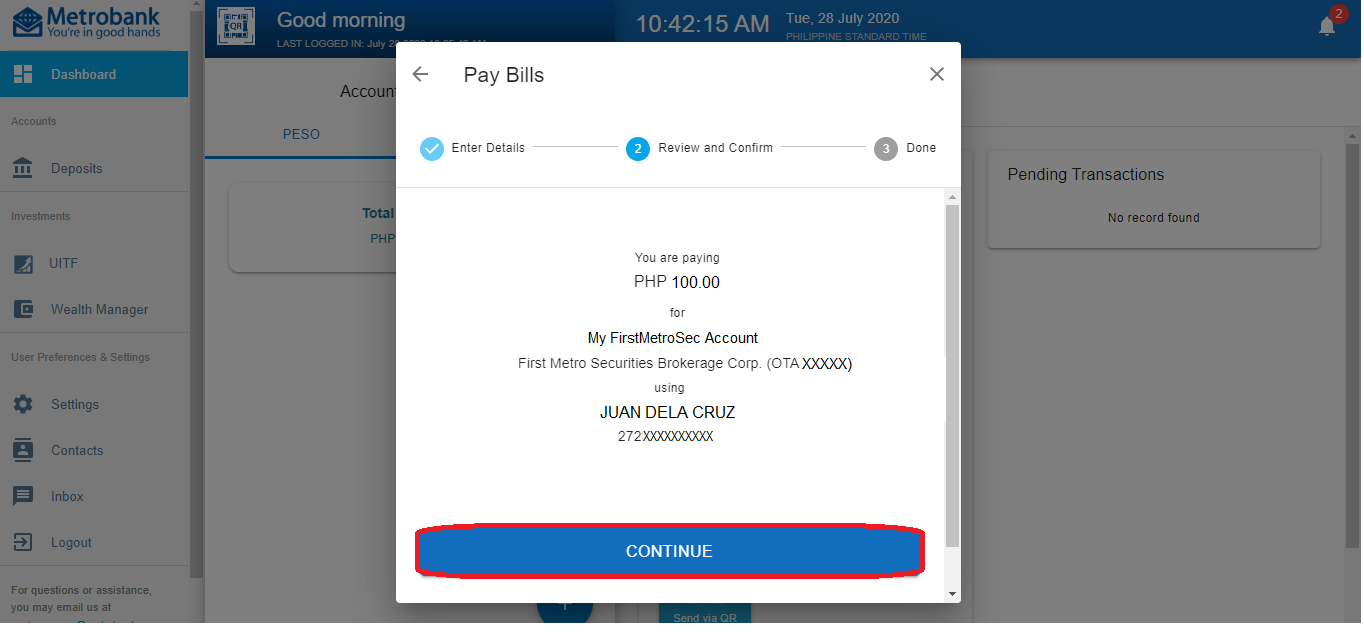

- Review the transaction, then click CONTINUE.

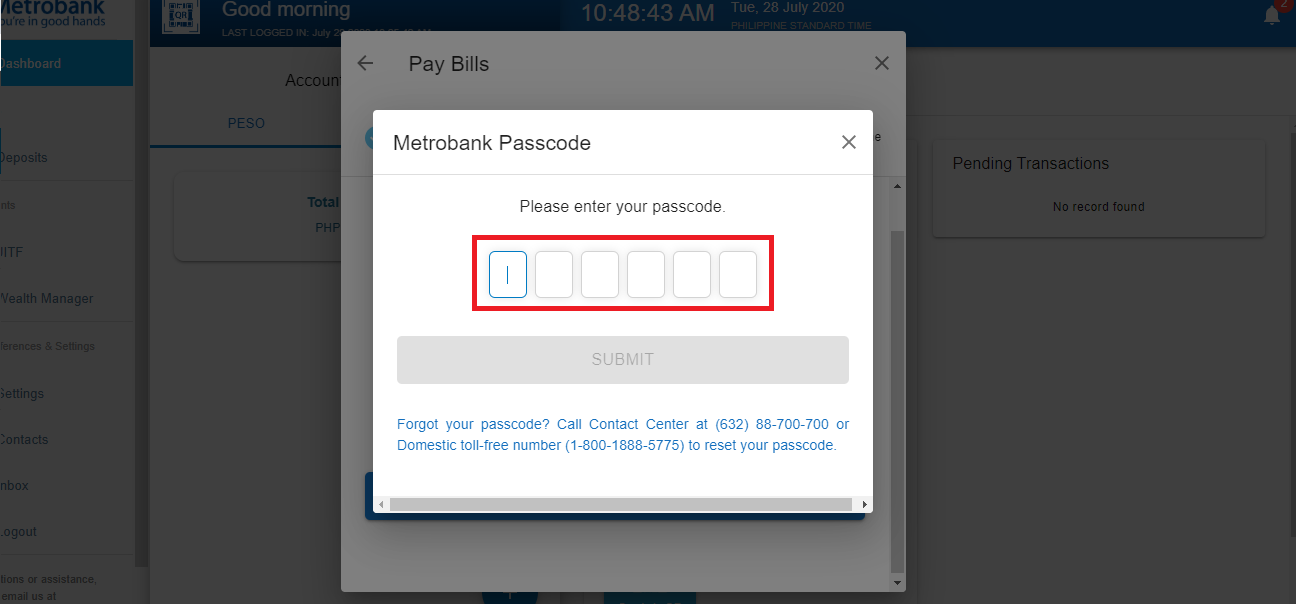

- Enter your Metrobank passcode.

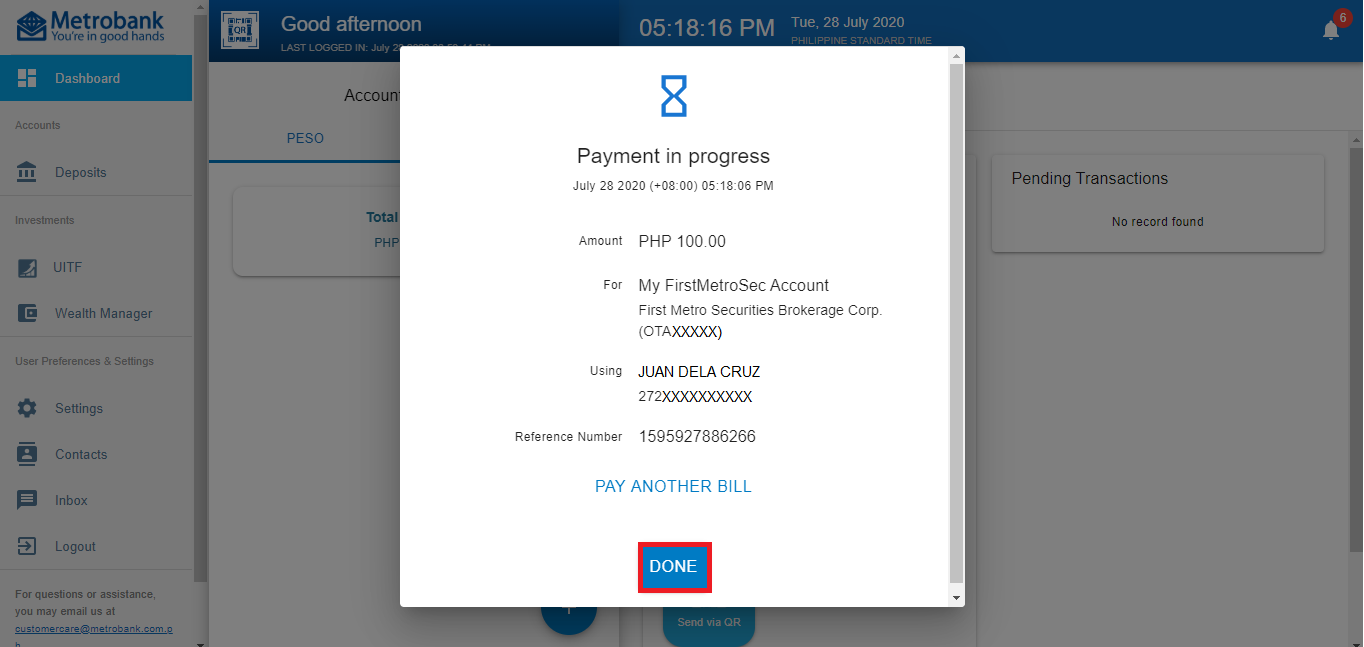

- Take note of your transaction summary and click DONE.

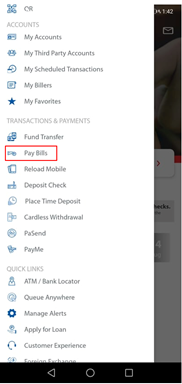

METROBANK APP

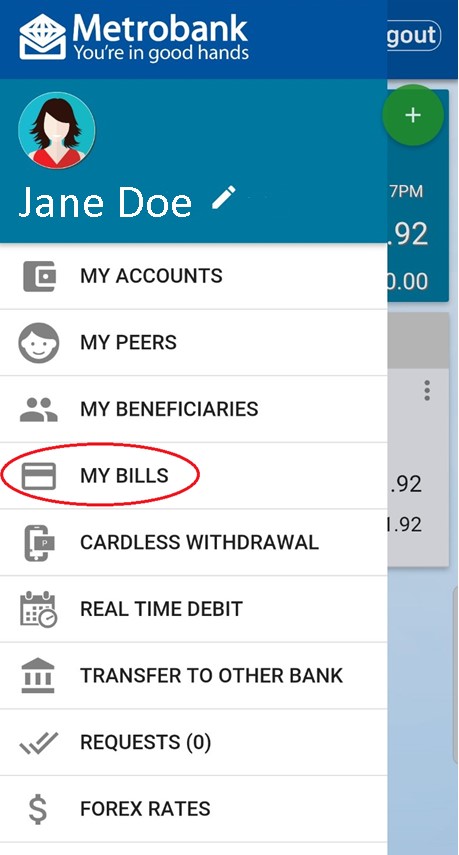

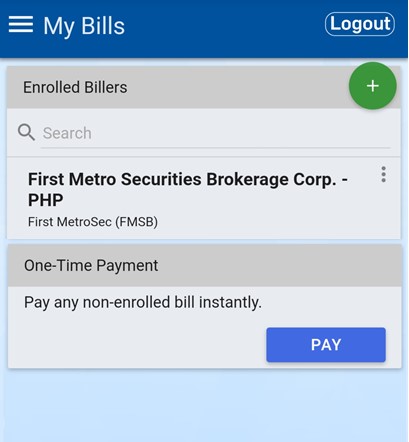

2. Click MY BILLS

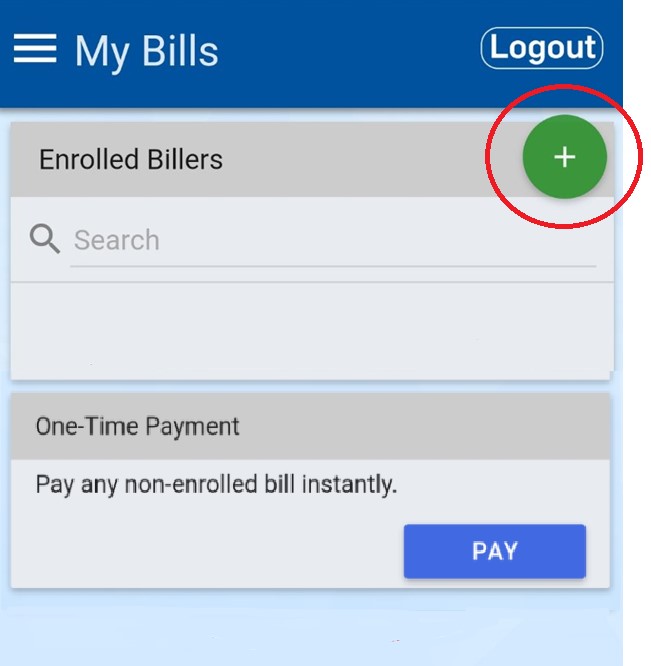

3. Click the plus (+) sign across Enrolled Billers

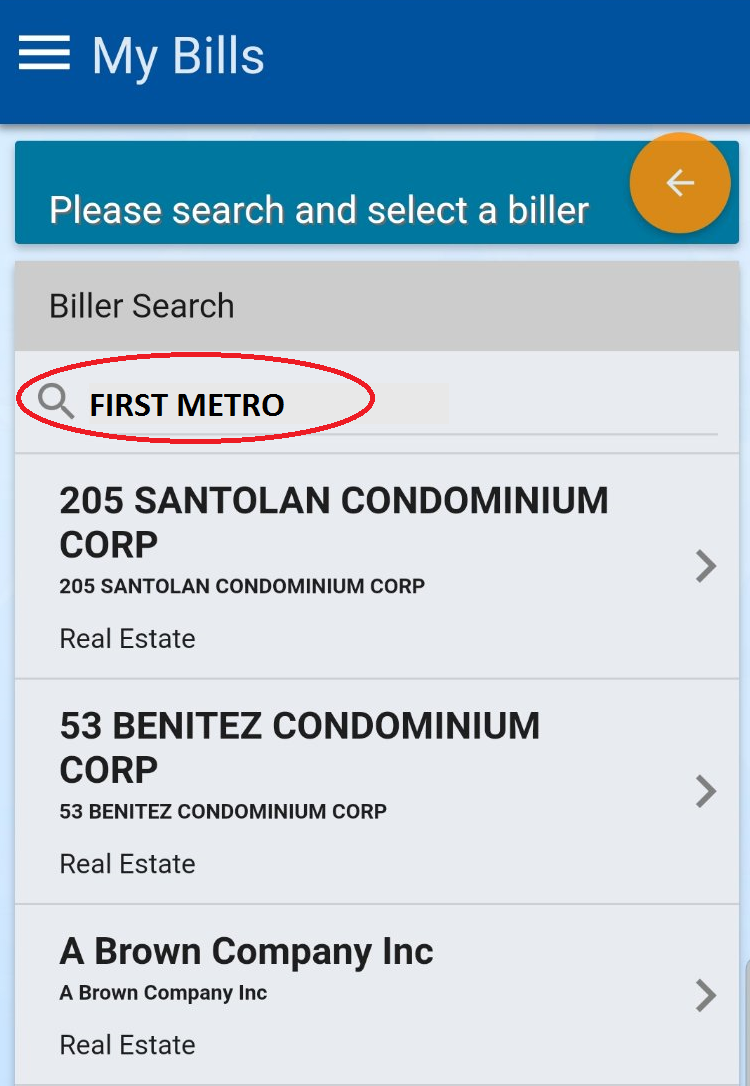

4. Under Biller Search, type FIRST METRO

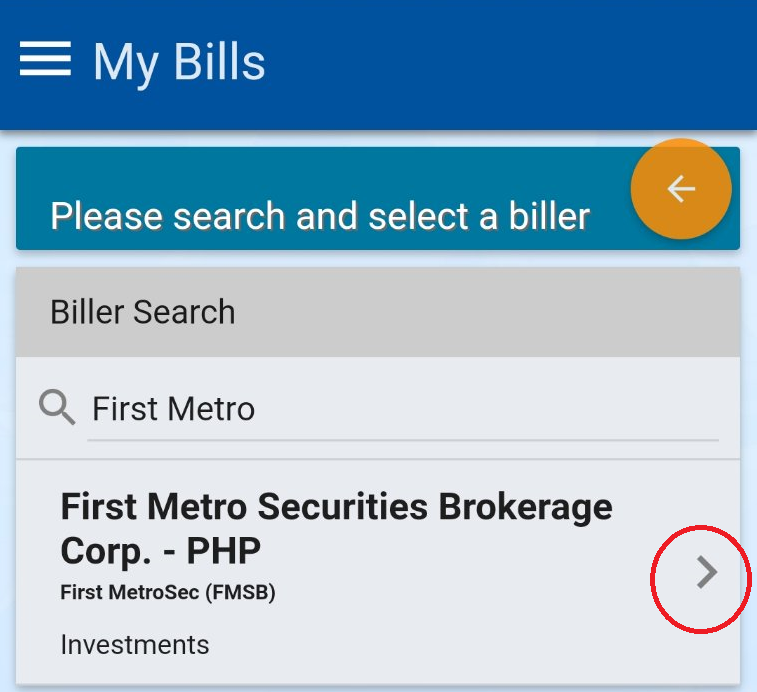

5. Click “>”

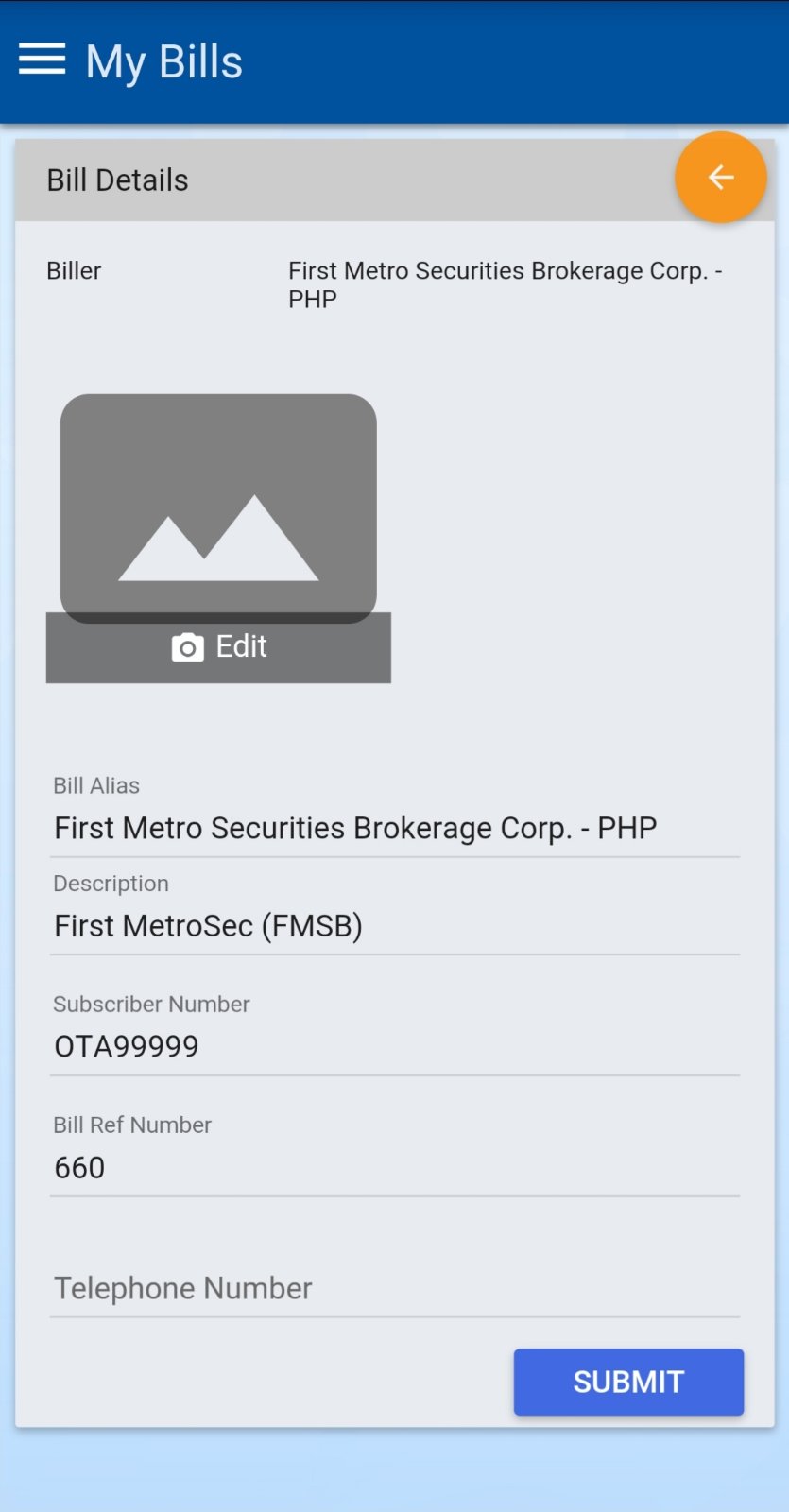

6. Enter your FirstMetroSec Account Code under “Subscriber Number” and enter 660 under “Bill Ref. Number.” Indicate your telephone number (in case of discrepancies). Click Submit.

7. Select the Enrolled Biller and click Pay. Select the source account for your payment. Enter the amount and click NEXT.

8. Review payment details, then SUBMIT

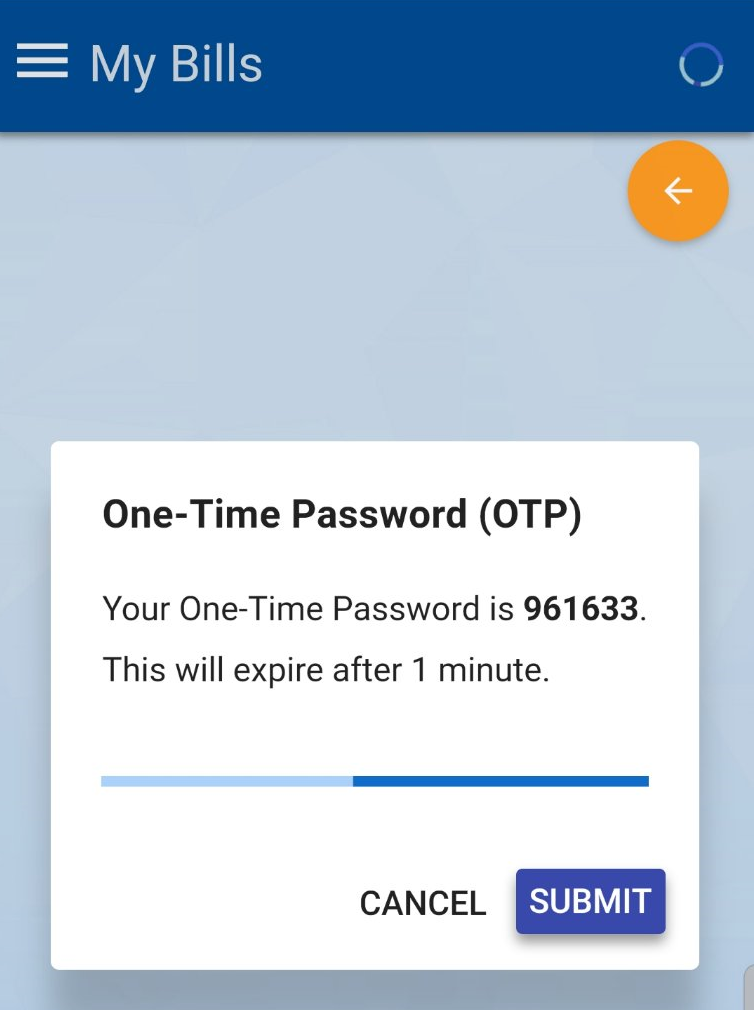

8. Wait for the app-generated OTP (not via SMS), and click SUBMIT

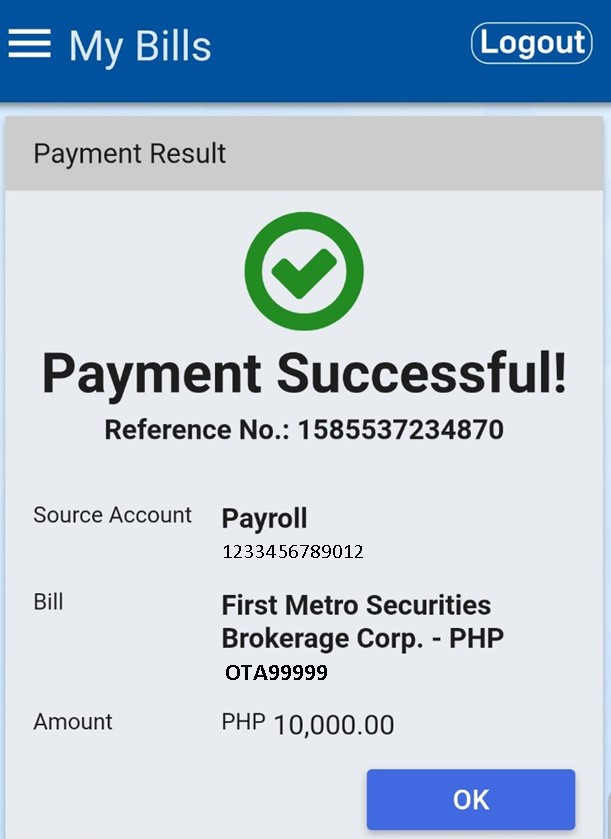

Keep a screenshot of your Payment Result for reference

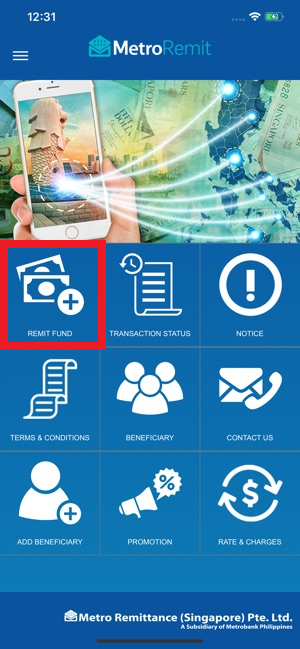

MetroRemit Bills Payment

Instead of remittance from overseas, you may fund your FirstMetroSec PHP account using the BILLS PAYMENT facility of MetroRemit from these countries:

| Foreign Offices | Bills Payment Service Fee |

| Metro Remittance Singapore | SGD 4.00 |

| Metro Remittance Hong Kong | HKD 20.00 |

| Metro Remittance Seoul & Pusan, Korea | KRW 4,900 |

| Metrobank New York, USA | USD 8 |

| MB Center Hawaii Kalihi (Honolulu) | USD 9 |

| Metro Remittance Canada (Vancouver) | CAD 8.00 |

| Metro Remittance Canada (Toronto) | CAD 10.00 |

| Metro Remittance United Kingdom | £7.00 |

Benefits:

- Faster crediting to your FirstMetroSec account (within the trading day)

- No need to send proof of remittance/payment

How?

- Visit the nearest MetroRemit branch near you. Click here for the addresses and telephone numbers of the above foreign offices.

- Fill out the Bills Payment form.

- Write First Metro Securities Brokerage Corp. as biller/merchant.

- Indicate your name, FirstMetroSec account number (OTAxxxxx), and amount.

- Pay the amount at the counter.

- Launch the MetroRemit mobile app and log in using your credentials.

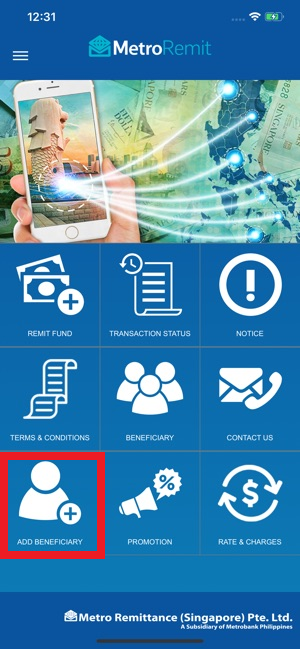

- Go to BENEFICIARY to add FirstMetroSec.

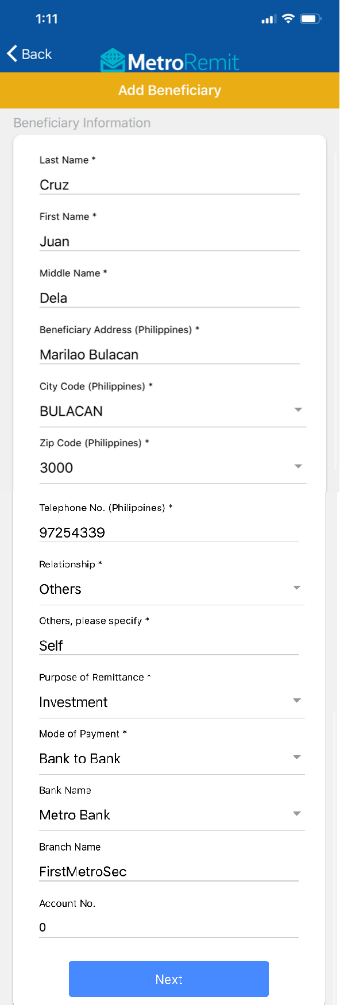

- Fill in with your name, address, and contact number. Then complete the following fields with these information:

- Relationship: OTHERS

- Others, please specify: SELF

- Purpose of Remittance: INVESTMENT

- Mode of Payment: BANK TO BANK

- Bank Name: METROBANK

- Branch Name: FIRSTMETROSEC

- Account Number: 0

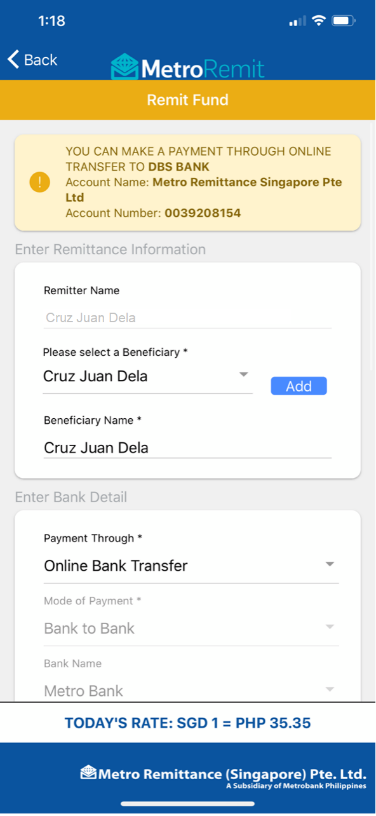

- Next, go to REMIT FUND.

- Select the beneficiary previously registered, then enter your name as Beneficiary Name. Select your preferred payment method.

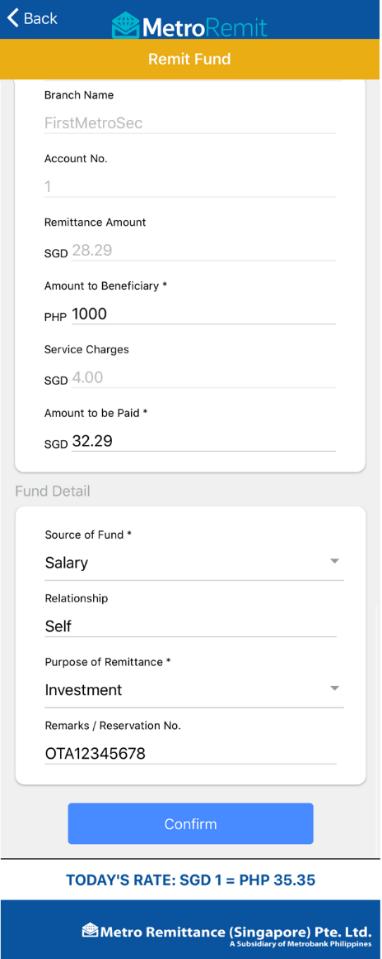

- Input your desired amount. Total Amount to be Paid will be auto-computed and converted to Singaporean Dollar. Select your Source of Fund, then fill in the remaining fields with the following:

- Relationship: SELF

- Purpose of Remittance: INVESTMENT

- Remarks/ Reservation No.: Your FirstMetroSec Account No. (i.e. OTAxxxxx)

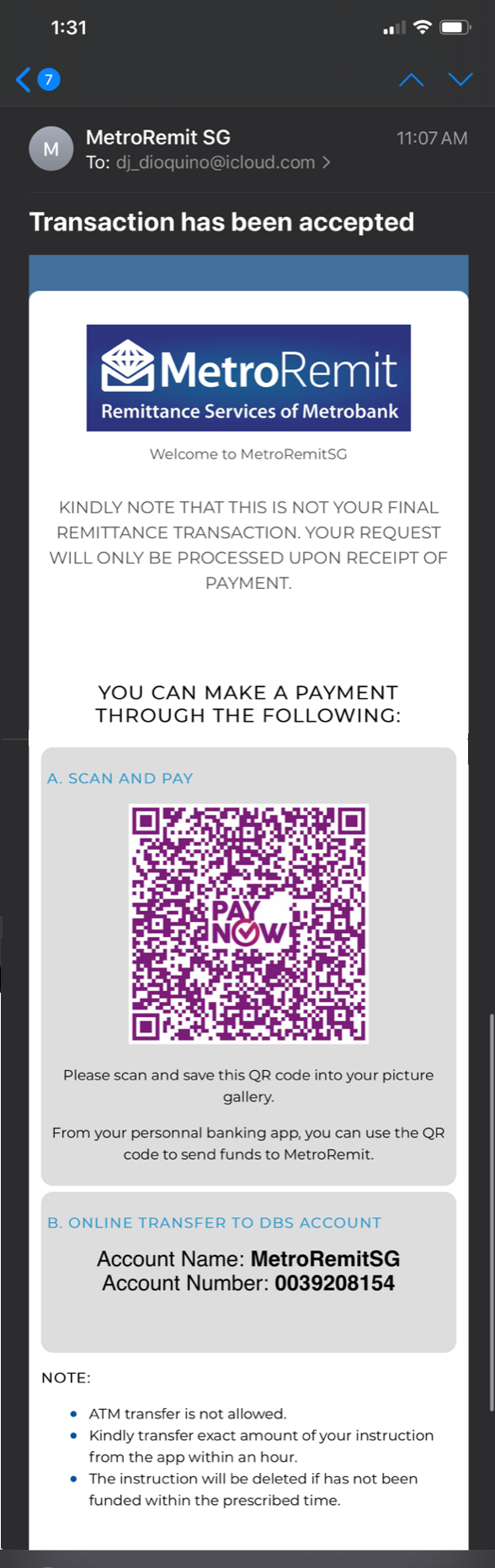

- Wait for the remittance instruction which will be sent to your email. For online bank transfer, use your personal banking app to pay within the prescribed time. Note: For security, payment instruction will be automatically deleted within one (1) hour.

8. Once you complete the fund transfer, wait for the transaction receipt.

METROREMIT (SINGAPORE) FAQs

Can I use foreign-issued bank accounts to fund my FirstMetroSec account?

Yes. However, please note that PERSONAL/PHYSICAL DEPOSIT TO DBS ACCOUNT IS NOT ACCEPTED. Instead, you may send your payment via online banking to MetroRemit SG within an hour:

| Account Information | |

| Bank Name | DBS Bank |

| Account Name | MetroRemitSG |

| Account number | 0039208154 |

Can I fund my account without registering as beneficiary?

No, you need to register beneficiaries for all remittances initiated using the app. However, you can modify or delete these beneficiaries anytime.

Why do I need to register myself as a beneficiary?

Because you’re funding your FirstMetroSec account, which you registered under your name. This would also distinguish your account funding transaction from your regular remittances. Make sure to enter “FirstMetroSec” and your FirstMetroSec account number, as instructed above.

How do I know the status of my transaction?

You may review all your transactions in the Transaction Status page on the MetroRemit SG app/website.

What are the fees and charges?

A service fee of SGD4 will be charged per transaction.

Is there a transfer limit?

The mobile app daily transaction limit is SGD12,000. For higher amounts, please visit the MetroRemit SG branch.

How do I know if my transaction was successful?

You will be notified by MetroRemit via email.

Can I fund my FirstMetroSec account at the MetroRemit branch itself?

Yes, fill out the BILLS PAYMENT form with First Metro Securities Brokerage Corp. as biller/merchant, instead of remittance. Use Biller Reference No. 660.

I have questions on my remittance/funding transactions, how do I get in touch with MetroRemit SG?

Contact details:

MetroRemit Singapore

03- 30 Lucky Plaza, Orchard Road, Singapore 238863

Email: [email protected]

Tel No: +65 6734 2748

Can I fund my FirstMetroSec account at the MetroRemit locations?

| Country | Branches |

| Hong Kong | Metro Remittance United Centre, Worldwide House, Shatin, Tsuen Wan, and Tsuen Kwan O |

| Korea | Metrobank Seoul and Metrobank Pusan |

| Taiwan | Metrobank Taipei |

| China | Metrobank Shanghai, Beijing, Nanjing, Changzhou, Quanzhou, & Xiamen |

| Canada | Metro Remittance Center Toronto & Vancouver |

| USA | Metrobank New York, MB Remittance Center Honolulu & Waipahu |

| UK | Metro Remittance London |

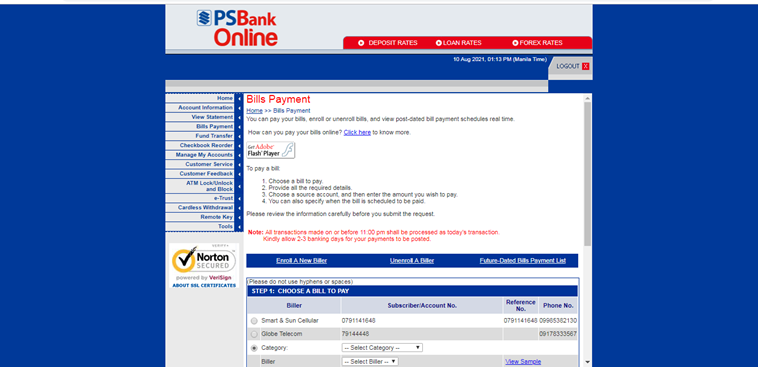

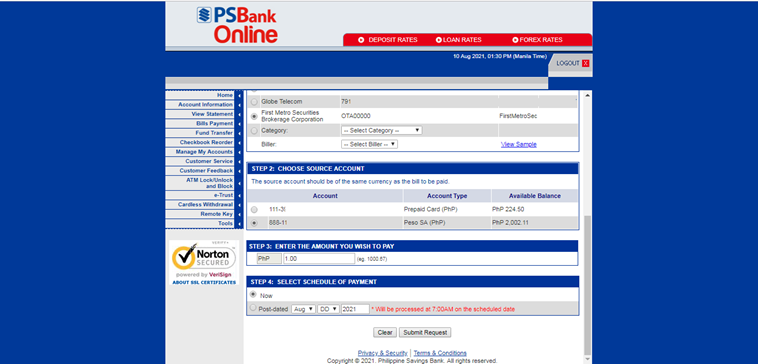

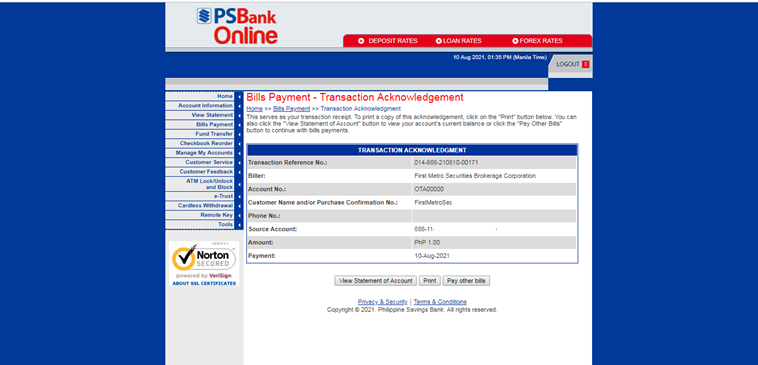

PSBANK ONLINE

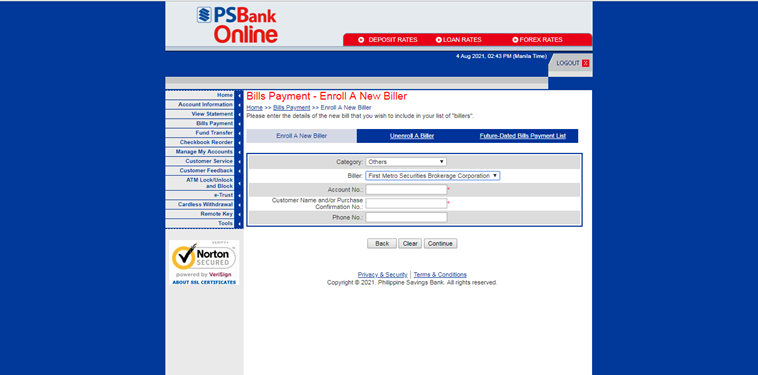

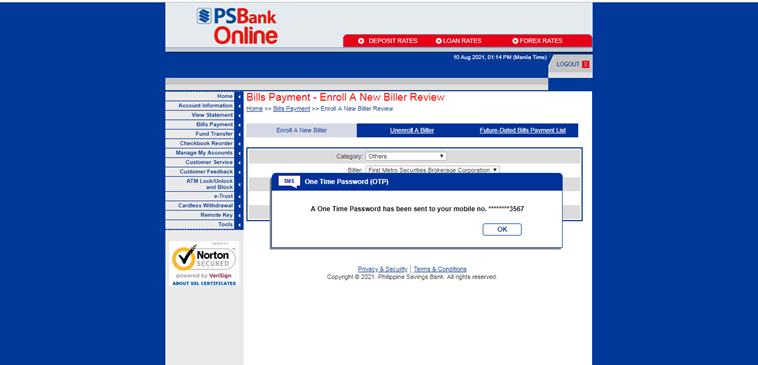

1. Log into your PSBANK Online account, and then go to BILLS PAYMENT to enroll First Metro Securities Brokerage Corporation as a biller.Note: To be able to use PSBank mobile app for succeeding funding, you have to enroll FirstMetroSec as biller thru PSBank Online first.

2. Go to ENROLL A NEW BILLER. Select OTHERS, and then select FIRST METRO SECURITIES BROKERAGE.

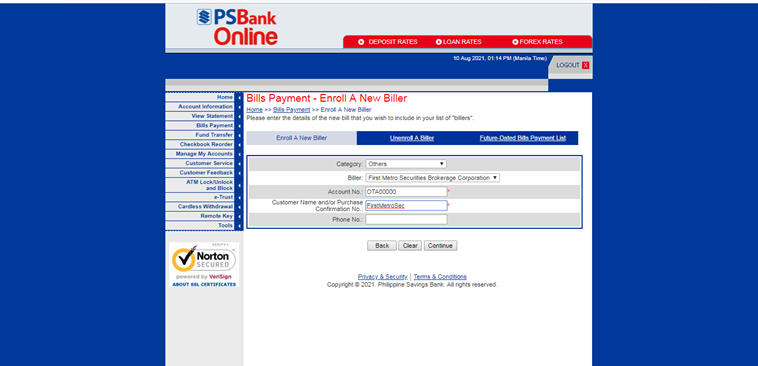

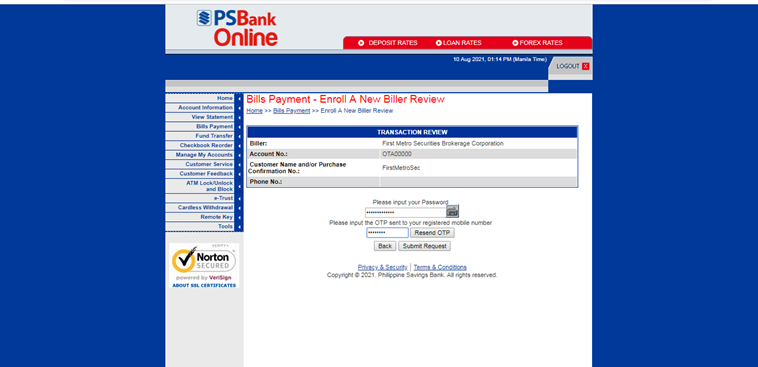

3. Enter the following information before clicking CONTINUE:

A. Account Number (ex. OTA00000)

B. Customer Name and/or Purchase Confirmation No.

C. Phone Number (Optional)

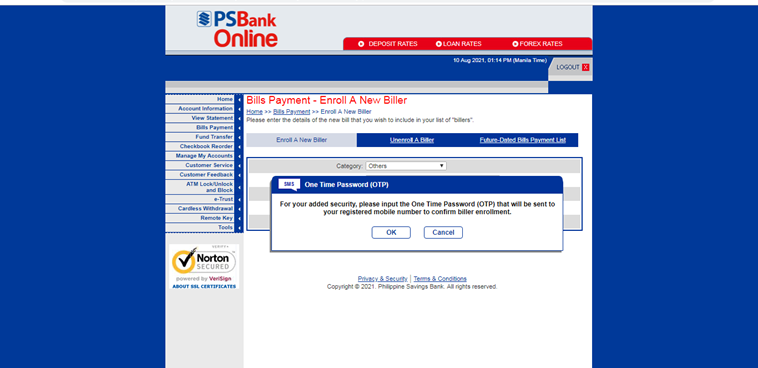

4. Click OK.

5. OTP will be sent to your registered mobile number.

6. Input your Password and OTP then click SUBMIT REQUEST.

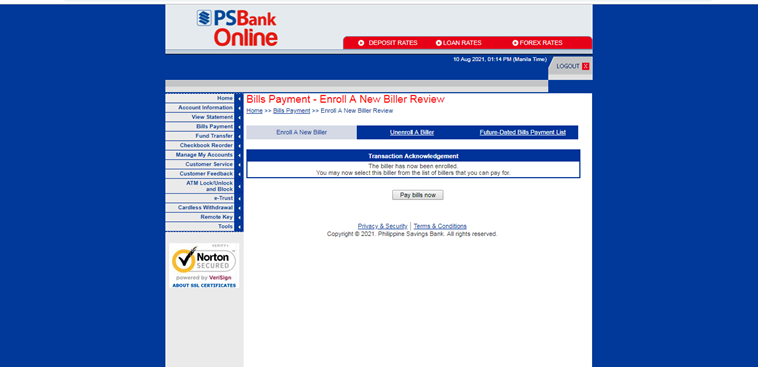

7. FirstMetroSec has now been added as your biller. You may now fund your FirstMetroSec account thru PSBANK Online or PSBANK mobile app.

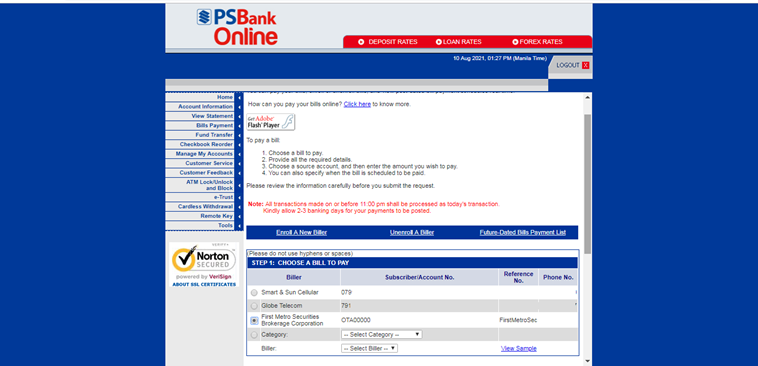

8. In the Bills Payment Module (CHOOSE A BILL TO PAY), select your enrolled FirstMetroSec biller.

9. Choose the Source Account, enter the amount you wish to pay, and select schedule of payment.

10. Click SUBMIT REQUEST to proceed.

11. Review your previously entered information. Then enter your password and click SUBMIT REQUEST.

12. Your payment via PSBank Online is successful.

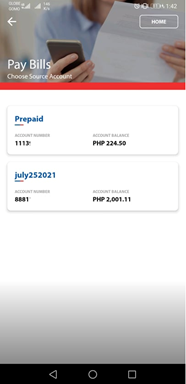

PSBANK APP

A. Thru Side Menu

1. Log into your PSBANK Mobile account, and then go to Pay Bills module in the Side Menu

2. Choose Source Account

3. Select your Enrolled First Metro Securities Brokerage Corporation Biller

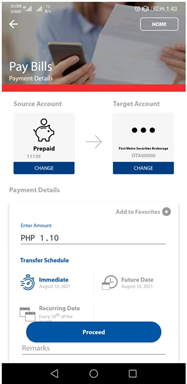

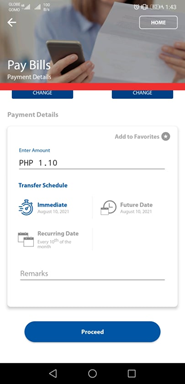

4. In the Payment Details Screen:

- Enter Amount

- Select Transfer Schedule

- Remarks (Optional)

- Click Proceed button

5. Review payment details in the Summary Screen, and then press Submit button.

6. You have successfully funded your FirstMetroSec account.

B. Thru Create a Transaction

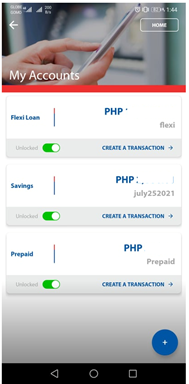

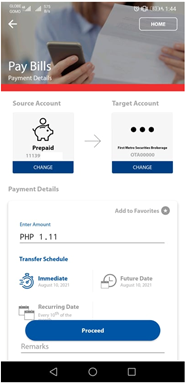

1. Go to My Accounts module. Tap Create a Transaction on your Savings or Checking Account you wish to use as a source account.

2. Select PAY BILLS in the transaction tiles displayed on your screen.

3. Select your Enrolled First Metro Securities Brokerage Corporation Biller.

4. In the Payment Details Screen, enter Amount, select Transfer Schedule, and remarks (optional). Next, click Proceed.

5. Review payment details in the Summary Screen, and then press Submit button.

6. You have successfully funded your FirstMetroSec account.

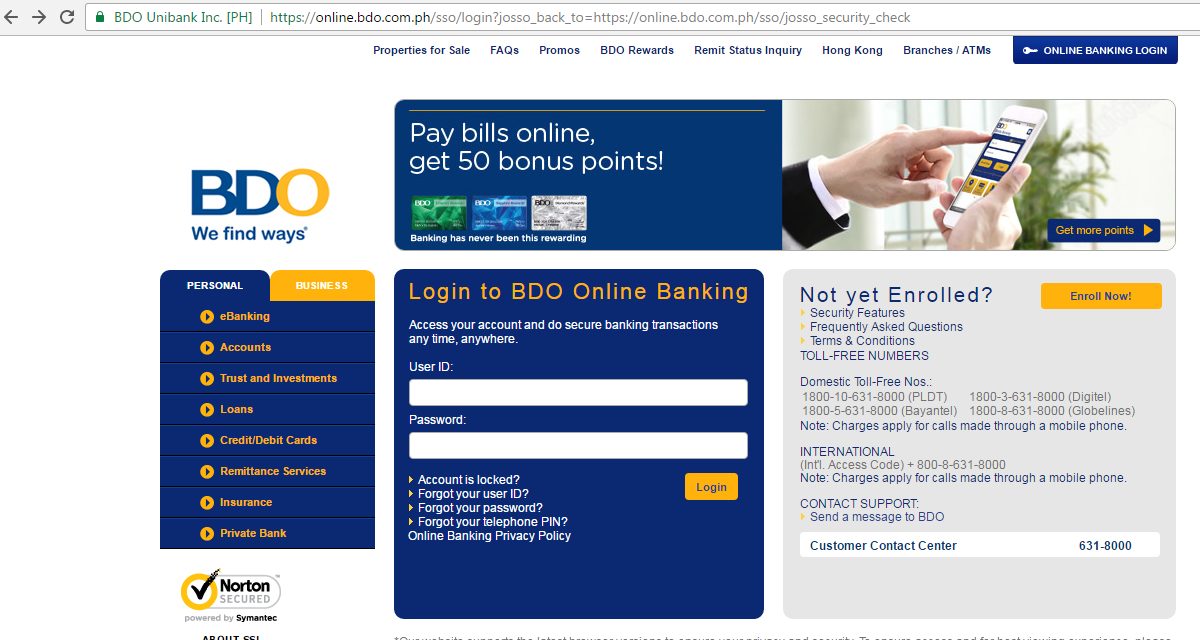

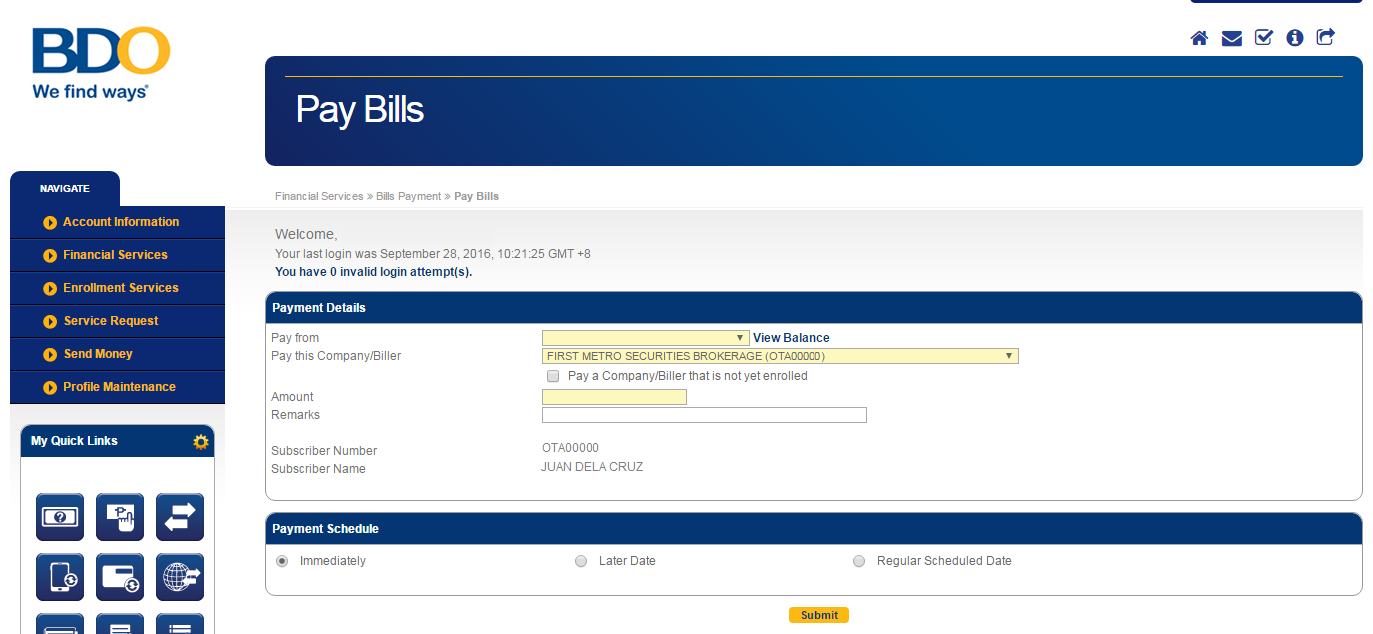

BDO ONLINE BANKING

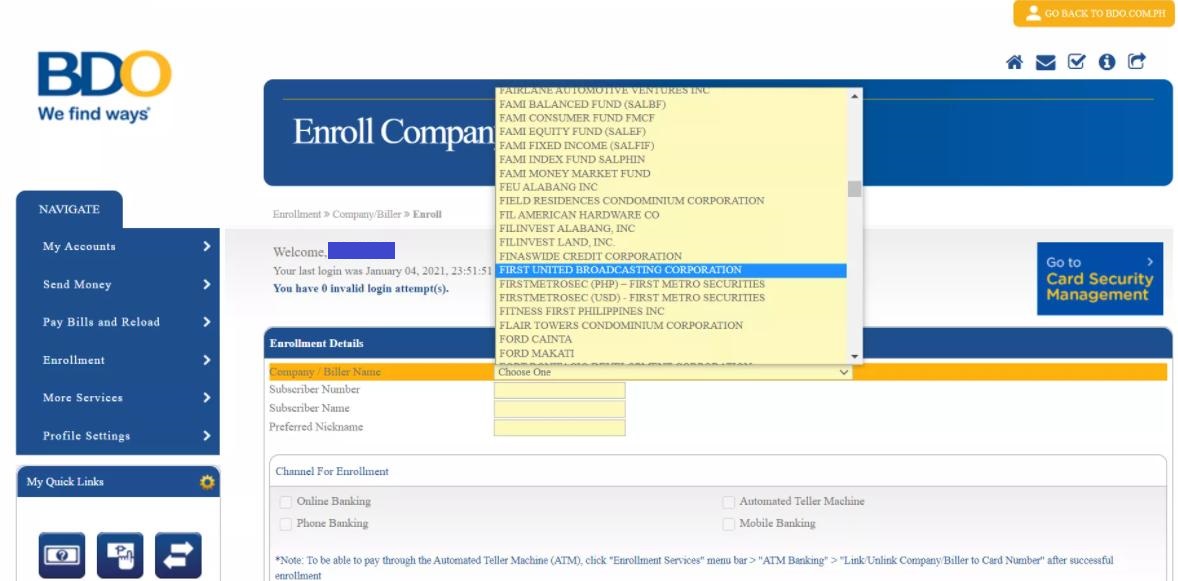

NOTE: If using the BDO Mobile App, please enroll first the Company/Biller via the BDO Online Banking website. DO NOT enroll the Company/Biller via the Mobile App as there is bug that is currently being fixed.

Step 1: Enroll Company/Biller

1. Go to https://online.bdo.com.ph and log-in using your account details

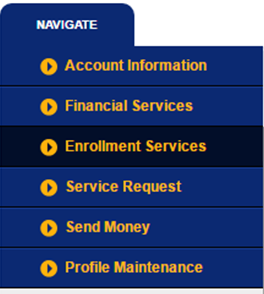

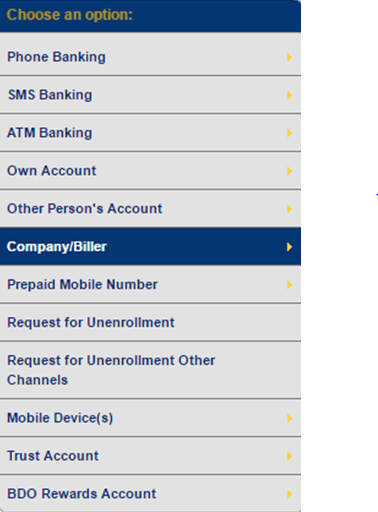

2. On the left menu bar, click on Enrollment Services

3. Under Choose an Option, select Company/Biller

4. Then click on Enroll

5. Under Company/Biller Name, choose FIRSTMETROSEC (PHP) - FIRST METRO SECURITIES or FIRSTMETROSEC (USD) - FIRST METRO SECURITIES

6. Enter Subscriber Number, your FMS Account Code (OTxxxxxx)

7. Enter Subscriber Name, your FMS Account Name

8. Indicate your Preferred Nickname for the Company/Biller enrolled

9. For Select Channels For Enrollment, put a check on Online Banking

10. Then click Submit

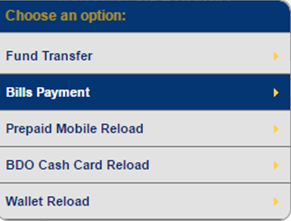

Step 2: Transfer funds to your FMS account using Pay Bills

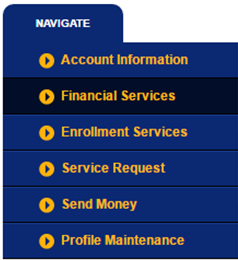

1. On the left menu bar, click on Financial Services

2. Under Choose an Option, select Bills Payment

3. Then click on Pay Bills

4. Fill out the Payment Details

5. For Pay from, choose the funding/source account

6. For Pay this Company/Biller, select the FMS Biller enrolled in Step 1 --- First Metro Securities Brokerage Corporation (OTxxxxxx)

7. Enter the amount you wish to transfer to your FMS account

8. For Payment Schedule, select Immediately

9. Click Submit

*Discalimer: Kindly transfer funds within office hours (8:30AM-5:00PM) so that it will be reflected in your FirstMetroSec account within the day. If funds are transferred beyond office hours, please send a copy of the fund transfer receipt with your name and FirstMetroSec account code (OTxxxxxx) to [email protected]. Funds transferred beyond office hours will be processed the following business day.

**Each fund transfer transaction using BDO Online Banking is FREE-OF-CHARGE.

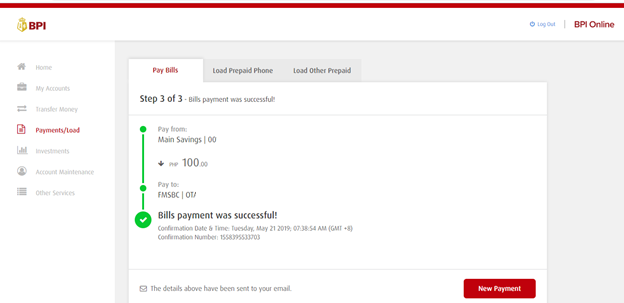

BPI ONLINE BANKING

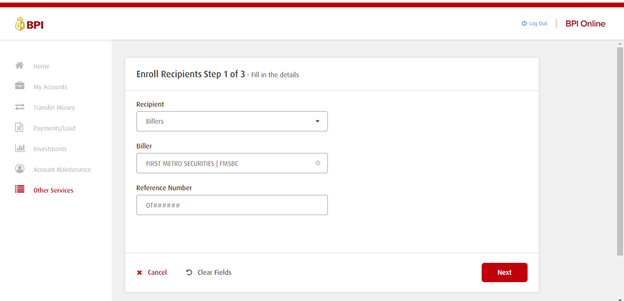

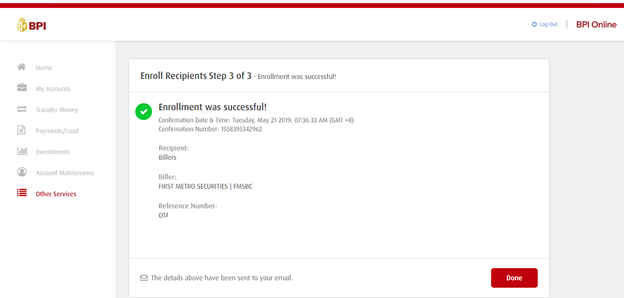

Step 1: Enroll Company/Biller

- Go to https://www.bpi.com.ph/

- Click on Login, indicate your Username and Password, then click Login

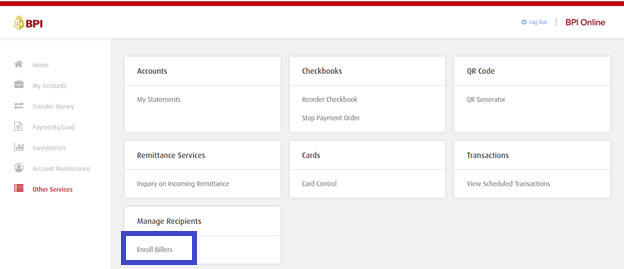

- On the side bar menu, click on Other Services, and under the Manage Recipients table, click on Enroll Billers

- Fill out the following details:

- Biller’s Name – FMSBC or First Metro Securities

- Reference Number – FMS Account Code (ex: OTxxxxxx);Application Reference Number (ex: 20240101-1234 for new applications)

- Click on Next

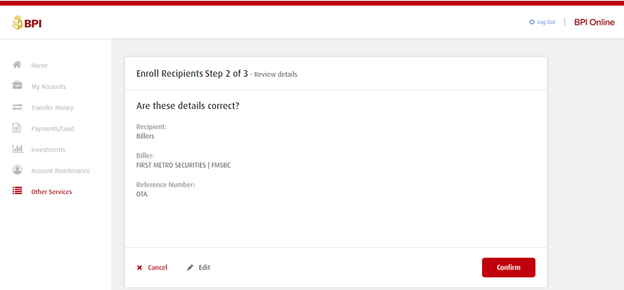

- Check if the details are correct then click Confirm

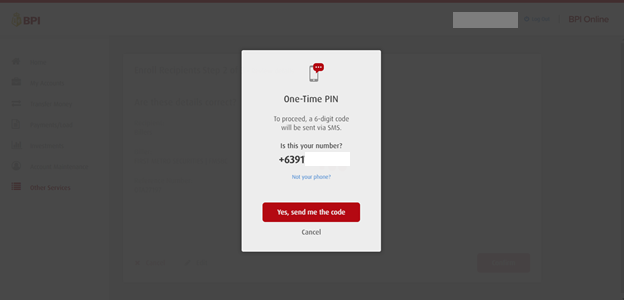

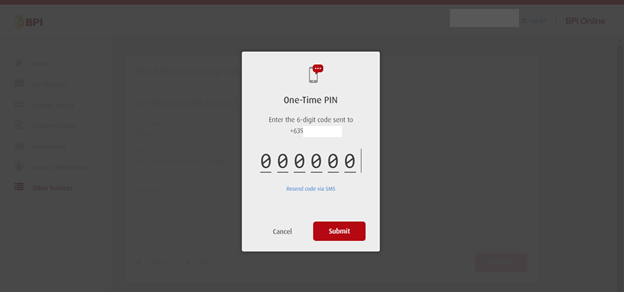

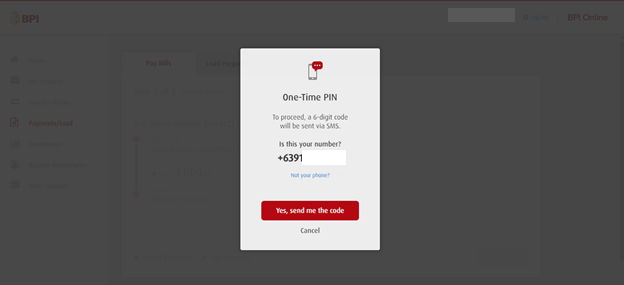

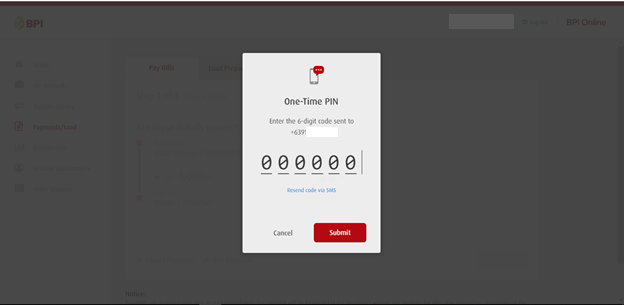

- A one-time pin will be sent to your registered mobile number, enter this pin and click Submit

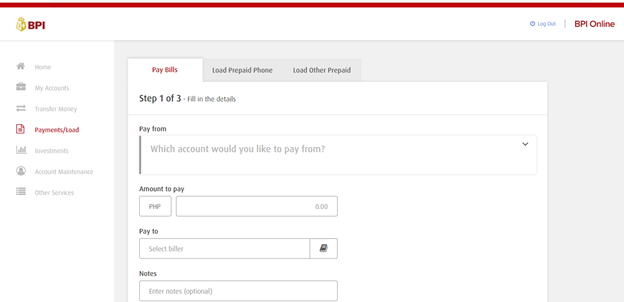

- On the side bar menu, click on Payments/Load

- Indicate the following:

- Pay from – select the bpi account to be debited from the drop-down list

- Amount to pay – indicate the amount you wish to transfer to your FMS Account

- Pay to – select the enrolled FMSBC biller from the drop-down list (ex: FMSBC OT######)

- Click Confirm

- Check if the details are correct then click Submit

- Depending on your settings, you may be asked to submit a one-time pin that will be sent to your registered mobile device.

- Click on Submit.

*Each fund transfer transaction using BPI Bills Payment is FREE-OF-CHARGE.

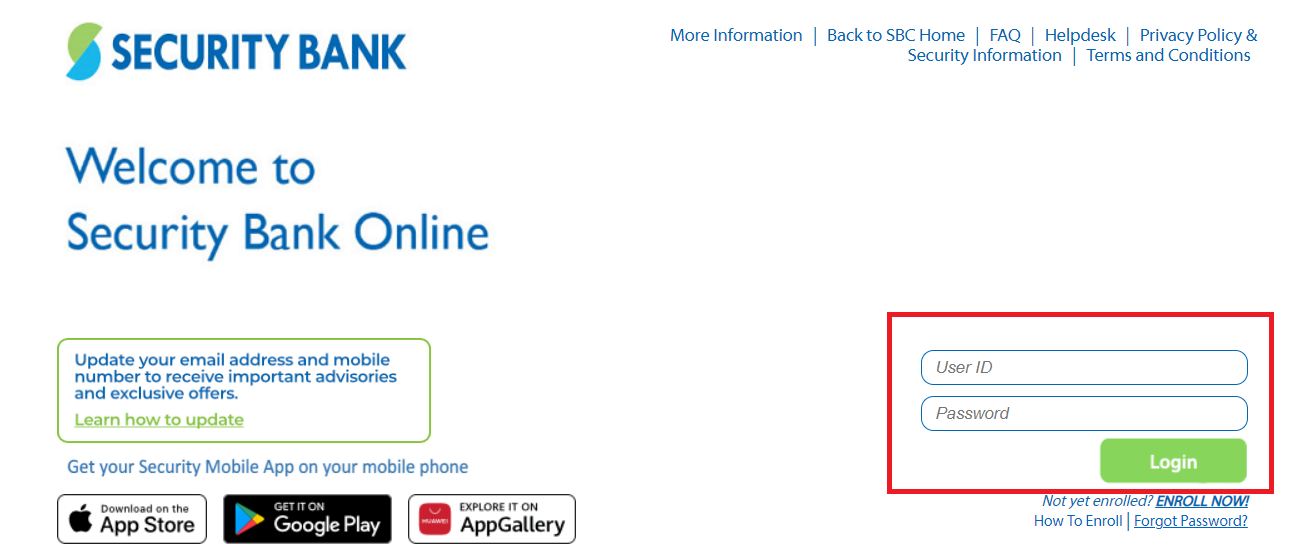

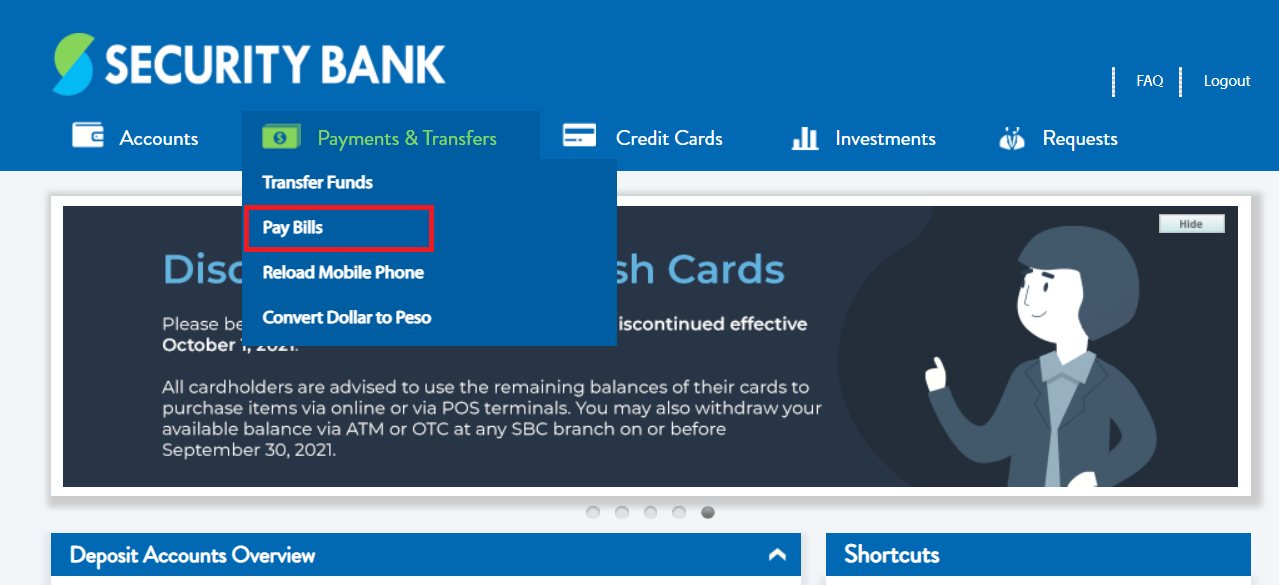

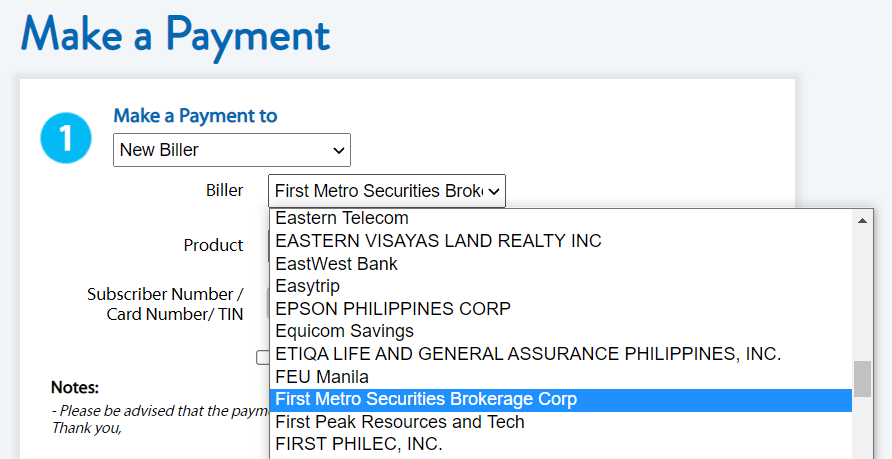

SECURITY BANK ONLINE

1. Go to Security Bank Online and login with your User ID and Password.

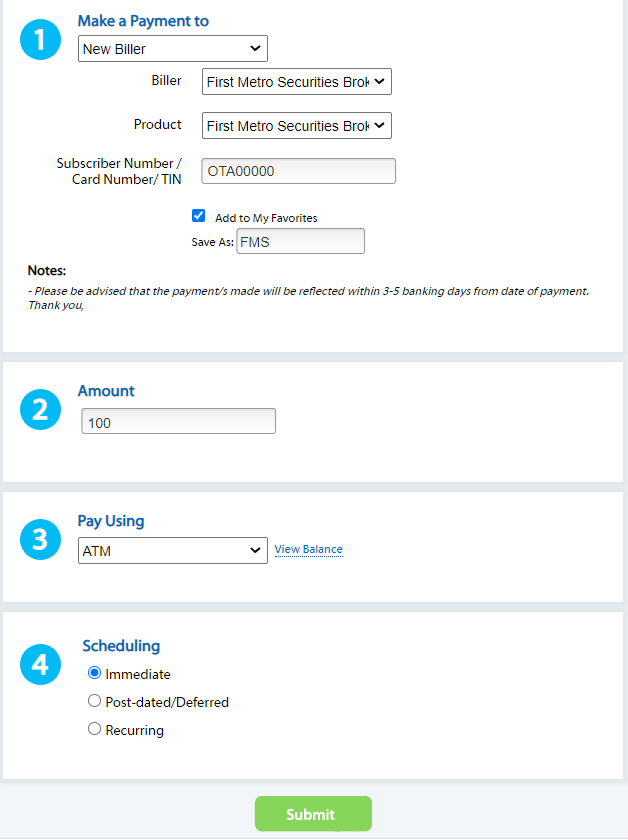

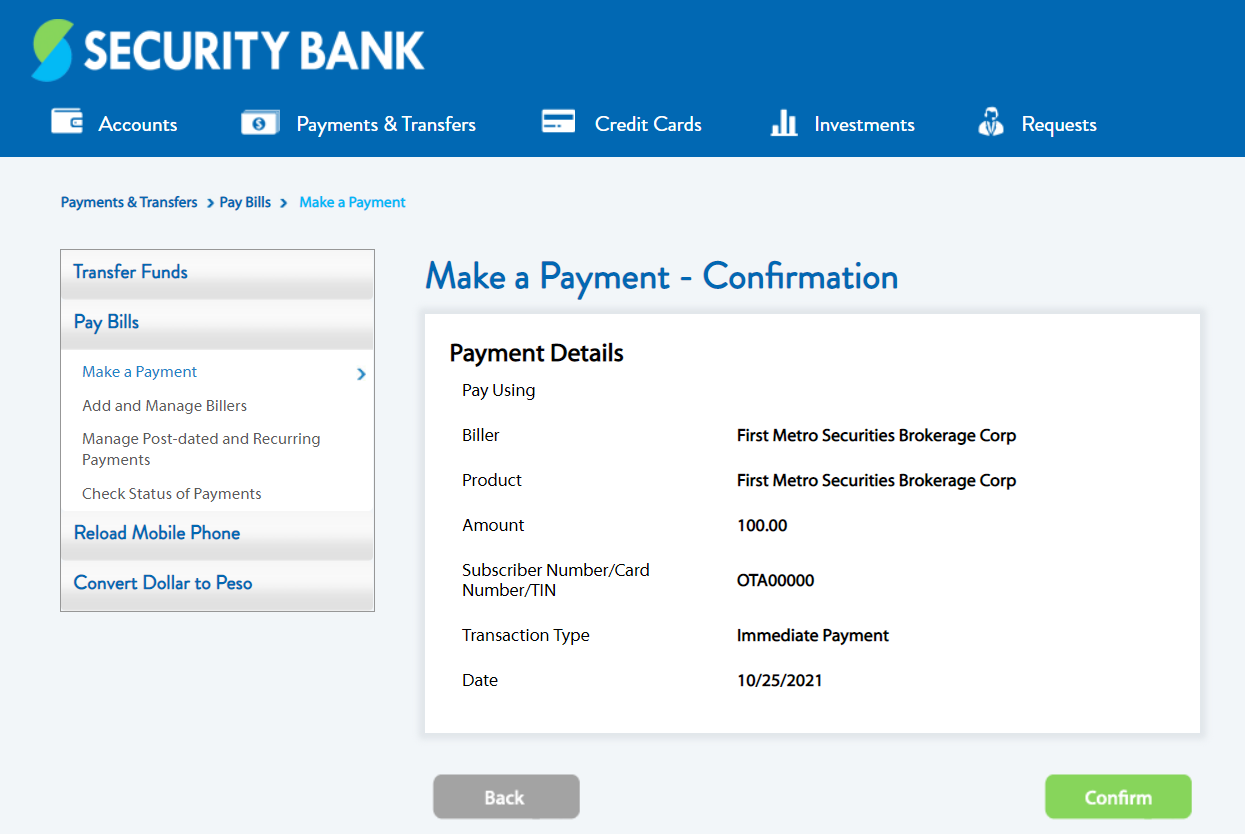

2. Go to Payments & Transfers, then Pay Bills

3. Fill in the required details. Choose First Metro Securities Brokerage Corp. as Biller

4. Under Subscriber Number, enter your FirstMetroSec Account Code (OTAxxxxxx). Tip: tick Add to My Favorites for future transactions. Input the amount, source account, and scheduling.

5. Review the details and confirm.

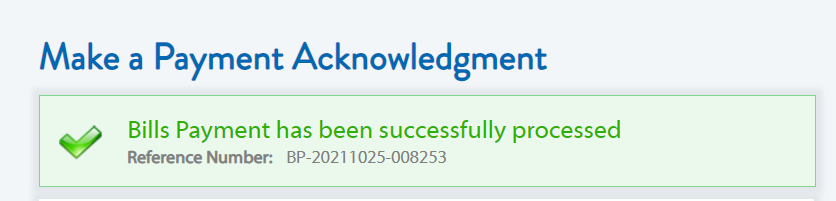

6. Take note of your Reference Number.

Notes:

- No transaction fee. Free-of-charge for any amount

- Crediting to your FirstMetroSec account will be on the following business day (T+1).

- No minimum amount.

- Daily aggregate limit is P600,000.

- This facility is not available for over-the-counter transactions

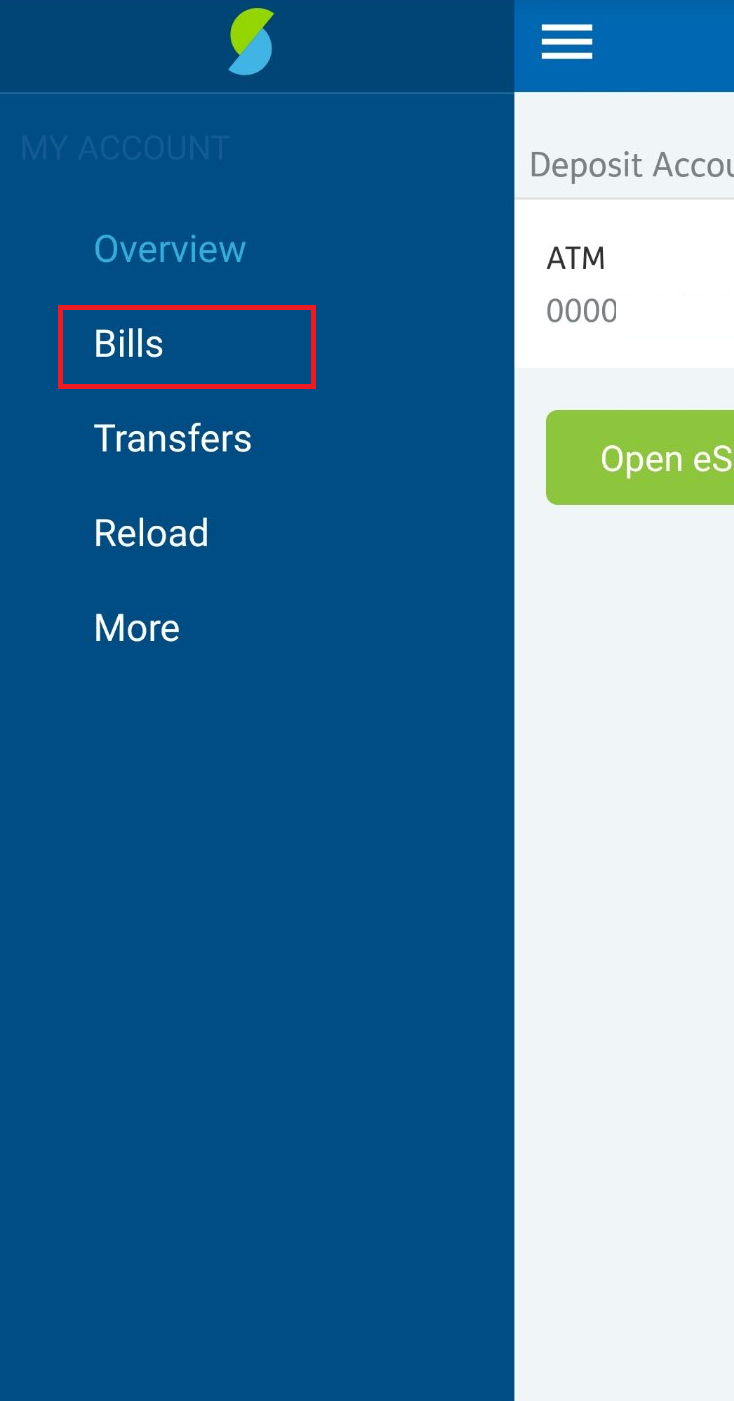

SECURITY BANK MOBILE APP

1. Launch the Security Bank Mobile App and login with your User ID and Password.

2. Go to Bills.

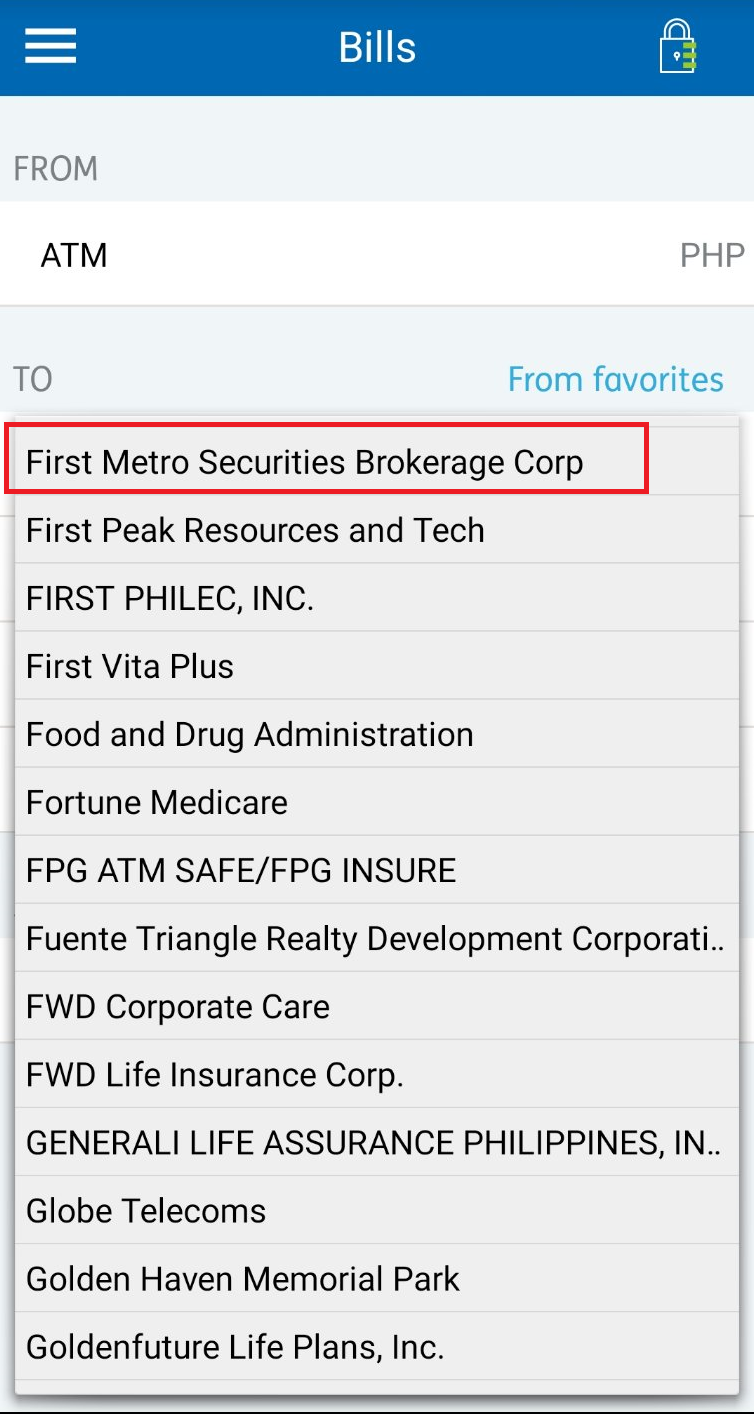

3. Indicate your source account, and choose First Metro Securities Brokerage Corp as Biller

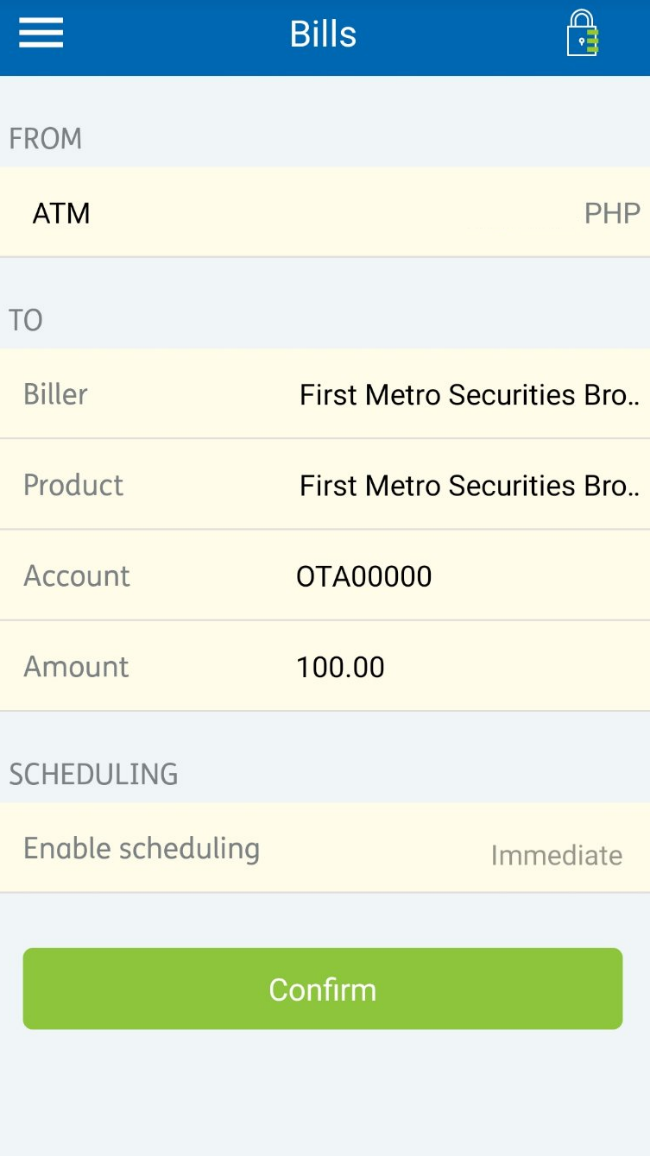

4. Under Account, enter your FirstMetroSec Account Code (OTAxxxxxx), then, input amount, and scheduling.

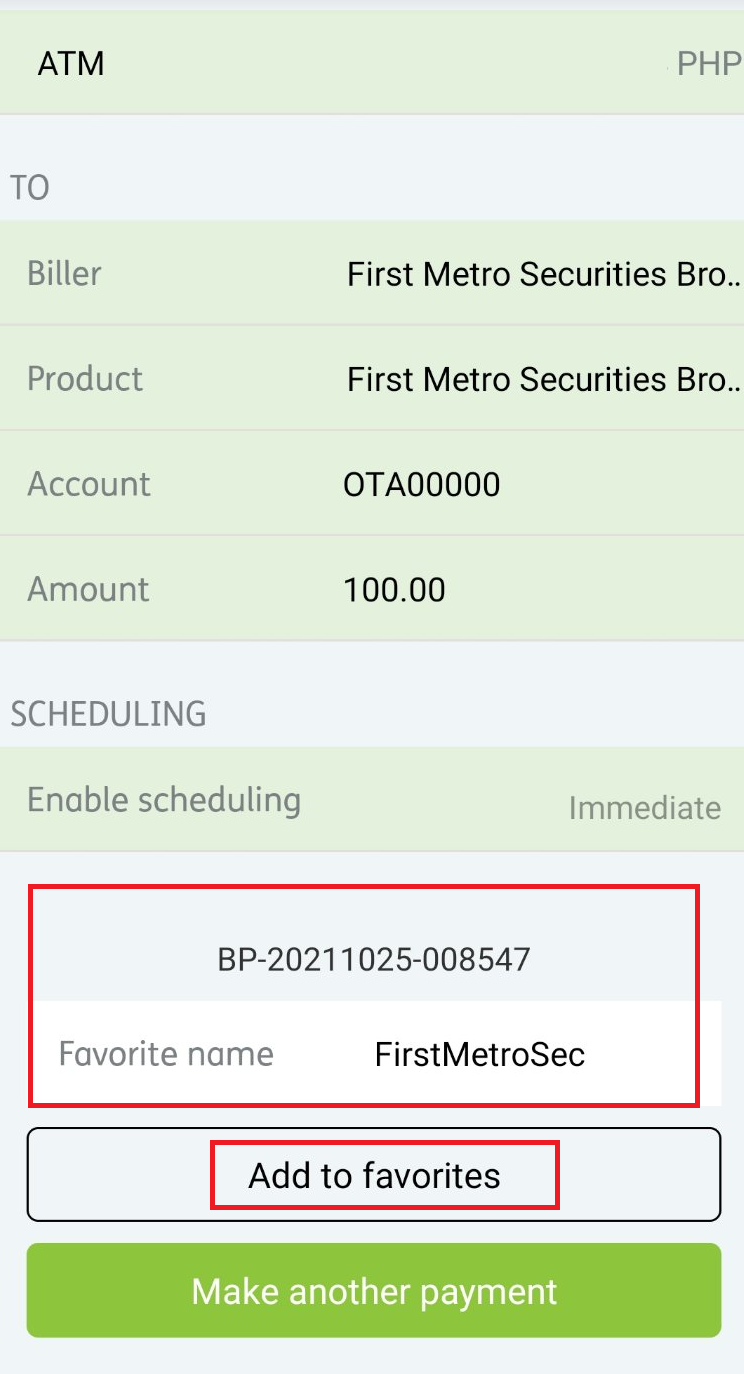

5. If successfully processed, you will get a Reference Number in this format, BP <date> <number>. Tip: Set a Favorite Name and tap Add to Favorites for future transactions.

Notes:

- No transaction fee. Free-of-charge for any amount

- Crediting to your FirstMetroSec account will be on the following business day (T+1).

- No minimum amount

- Daily aggregate limit is P600,000

- This facility is not available for over-the-counter transactions

LANDBANK ONLINE BANKING

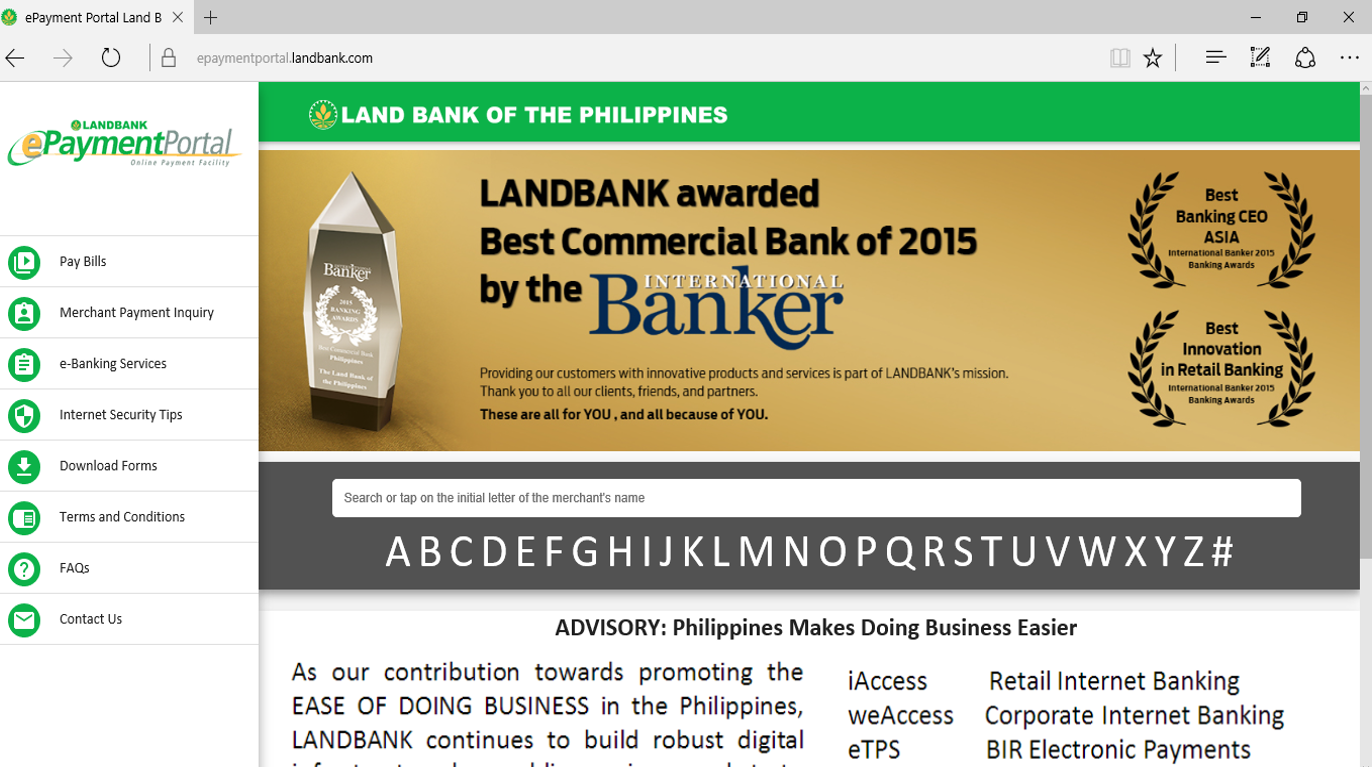

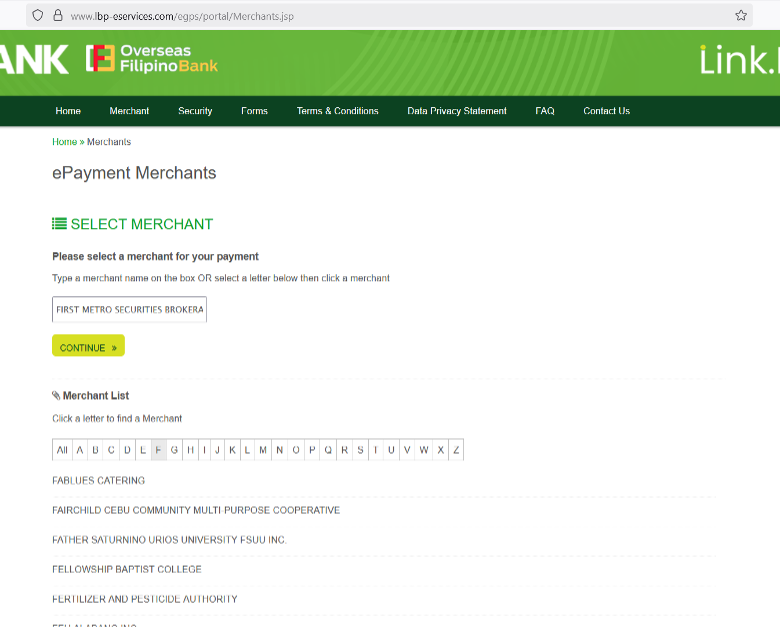

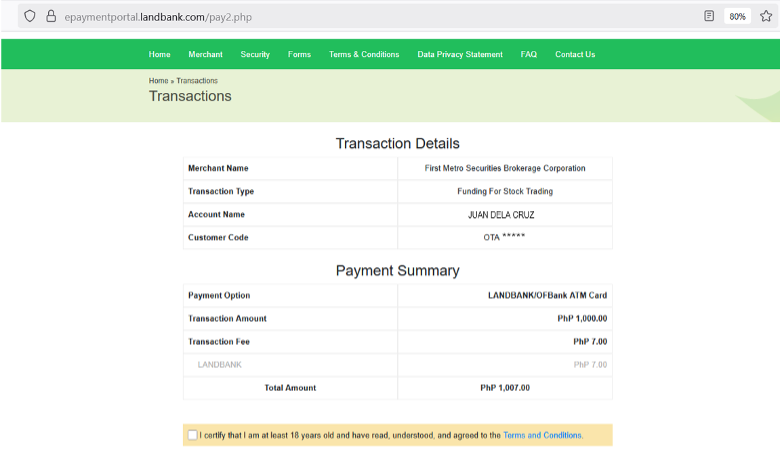

Step 1: Go to https://www.lbp-eservices.com/egps/portal/Merchants.jsp

Step 2: Select First Metro Securities Brokerage Corp. from the list of merchants, then click CONTINUE.

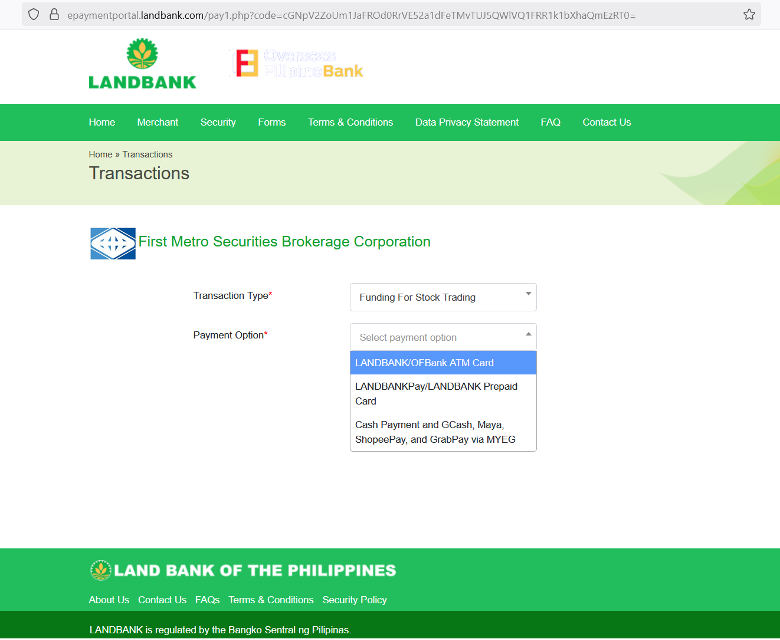

Step 3: Under Transaction Type, select Funding For Stock Trading.

For Payment Options, you may use any of the following.

Please be advised that transaction fees may be imposed by the bank depending on the selected Payment Option. Furthermore, certain options may incur other charges, which could result in a lower net amount credited to your FirstMetroSec account. To minimize charges, you may wish to consider alternative payment methods where applicable.

- Landbank/OFBank ATM Card - subject to bank charges/transaction fee of PHP7.00

- Landbank/OFBank Prepaid Card

- Cash Payment and GCash, Maya, Shopeepay, and GrabPay via MYEG - subject to bank charges/transaction fee of PHP30.00 and additional deductions (or 1% of 50% of your gross transaction amount) to be deducted from the amount that will be credited to your FirstMetroSec account.

If you fund PHP2,000 using this option:

• PHP30.00 transaction fee (bank)

• PHP10.00 additional bank charge (1% of 50% of P2000 = 1% of P1000 = P10)

Only PHP1,990.00 will be credited to your FirstMetroSec account.

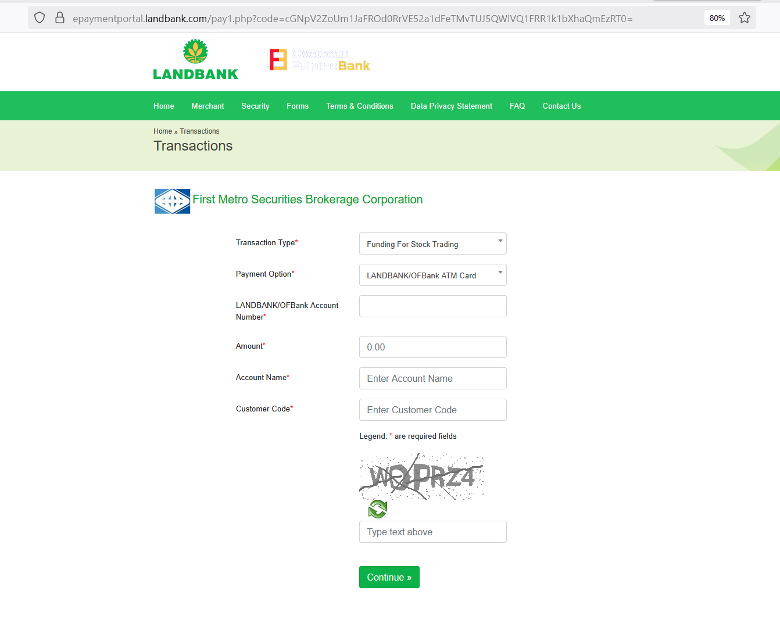

Step 4: Input the required information:

- Landbank/OFBank account number

- Amount,

- FirstMetroSec Account Name, and

- FirstMetroSec Account Code (ex. OTAXXXXXX or OTXXXX-X)

Step 5: Review the details and payment summary. Review and tick the box to agree to the Terms and Conditions.

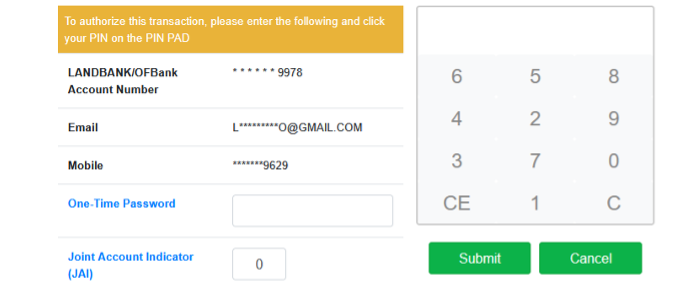

Step 6: Input the OTP and your Landbank/OFBank Joint Account Indicator (on the pin pad). Click SUBMIT.

Step 7: Wait for payment confirmation

Disclaimer: Kindly transfer funds between 9:30AM to 3:00PM to ensure same day credit to your FirstMetroSec account. Funds transferred beyond trading hours will be processed the following business day.

UNIONBANK

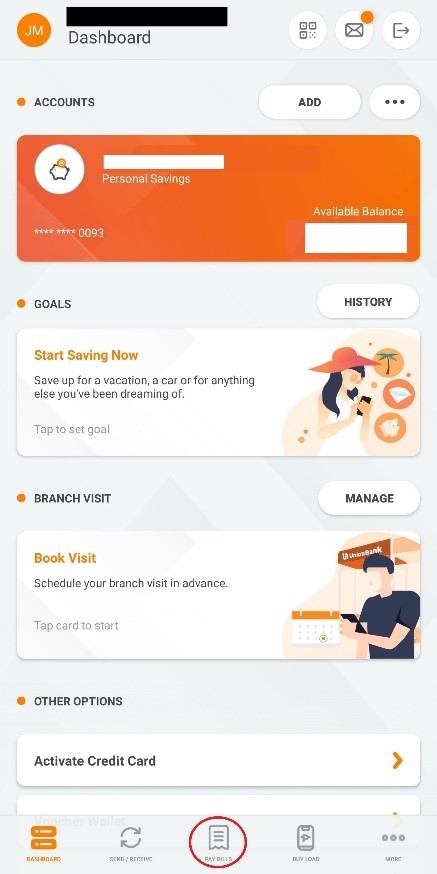

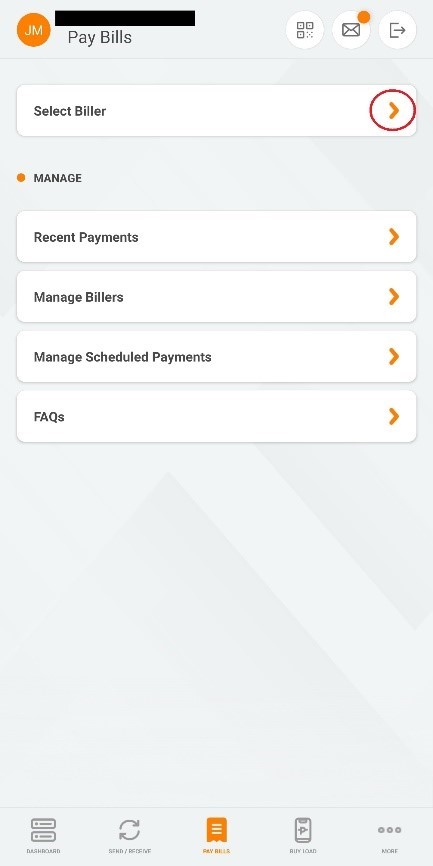

1. Log in to your account.

2. Go to Pay Bills.

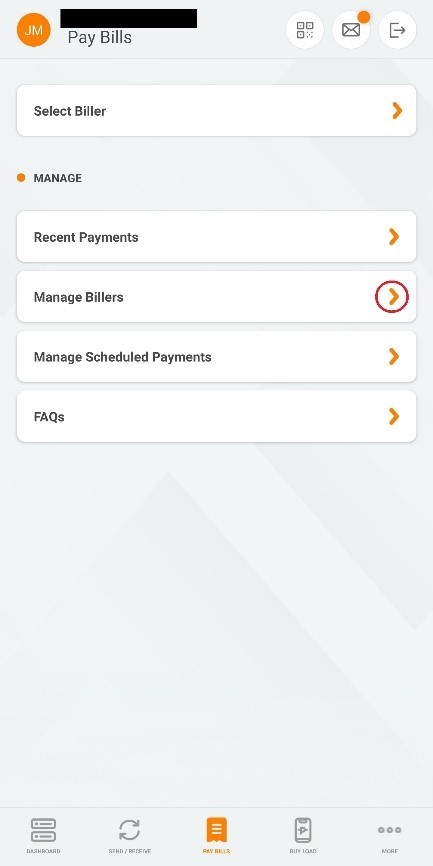

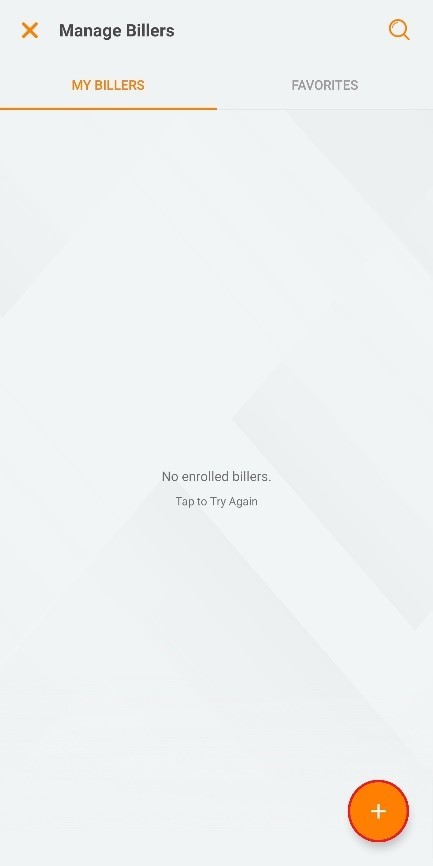

3. Select Manage Billers.

4. Add Biller

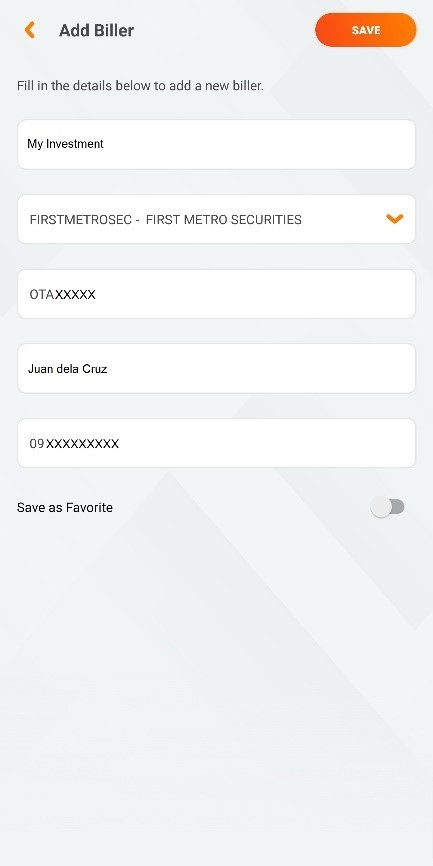

5. Designate a biller name. From the dropdown, select FIRSTMETROSEC – FIRST METRO SECURITIES. Enter your FirstMetroSec account number and phone number. Then click SAVE.

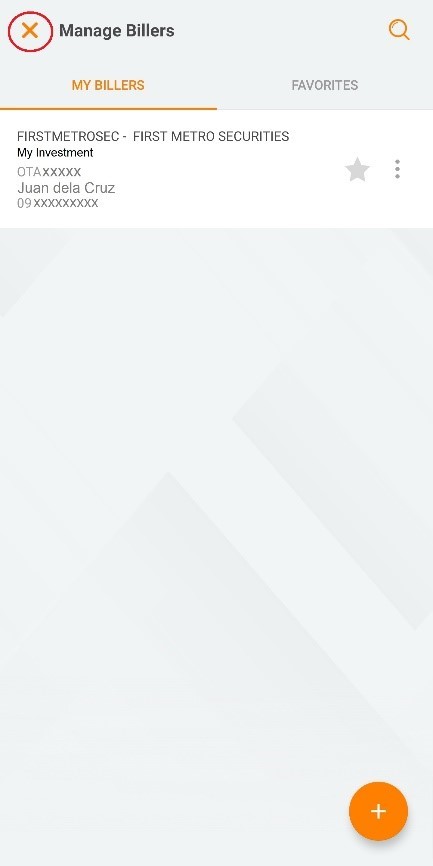

6. FirstMetroSec has been added as a biller. Exit Manage Billers.

7. Go back to Pay Bills, then Select Biller.

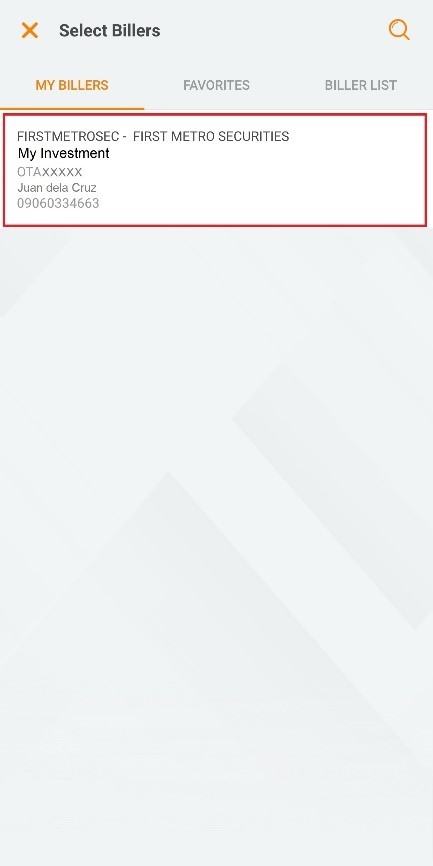

8. Under MY BILLERS, select FirstMetroSec.

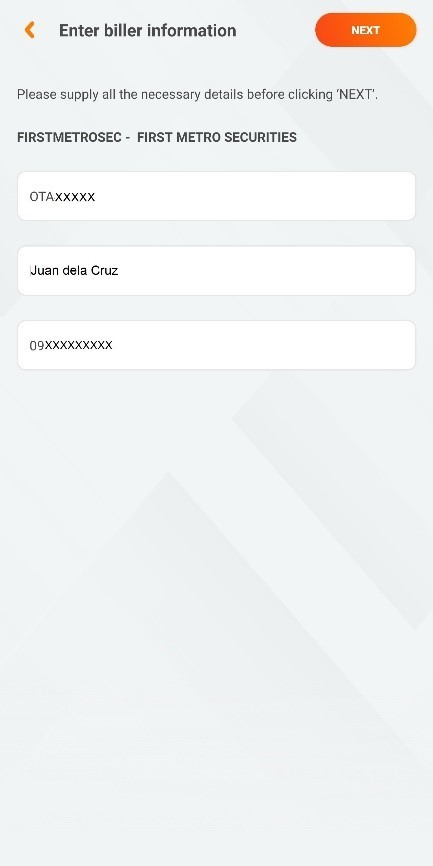

9. Review your account details, then click NEXT.

10. Enter an amount, then click NEXT.

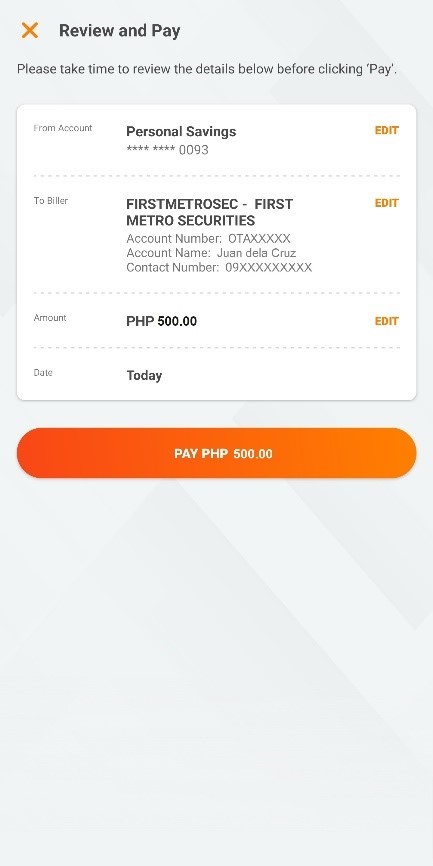

11. Review your entered information, then tap Pay to confirm.

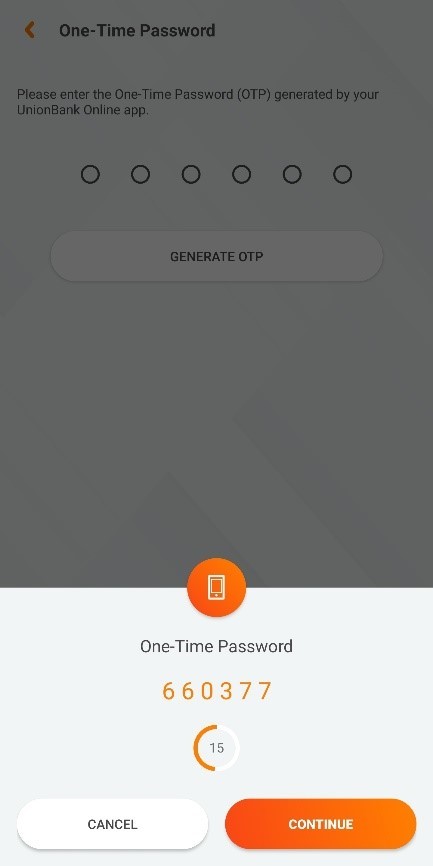

12. Enter OTP sent to your number, then click Continue.

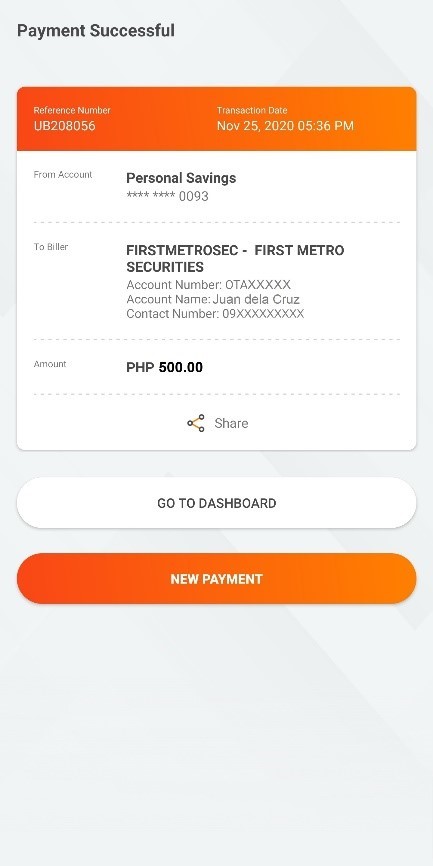

13. Payment Successful.

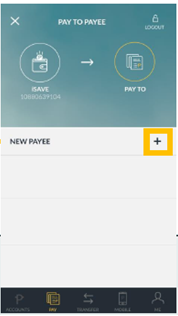

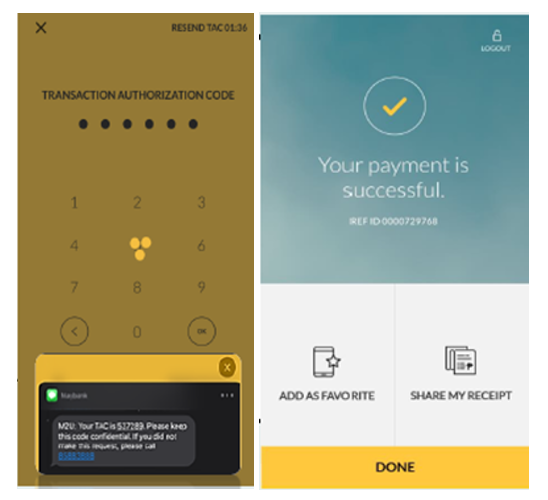

A. Via Maybank2u Mobile App

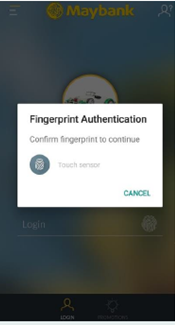

1. Login to Maybank2u PH app.

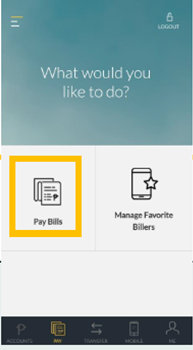

2. Tap “PAY”, then select “PAY BILLS”.

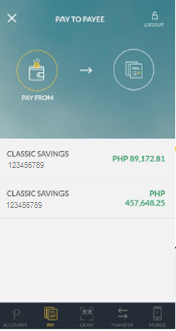

3. Choose source account to be used for bills payment.

4. Tap the plus (+) sign to see list of billers.

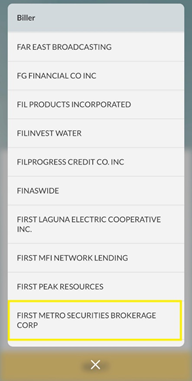

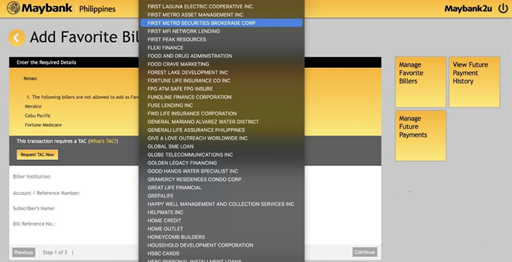

5. Type/Select “FIRST METRO SECURITIES BROKERAGE CORP” in the list of billers.

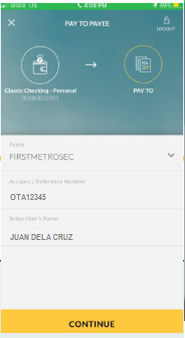

6. Enter your FirstMetroSec account number (ex. OTA00000) and name, the click “CONTINUE”.

7. Enter the amount then click “OK”.

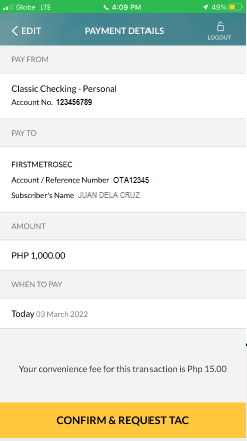

8. Review transaction details before clicking “CONFIRM & REQUEST TAC”.

9. Enter Transaction Authorization Code (TAC) sent to your registered mobile number, then tap "OK".

10. Add FirstMetroSec as a favorite biller for faster and easier funding in the future.

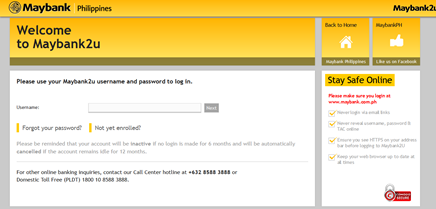

B. Via Maybank2u Online Banking

1. Login to your account at https://www.maybank2u.com.ph.

2. Click “Pay and Transfer”.

3. Select a source account.

4. Type/Select “FIRST METRO SECURITIES BROKERAGE CORP” in the list of billers.

5. Enter your FirstMetroSec account number (ex. OTA00000), name, and amount.

6. Review the transaction, then key in the TAC to finalize.

7.Add FirstMetroSec as a favorite biller for faster and easier funding in the future.

NOTES:

- Subject to P15 transaction fee.

- No maximum amount per transaction.

- Your FirstMetroSec account will be credited on the next business day (T+1).

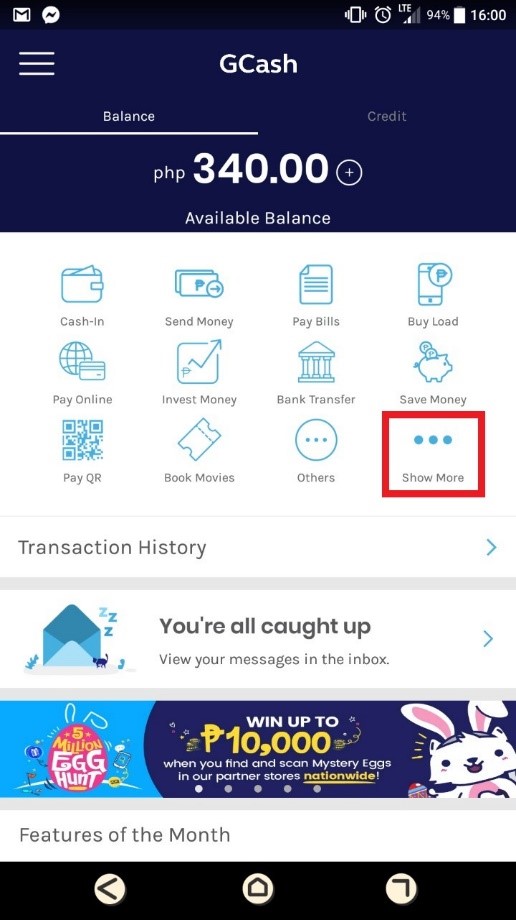

GCASH

Step 1: Log in the GCash app

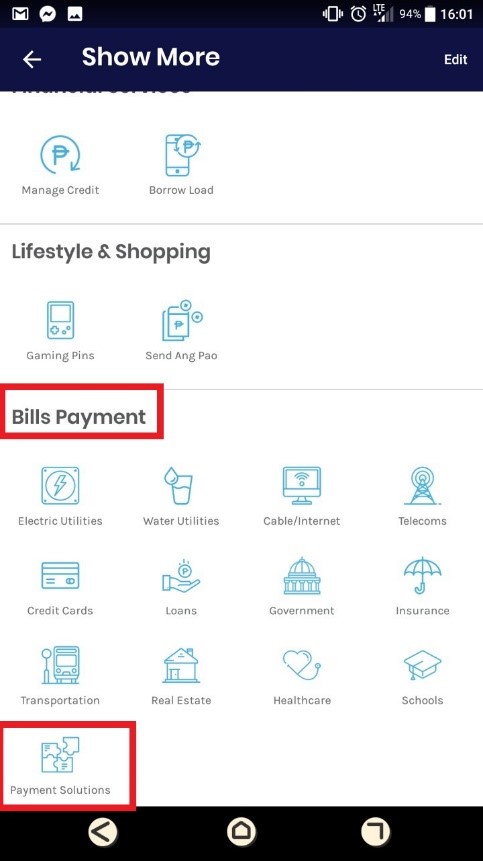

Step 2: Click Show More on the GCash dashboard to see additional selections:

Step 3: Scroll down to select Payment Solutions under the Bills Payment section

Step 4: Choose FirstMetroSec from the list of bills payment providers:

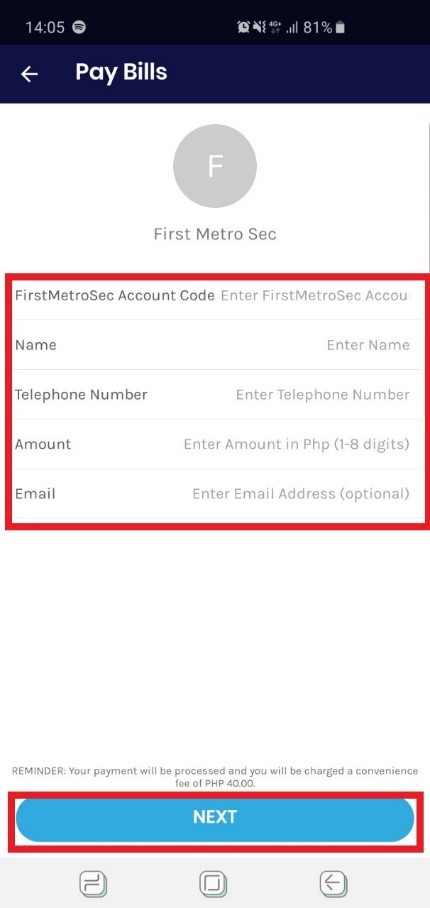

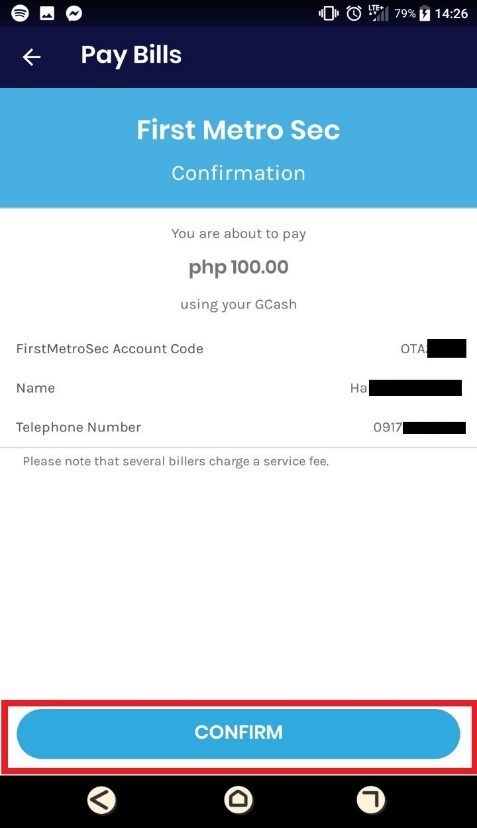

Step 5: Provide the following information and click on Next:

- FirstMetroSec Account Code

- Name

- Number

- Amount

- Email (optional)

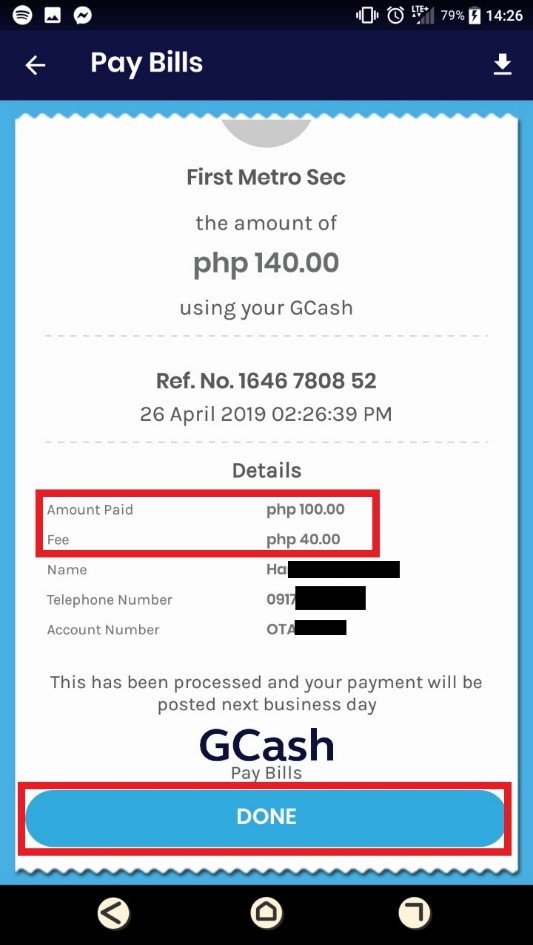

Step 7: GCash will show a receipt of the transaction with the breakdown of the payment. Click on Done to finish the transaction and go back to the dashboard.

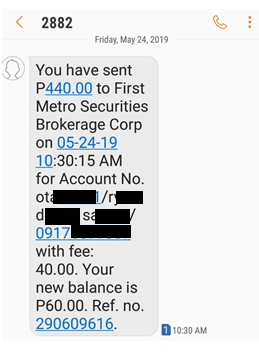

An SMS confirmation will also be sent to your mobile number:

*There is a convenience fee of PHP 40/transaction.

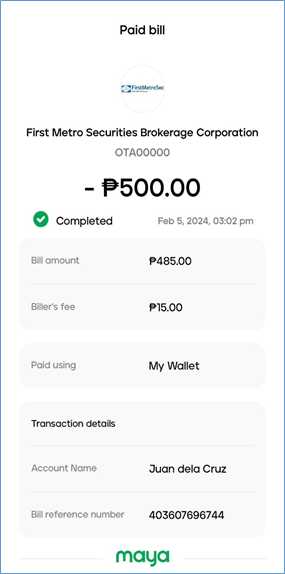

MAYA

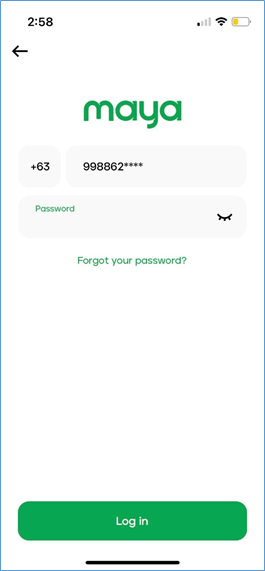

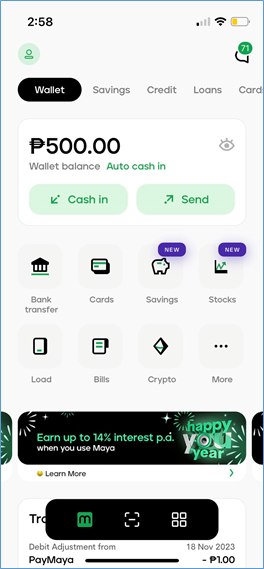

1. Log in to your Maya account.

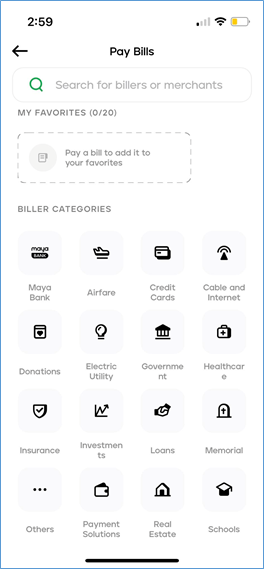

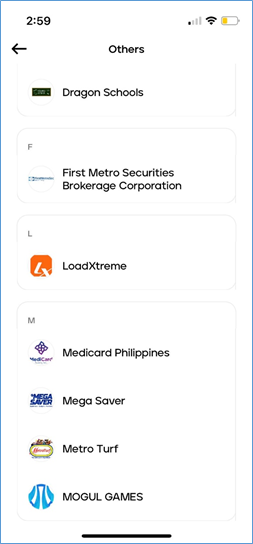

2. Click Bills > Others

3. Choose First Metro Securities Brokerage Corp.

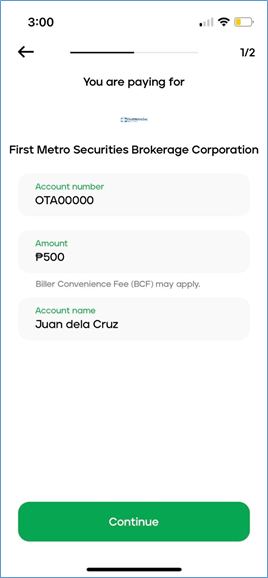

4. Enter your FirstMetroSec account number (ex. OTA00000), Amount, and Account Name. Then, tap Continue.

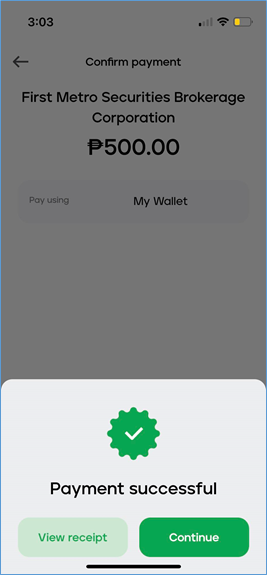

5. Review the Confirmation page, then tap Pay.

6. Your payment has been submitted and will be credited to your FirstMetroSec account after one (1) business day. A Php 15.00 convenience fee will be charged per transaction.

Tip: Be sure "Add to Favorites" for your succeeding funding transactions.

7-ELEVEN

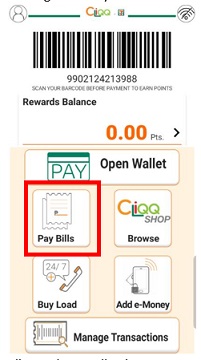

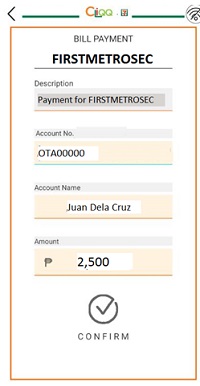

1. Client opens the CLiQQ app

2. Click Pay Bills on the CLiQQ dashboard to see additional selections

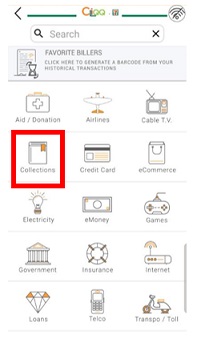

3. Click on Collections section

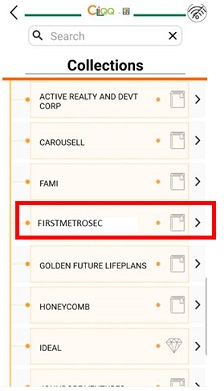

4. Click on FIRSTMETROSEC from the list of partners.

5. Type in the following basic information on the CLiQQ app:

- FirstMetroSec Account Code

- Account Name

- Amount

6. Check and confirm the details of the funding

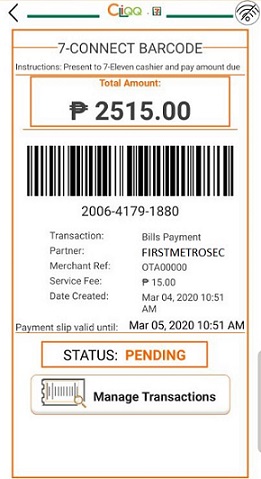

7. Go to 7-eleven and show the created barcode at the cashier. Note that the barcode shall only be valid for 24 hours.

Fee Structure:

How much is the fee for funding through 7-eleven?

| Transaction Amount | Convenience Fee |

| P1 - P5,000 | P15 |

| P5,001 - P10,000 | P25 |

| P10,001 - P15,000 | P35 |

| P15,001 - P20,000 | P45 |

GAISANO, NCCC, LCC MALLS

1: Go to the Customer Service Counter

2: Follow the procedure of the Customer Service counter for paying of bills.

3: Select FirstMetroSec as biller

4: Pay for the transaction

Fee Structure:

How much is the fee for funding through Gaisano, NCCC, LCC Malls?

| Transaction Amount | Convenience Fee |

| P1 - P5,000 | P15 |

| P5,001 - P10,000 | P25 |

| P10,001 - P15,000 | P35 |

| P15,001 - P20,000 | P45 |

HOW TO FUND OVER-THE-COUNTER (OTC) AT METROBANK BRANCHES?

- Fill out the (green) Payment Slip

- Check either Peso or Dollar Billing

- Under Company Name, write “FMSec - PHP” for peso payments, “FMSec - USD” for dollar payments.

- For the Reference No, use 660 for PHP, while 512 for USD

- Indicate the Account Name

- Under Subscriber No., write your FMSec account code (ex. OTA00000 or OT0000-0) or your application reference number for new accounts (ex. 20230101-0000)

PHP

USD